Mt Monger Resources gold IPO takes MD back to where the happy hunting first began

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

You can forgive incoming Mt Monger Resources managing director Lachlan Reynolds for having a sense of déjà vu.

In a way he is back where it all started with the emerging gold explorer, which this week opened the latest junior gold IPO to raise money for exploration at its Mount Monger and East Laverton gold projects.

Both were areas where Reynolds worked as a young exploration geologist when he started his career in Kalgoorlie with Western Mining Corporation.

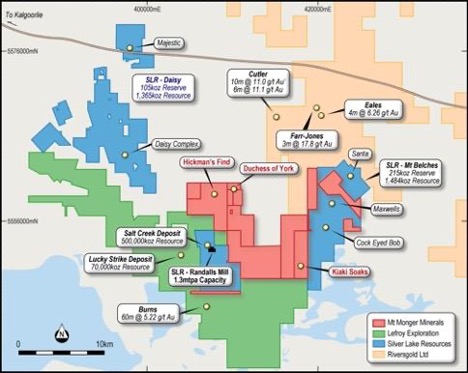

With the company’s flagship Mount Monger presenting ready to drill targets just kilometres from the 1.3Mtpa Randalls mill owned by Silver Lake Resources, it is little wonder he views the tenements as a happy hunting ground.

“As far as the projects themselves, they’re both in locations I worked on back in the early 90s with WMC,” he said.

“It’s a nice sense of déjà vu, it’s almost the career going full circle having worked in WA, going elsewhere and now coming back.

“One of the things that sort of surprises me is there’s not that much additional work that’s really been done on some of those areas. They’re still as interesting as they were 30 years ago, if not more so.”

Hot exploration district

Silver Lake’s long-running Mount Monger gold operations are, curiously, flying under the radar, with gold explorers in the district capturing more of the headlines of late.

Among a catalogue of explorers operating in the general vicinity are Breaker Resources, Riversgold, Kairos Minerals, Apollo Consolidated, Black Cat Syndicate and fellow new IPO, Torian Resources spinoff Monger Gold.

But it has been Lefroy Exploration’s Burns porphyry discovery, just 5km from Mount Monger Resources’ ground, that has enjoyed the limelight of late.

The junior goldie has been one of the best performers on the ASX since striking 60m at 5.2g/t in a discovery hole in February.

For Reynolds and Mount Monger, the exciting find shows just how much can be achieved by applying modern exploration techniques to overlooked targets.

“We’re fortunate at this stage that lots of the areas we want to test are anomalies which were identified by other explorers over that time period,” he said.

“Western Mining at the time was obviously looking for quite large deposits, and if they didn’t see what they thought were the signs they tended to move on.

“What that’s done is left a lot of opportunities for people to come back and explore those targets with new ideas.

“(Lefroy’s Burns discovery) highlights the fact that you can go back to these known occurrences of gold and with the right amount of perseverance come up with something quite unexpected.

“It just highlights the limited exploration that’s been completed over a lot of these target areas.

“It would be lovely to find something like that, but we also think Mount Monger has a lot of scope for more classical styles of mineralisation in the greenstone rocks.”

Exploration plans in motion

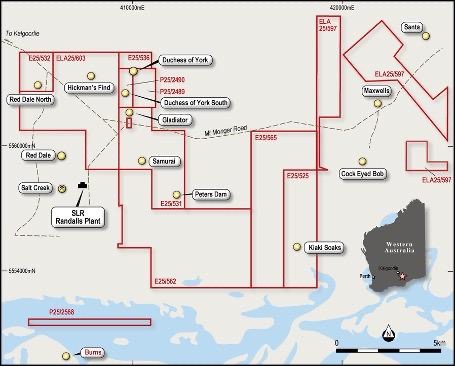

The first cab off the rank in that respect is the Duchess of York prospect at Mount Monger.

WMC completed shallow drilling at Duchess of York in 1988-89 to about 60m in depth, but it was when Hampton Hill Mining picked up the ground in the mid-90s that some promising drilling results emerged, showing a series of stacked mineralised lodes.

Hampton Hill reported a non-JORC compliant resource of 132,000t at 2.3g/t for 10,000oz of gold in 2002, but to now, that is where the story ended.

Mount Monger will pick up where they left off with an initial RC percussion drilling program to both confirm the mineralised system and historical results, and test for extensions where it remains open along strike and down dip.

The next step will be to target other known mineralisation and anomalies across the company’s tenure through soil sampling, surface geophysics and drilling.

“Discovery is the aim,” Reynolds said. “I’m an exploration geologist at heart and an MD close behind that.

“Ultimately success in terms of good drill results is what the market is rewarding.”

Two is better than one

Mount Monger has a series of exploration licences either granted or under application covering a massive 3,000km2 expanse of the Australian outback at its East Laverton gold project.

It includes prospective ground with potential to host gold and rare earth elements located between Gold Road Resources’ 6.6Moz Gruyere discovery, the 5.9Moz Tropicana gold mine and the Mt Weld rare earths deposit owned by $5 billion capped Lynas Corp (ASX: LYC).

Despite the presence of these giants, East Laverton is relatively unexplored. Previous work carried out in search of uranium and diamonds has highlighted gneissic rocks similar to those which host Tropicana.

The early focus for drill-testing will be the Seahorse target. Seahorse South includes a known surface gold anomaly up to 46ppb Au extending over about 1.5km of strike, only part of which has been tested by drilling.

Limited shallow aircore drilling targeting Tropicana-style gold was completed by IGO. On the other hand, the North Seahorse prospect is a magnetic anomaly that has never been tested by drilling.

It will be the focus of an aircore drilling program to evaluate the structures associated with this anomaly.

Experienced heads

If you’re a believer in the adage that investing in junior explorers is about investing in the people behind them there is plenty of experience to back on the Mount Monger board.

Well-known Perth corporate executive John Hannaford is on board as the company’s non-executive chairman, with a stake of 8.15 per cent once the raising is complete.

He is joined by Reynolds and ex-SMS Mining CFO David Izzard (MTM’s top shareholder) on the explorer’s three-person board of directors.

In between his early-career stint with WMC and today, Reynolds himself has enjoyed a variety of roles exploring for gold, copper, nickel, uranium and more across the world.

Those include stints as managing director at ASX-listed explorers Namibian Copper (ASX: NCO) and most recently Golden Mile Resources (ASX: G88).

Mount Monger, which will have the proposed ticker code of MTM is seeking to raise $5 million through the issue of 25 million shares at 20c a share.

This article was developed in collaboration with Mount Monger Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.