Monsters of Rock: Lithium shares flush with positive sentiment to dominate the gains

Mining

Mining

Lithium miners were the kings, queens, jacks and aces of the bourse on an avalanche of positive news around the sector.

The biggest trigger was probably the incredible rise in value for Tesla overnight, which soared beyond a US$1 trillion valuation on news Hertz would order US$4 billion worth of electric vehicles from the automaker.

As the leading electric vehicle maker in the western world, and with a big presence also in China and energy storage, Tesla is one of the biggest end users of lithium products globally.

Its boss Elon Musk, now the richest man ever, has a fair bit of sway on the market as well.

Wild $T1mes!

— Elon Musk (@elonmusk) October 25, 2021

On top of that Pilbara Minerals (ASX:PLS), up 525% over the past 12 months since spodumene prices bottomed out at under US$400/t (it sold a batch for upwards of US$2000/t last month), gained 7.66% after formally announcing plans to develop a lithium chemical plant in a JV with South Korea’s POSCO.

Core Lithium (ASX:CXO) declared the start of construction on its Finniss Lithium Mine in the Northern Territory. That will be shipping concentrate from the end of 2022.

$550 million capped Neometals (ASX:NMT) was up 14% after announcing its battery recycling demonstration plant in Hilcenbach, Germany, had been fully commissioned.

The one time lithium miner is up 405% over the past year.

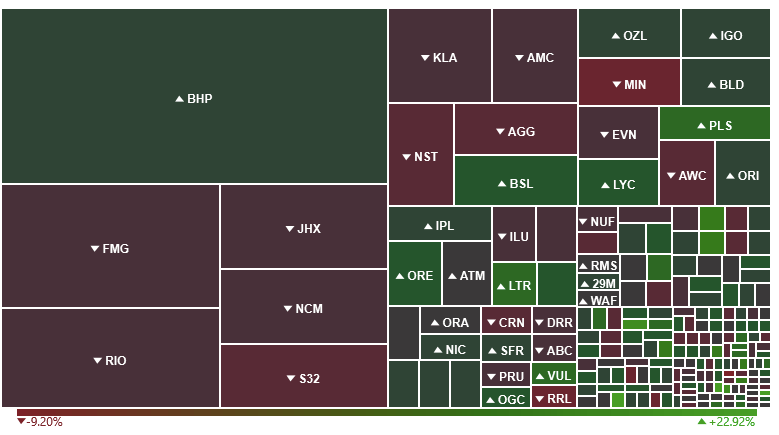

Vulcan Energy (ASX:VUL), Sayona (ASX:SYA), Liontown (ASX:LTR) and Orocobre (ASX:ORE) were among the lithium miners to dine out on the day’s news, while rare earths miner Lynas (ASX:LYC) was also up.

On the flippity flip, iron ore miners were weak with Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) cancelling out a gain from BHP (ASX:BHP), while Mineral Resources (ASX:MIN) cancelled out the gains it made with yesterday’s announcement the Wodgina lithium mine would be coming back online with news it ate a 48% price discount on iron ore sales in the September Quarter.

MinRes’ average realised prices fell from US$178/t to around US$78/t between the June and September Quarters.

Base metals were back up on Monday, with production cuts in energy starved China and Europe hitting primary supply.

Inventories held by the major exchanges are being chewed up.

While price moves among the miners was muted, nickel rose 3.2% to climb back over US$20,000/t overnight after hitting US$21,000/t briefly last week.

“Nickel rallied after Eramet disclosed a 19% drop in ferronickel production from its operations in New Caledonia,” ANZ analysts said in a note.

“The market is also showing signs of tightness, with cash contracts closing at their biggest premium to futures in two years. LME inventories are down nearly 50% since April.”

LME stockpiles for copper hit their lowest level since 1974 last week, but Commbank analyst Vivek Dhar says it is too early to say whether the market is as tight as it seems, or whether some traders are hoarding to capitalise on high prices.

The market is expected to be in a small deficit at the end of this year to a 328,000t surplus in 2022 on rising supply (about 1.3% of global demand).

Mined supply is expected to increase 2.1% this year and 3.9% in 2022, but Dhar warned copper miners had a history of underwhelming.

“The rising forecasts for copper mine production reflect 5 major copper projects due to arrive by the end of 2022,” Dhar said.

“That compares with just two major copper projects in the last 4 years.

“Given the track record of mine disruptions (i.e. labour strikes, power and water scarcity and geopolitics) and the decline in copper grades, elevated copper mine production growth forecasts don’t tend to last long.

“We think it’s worth considering that new mine supply may take longer than currently expected to hit the market.”