Monsters of Rock: Why FMG’s decarbonisation plan could eat into its dividends

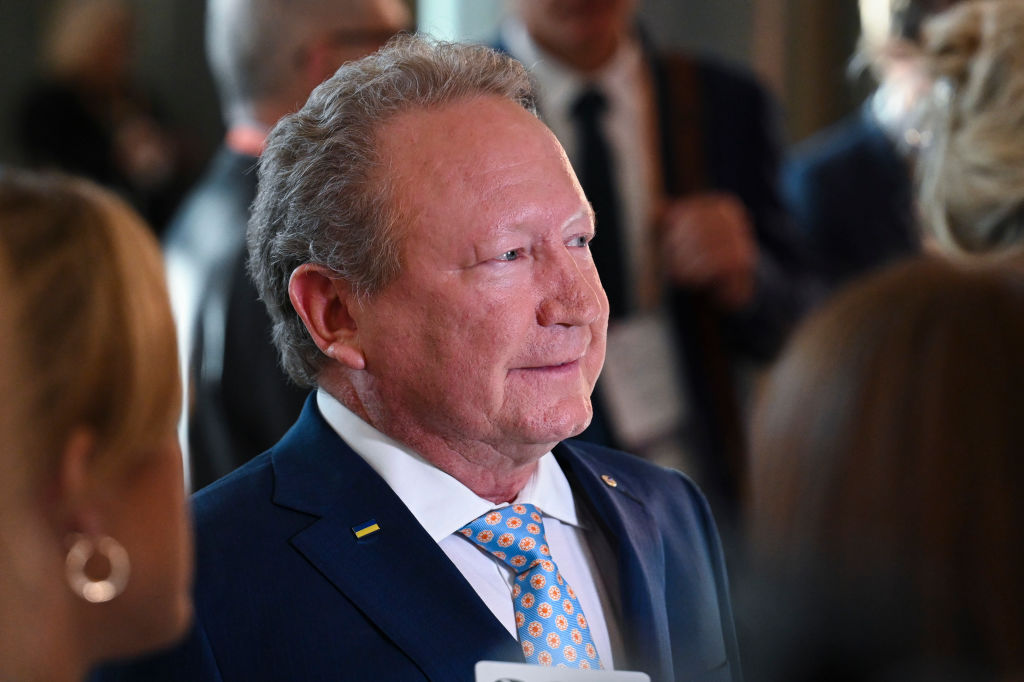

Pic: Martin Ollman/Getty Images

- GS continues to rate FMG a buy, says capital commitment to decarbonisation strategy could see shareholder returns dialled back

- Investment bank rates New Hope Corp a sell even after yesterday’s monster profit, but Macquarie goes big on coal miner

Fortescue Metals Group (ASX:FMG) launched a mega decarbonisation plan yesterday aiming to strip 3Mt of CO2 emissions a year out of its operations by 2030 in a bid to hit what it calls ‘real zero’.

The US$6.2 billion bill to remove diesel and gas from its operations would save around US$818 million a year, sparing Andrew Forrest’s FMG from rising oil and gas costs and Australian Carbon Credit Units, with the iron ore miner and green energy aspirant saying it will not buy offsets to moderate its climate impact.

While Forrest has spoken passionately about the growing heft of his share register and increasing number of investors holding Fortescue stock, a lack of clarity around the value of FMG’s Fortescue Future Industries arm and concerns about its capital allocation framework have seen many analysts at major investment banks issue notes of caution on its current $51 billion market valuation.

One of those names is Goldman Sachs, whose Australian analysts Paul Young and Hugo Nicolaci have a $12.1/sh price target on the 190Mtpa iron ore producer and sell rating on the stock.

They think FMG payouts, which topped out at 80% of profit last year, will fall from 75% to 50% from FY24 onwards.

“(Yesterday’s) announcement and commitment underpins our view that FMG is at an inflection point on capital allocation, and to fund the ambitious decarb strategy, we assume the dividend payout ratio falls from the current 75% to 50% from FY24 onwards,” they said in a note.

“The capital estimate of US$6.2bn represents the incremental spend over and above existing planned sustaining and mining fleet replacement capex and excludes Iron Bridge mining fleet replacement, implying the overall decarbonisation spend is above our previous US$7-8bn estimate (not in our numbers) which included the Pilbara Energy Connect (PEC) project.

“While FMG expect the investment to generate a positive NPV largely on the displacement of diesel costs, the target opex saving of ~US$0.8bn pa was below our prior estimate of ~US$1bn, but this will depend on oil and WA domestic gas price assumptions.”

GS says it continues to rate Fortescue as a sell due to its higher multiples compared to rivals BHP (ASX:BHP) and Rio Tinto (ASX:RIO), widening discounts for the 58% Fe ore FMG specialises in, execution and ramp up risks around its Iron Bridge magnetite mine and uncertainties around FFI and the decarb strategy.

On the flipside Young and Nicolaci say higher iron ore prices and improved steel demand would present upside risk for FMG shares, along with potential monetisation of FFI via an IPO.

Fortescue Metals Group (ASX:FMG) share price today:

New Hope still a sell despite mega profit

Also failing to exit GS’ sell list yesterday was New Hope Corp (ASX:NHC), which today rose 3.7% to $6.16, around a 10 year high.

The coal miner could thank extraordinary prices for thermal coal over the past year for a 1146% rise in FY22 profits after tax to $983 million, bankrolling a 56c per share dividend worth $466 million.

But GS remains concerned about its growth option and is more conservative on thermal coal prices than NHC, whose boss Rob Bishop yesterday predicted market tightness would support prices around current levels beyond the end of the year.

GS is a bit more bearish, with calendar year 2023 prices of US$200/t.

They think New Hope is already trading at an NAV of 2x and discounting a long run thermal price of US$145/t, well above GS’ US$75/t long run estimate.

Young and Nicolaci also says production growth potential is muted at the 10Mtpa Bengalla mine, with the 5Mtpa New Acland Stage 3 still waiting on a key water licence and full production at its 15% owned Malabar Resources growth option only incremental at around 900,000tpa.

But GS has ramped up the price target from $3.60 to $3.80 per share after increasing its target multiple for coal stocks from 1.5 to 2x. The New Acland approval and thermal coal market tightness could provide upside risks as well.

It’s worth noting that not everyone is so bearish, with Russia’s war in Ukraine, the main reason for this year’s surge in coal prices, showing little sign of ending.

Macquarie just raised its price on New Hope by 20% to $6 per share.

New Hope Corp (ASX:NHC) share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.