Monsters of Rock: One of the ASX’s best gold stocks runs down takeover target, tin miner goes parabolic

Pic: Via Getty

- Perseus moves up to a ~75% stake in $270 million takeover target OreCorp

- Tin prices charged past US$30,000/t overnight, with three month prices on the LME hitting US$31,177/t

- ASX tin miner Metals X has been even more bullish, with shares up ~60% year to date

- The ASX 300 Metals and Mining index gains 0.85% today to hit its highest point since late January

Perseus close to finalising key acquisition, Emerald continues to miss the Bullseye

This one’s all over bar the shouting, with Perseus (ASX:PRU) moving up to a ~75% stake in $270 million takeover target OreCorp (ASX:ORR).

It came as rival Silvercorp sold its 15.61% stake into PRU’s 57.5c per share bid after months of jawing between the TSX and ASX listed rivals over ORR’s proposed 234,000ozpa Nyanzaga project in Tanzania.

In the end it was Perseus’ financial muscle that won the day. It secured Tanzanian competition approval for the OreCorp takeover in March with the promise of a cash payout for shareholders unmatched in Silvercorp’s cash plus share bid.

The latter would have left holders exposed to the potentially volatile performance of Silvercorp, which boasts silver assets in China.

The offer was recently made unconditional, with OreCorp’s board along with significant shareholders and WA mining big wigs Nick Giorgetta and Tim Goyder shifting allegiances behind PRU and its MD Jeff Quartermaine’s approach.

Perseus, which owns the Yaoure, Sissingue and Edikan mines in Cote d’Ivoire and Ghana had been banking on the Meyas Sand project in Sudan as its next major development project.

But a civil war has hampered that. Nyanzaga looks to be a better short term development prospect, with the Tanzanian Government seeking to up its stake from 16% to 20% as a concession on the downside.

Perseus, one of the world’s lowest cost mid-tier gold miners, has been stagnant on the share market for several years owing to the ‘African discount’ and both relatively short life and middling scale of its West African assets.

But it has been a cash machine, building a US$642 million war chest by December 31 last year and with US$300m in undrawn credit to continue its M&A approach in the months and years ahead.

Meanwhile, deftly evading problems plaguing other gold companies during ramp up, Emerald Resources (ASX:EMR) remains on track to hit FY24 guidance of 100,000oz at US$780-US$850/oz all in sustaining costs from its Okvau mine in Cambodia.

It now plans to become a multi-mine 300,000ozpa producer via Mermot in Cambodia, as well as North Laverton in Australia via the takeover of Bullseye Mining.

The Bullseye deal has dragged out since December 2021, when EMR picked up 19.45% cornerstone stake and launched an off market takeover bid.

EMR, whose % equity position in Bullseye has stagnated in the high 70s since mid-to-late 2023 — has today, once again, urged the holdouts to “to accept without delay” before the offer closes at 5pm (AWST) on Wednesday 24 April 2024.

PRU and EMR share price charts:

The force is strong with this lithium mine developer

$760m capped Wildcat Resources (ASX:WC8) had an insane 2023, gaining 3375% in a weak lithium market thanks to an acquisition in the Pilbara, called Tabba Tabba.

Initially drawing attention on speculation Fortescue had made a lithium discovery next door, nearology saw the stock, trading at just 2c as 2022 closed, hit a high of 92c with MinRes piling in to take a 19.85% stake.

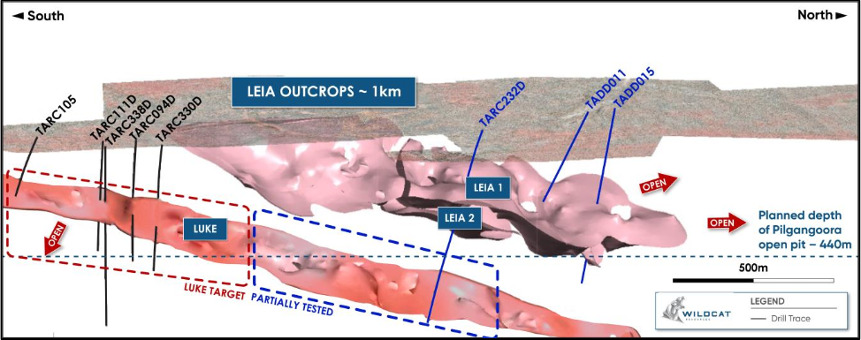

With $100m in the tin, WC8 has been backing up this speculation in 2024 with solid drill results at the Leia deposit and now the discovery of a ‘blind’ pegmatite called Luke.

The Star Wars buffs at WC8 announced highlight results like 41.0m at 1.0% Li2O from 267m at Luke, which sits beneath Leia:

New results from Leia, meanwhile, include 68.0m at 1.4% Li2O from 337m. Impressive.

The nearly 74,000m drilled so far has defined a 3.2km long LCT pegmatite field hosting at least seven significant pegmatite bodies (Leia, Luke, Boba, Chewy, Tabba Tabba, Han and Hutt).

Most of this drilling has been focused on the major Leia deposit which is now 2.2km long, with mineralisation from surface and continuing down plunge.

WC8 share price chart:

Its been a massive day for tin stock Metals X

It’s been a massive day for Metals X (ASX:MLX), the once married base metals attachment of Westgold Resources (ASX:WGX).

Since the demerger a few years ago Westgold has roared back to prominence off the back of storming gold prices, announcing a monster tie-up with TSX-listed Karora Resources this week.

MLX on the other hand lost its way somewhat, selling its underperforming Nifty copper mine and tossing its long dormant Wingellina nickel and cobalt project in remote WA into 2021’s NiCo Resources (ASX:NC1) float.

That’s left Metals X entirely at the whim of the tin market. It is also pretty much the only direct bet on the price of the important but sparsely produced base metal on the ASX.

Tin has now fallen into backwardation, which suggests the market is tight as hell, something that has been brewing since Myanmar’s Wa State militia stemmed the export of concentrates to Chinese smelters last year.

Cash – 3 months #tin moves to a backwardation. Only $26 for now, with the tightness starting out of the May date. Will be tracking this closely to see if it widens and attracts metal to warehouse or not. pic.twitter.com/9n8Sglz22F

— Mark Thompson (@METhompson72) April 9, 2024

Tin prices charged past US$30,000/t overnight, with three month prices on the LME hitting US$31,177/t. That’s 13.6% higher this very short month alone and 22.7% up this year to date.

Sentiment in Metals X has been even more bullish, with investors in the half-owner of Tassie’s historic Renison Bell tin mine seeing their shares lift ~60% YTD. Market cap is up over $400m as well. If tin prices rise we smell a new Monstar in the making.

Most of that climb has come in little over a month, with MLX stock up ~8.5% today.

It saw profits lift 46% to $14.6m in 2023 after MLX and JV partner Yunnan Tin produced 9532t of tin in concentrate last year. That came as grades and recoveries at one of the world’s few high grade primary tin mines rose and ahead of a DFS on a tailings retreatment project due Q3 this year, which could boost production further from the back end of 2026.

MLX share price chart:

Miners chalk up another win on Wednesday

Another good day for Materials, which finished the arvo session up 0.85%. The ASX 300 Metals and Mining index also gained 0.85% to hit its highest point since late January.

According to IG market analyst Tony Sycamore there have been “intriguing signs” of a rotation out of financials and into the battered Materials sector, which was down 7.9% last quarter as the price of iron ore plunged.

A global gauge of industrial activity known as the purchasing manager’s index has lately been better than expected, bolstering the price of key commodities such as copper, iron ore, gold and crude oil, Mr Sycamore said.

Today’s Best Miners

Stanmore Resources (ASX:SMR) (coal) +6.3%

Liontown (ASX:LTR) (lithium) +4.2%

Coronado Global Resources (ASX:CRN) (coal) +3.5%

Whitehaven Coal (ASX:WHC) (coal) +3%

Today’s Worst Miners

Westgold Resources (ASX:WGX) (gold) -4.1%

Energy Resources of Australia (ASX:ERA) (uranium) -3.5%

Perseus Mining (ASX:PRU) (gold) -2.6%

Ramelius Resources (ASX:RMS) (gold) -2.2%

Monstars share prices today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.