Monsters of Rock: Some coal stocks are rising 10pc at a time

Pic: Schroptschop / E+ via Getty Images

Misery loves company and coal and gold stocks are finding a bit of support from investors in miserable times.

Energy crises are causing gloom for global economies and literal gloom for people and businesses in the northern hemisphere struggling to get their hands on tight fuel supplies.

Coal miners are now enjoying their best run in years, with some rising in double digits even as general mining stocks are being hammered.

Yancoal (ASX:YAL) was today’s big standout, up 10.8% on no news as Newcastle thermal coal prices rose by more than 3% overnight to US$218/t.

Whitehaven Coal (ASX:WHC) and Coronado (ASX:CRN) extended their recent gains as well.

Gold miners were also finding support, with prices up over US$1750/oz overnight.

Evolution Mining (ASX:EVN) had the big news, announcing that the NSW Government had approved its $380 million underground development at the Cowal mine.

It is aiming to increase production from under 250,000ozpa to 350,000ozpa over the next three years at its flagship operation.

Northern Star (ASX:NST), Newcrest (ASX:NCM), Silver Lake Resources (ASX:SLR) and Gold Road Resources (ASX:GOR) were all supported well.

It came amid a terrible day for the ASX 200 and a 1.82% knock for the broader materials index, which was paced by losses from BHP (ASX:BHP), Rio (ASX:RIO) and Fortescue (ASX:FMG).

Coal prices driven by tight supply

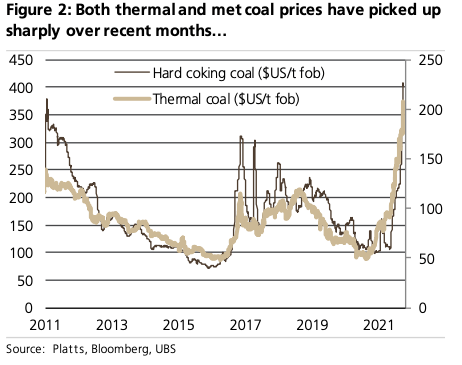

UBS analyst Lachlan Shaw said coal prices are rising 15% week to week amid tight supply on the seaborne market, which is down 1% year to date.

“Newcastle 6,000 kcal/kg thermal coal prices have risen ~15% w/w to ~US$210/t. Prices are performing strongly y/y, up ~160% after weak demand in 2020 due to COVID-19 restrictions,” he said today.

“Tight supply, low inventories and strong demand have supported the thermal coal price.”

“Chinese thermal coal markets remain very tight, with coal shortages resulting in record high prices. Authorities are ordering industry to cut output to reduce coal demand so that inventories can build ahead of winter.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.