Monsters of Rock: Juniors get more love than majors as iron ore loses allure

Iron ore miners reported lower prices across their quarterly reports. Pic: Getty Images

- Majors see lower iron ore prices amid push to diversify

- Some junior iron ore miners still making handy cash

- IGO and Tianqi ditch lithium plant expansion

Monsters of Rock drills deeper into the ASX’s large cap mining stocks with mining scribe Josh Chiat

Majors seem to be itching to dilute their iron ore divisions on concerns that waning demand in China and the onrush of supply from here, Brazil and Africa could strangle the golden goose before it hatches any more super-profits.

The latest to feel the fury of the market was Fortescue (ASX:FMG), which was unable to spin record hematite shipments from its Pilbara iron ore mines through Port Hedland into the positive story some analysts read.

Investors punted Twiggy’s ASX 20 giant 2.3% lower Thursday as it failed to generate additional cash in the December quarter, closing with its bank balance unchanged at US$3,4bn and with net debt of US$2bn after spending US$1bn on capex in the three months to December 31 despite lifting shipments 4% QoQ to 49.4Mt.

That helped C1 costs fall 10% from US$20.16/t in the September quarter to US$18.24/t, though that remained 4% higher than costs 12 months earlier.

Shipments from new magnetite mine Iron Bridge surprised to the upside as well, with output of 1.5Mt taking total shipments for the half year to 3.2Mt, well within the range required to meet its 5-9Mt FY25 guidance.

FMG captured 85% of the Platts 62% Fe benchmark iron ore price of US$103.39/dmt, collecting US$87.40/dmt for its hematite ore, while its high grade Iron Bridge concentrate traded at 99% of the 65% Fe index and 113% of the 62% index at US$116.85/dmt.

The result came within a week of revelations including news that Rio Tinto (ASX:RIO) had entertained a merger with Anglo-Swiss mining and trading giant Glencore, which would have cut its reliance on iron ore earnings from over 60% of earnings to just 36% by adding a string of large copper, zinc and coal assets to its portfolio.

Rio and BHP (ASX:BHP) both saw prices paid for their iron ore tumble in recent months. BHP’s first half saw prices drop 22% year on year to US$81.11/wmt. Rio’s fell from US$105.8/dmt in the first half of 2024 to US$89.7/dmt in the latter half (US$97.3/t to US$82.5/t on a dry metric tonne basis).

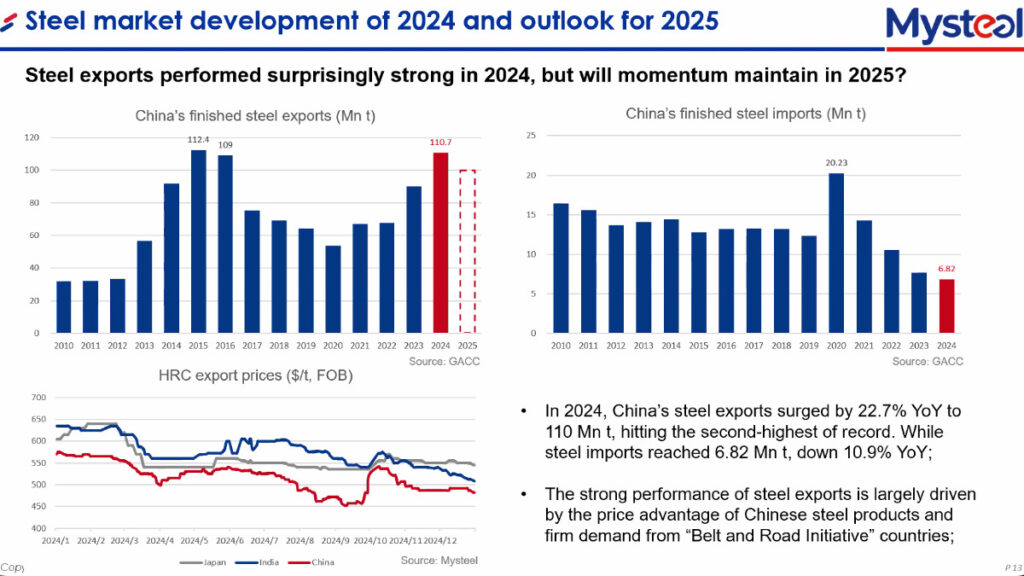

The challenges facing Chinese steel makers

China’s steel sector, the fuel for iron ore’s price strength in recent years, is delicately balanced.

Steelmakers have produced over 1Bt annually since 2020, the country’s peak at 1.065Bt. But its property sector, the traditional engine room for the market, has been pretty much cooked since Covid.

Manufacturing, electric vehicles and green energy have picked up some of the slack. But the past couple of years would have been even bleaker had it not been for record exports. Those could be curtailed as tariffs against Chinese products, both steel and the goods manufactured from it become more likely both in the EU and from the new Trump Administration in Washington.

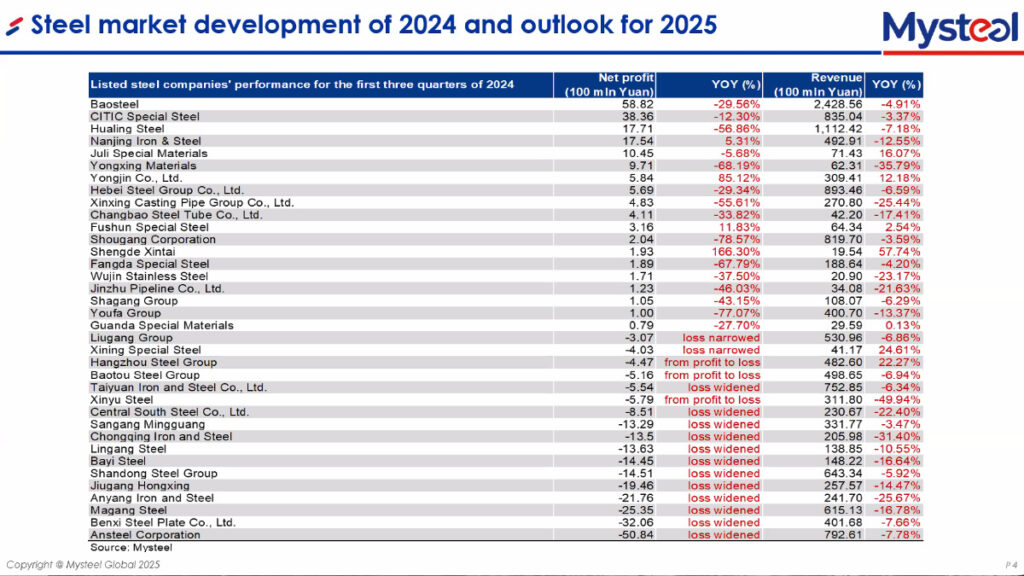

Research from MySteel this week shows just how bad the situation was for China’s largest 36 steel producers.

Nearly half lost money and just four improved their profit-loss statement.

While weaker markets tend to favour large, established players with low cost bases, the best received iron ore quarterlies have arguably come from smaller producers.

Mount Gibson Iron (ASX:MGX) sold ~700,000 wet metric tonnes of 65.2% Fe at cash operating costs of $94/wmt, turning out $16 million of group cash flow at its high grade Koolan Island mine. Its fines, including provisional pricing, pulled in US$91/dmt FOB – $145/dmt Aussie at current exchange rates.

The project has some mortality issues. MGX is milking the cash over the final two years of the remote Kimberley mine’s life, expecting to produce 2.7-3Mt at costs of $95-100/wmt FOB in FY25.

Mount Gibson had $451m of cash and investments with no debt, funding a planned buyback of up to 5% of its stock and the potential acquisition of new operations.

“At prevailing prices, and subject to the extent of any interruptions from the northern wet season now underway, we continue to anticipate positive cashflow generation over the remainder of the financial year,” chief executive officer Peter Kerr said.

“We remain focused on maximising production and cashflows from the high-grade Koolan Island operation over its remaining two year mine life, which together with our robust financial position, places the company in a good position for investments and opportunistic acquisitions.”

Fenix Resources (ASX:FEX), which counts MGX as a large shareholder, ended Thursday’s trade even after announcing a record 593,580wmt of shipments from its Mid West WA iron ore mines in the December quarter.

Unlike the large miners who sell linked to spot rates, Fenix operates a hedge book for much of its ore, outperforming the market price by 3% during the December quarter at US$106/dmt. Its lower grade Shine mine collected US$80/dmt, but Fenix says the grade profile will improve there.

Cash costs came in at A$82.8/wmt, against prices equivalent to A$146/dmt CFR generating an average C1 operating margin of A$31/dmt after shipping costs of A$27/t were taken into account.

Fenix locked in an additional 240,000t of hedges for forward sales through to December 2025 this week, with a hedge book of 660,000t at A$155/t through the end of the year providing a bullwark against a hypothetical deterioration in iron ore pricing.

Demand “strong”

While FMG, Rio and BHP’s results, as well as MySteel’s analysis of the Chinese steel sector, all provide a negative read through for the iron ore market, FMG’s Dino Otranto told analysts demand remained strong for the miner’s Pilbara product.

“Our products are moving relatively quickly. Steel – I know that there’s a lot of scuttlebutt around the Chinese market – you are seeing a diversification happening over the last couple of years,” he said.

“We’re certainly working closer with our customers than ever before.”

FMG says steel profitability will remain challenged, but that would support lower discounts for its hematite as mills look to save costs on material inputs.

Iron ore was fetching US$103.60/t in Singapore on Friday morning. The market could see short term support on the supply side from Rio Tinto, which copped a hammering from 274mm of rain that hit its facilities in Karratha on Monday. Tropical Cyclone Sean flooded a railcar dumper at its East Intercourse Island terminal, which shipped 45Mt in 2024 and its expected to be offline for three to four weeks.

Rio said first quarter shipments would be affected from the record rain incident, though 2025 guidance of 323-338Mt remains in place.

“Recovery works within the broader iron ore system are progressing, with the majority of rail and port operations now returned to operations,” Rio said in a statement.

“The company is working to mitigate impacts and will provide an update at its full year results on 19 February 2025.”

RBC’s Kaan Peker said the EII closure was likely to impact around 3-4Mt of exports over the shutdown period. That could be magnified since, as Peker pointed out, EII ships higher quality Pilbara blend fines and lump. Product quality has become a major issue for Rio, impacting price realisation. Its lower grade SP10 product lifted from 18% of shipments through the first nine months of 2024 to 25% of sales in the past quarter, a number that isn’t expected to reduce substantially for the broader Pilbara ops until Rhodes Ridge is developed later this decade.

IG-NO

And now for some entirely unsurprising news – Tianqi Lithium announced to the Hong Kong market on January 23 it was halting plans for a second 24,000tpa process train at the misfiring Kwinana lithium hydroxide plant in WA.

That’s good news for 49% owner IGO (ASX:IGO), which this week announced it planned to book an impairment on the facility, which has underperformed ramp up expectations and was forced to stockpile material late last year due to weak market demand.

Lithium prices tumbled from late 2022 through the end of last year, curbing the upside for the facility. Tianqi needed to act to constrain cash burn.

It was hurt worse than most lithium players last year and in 2023 because the electric vehicle battery chemicals it produced fell further and harder than the price of spodumene concentrate it mined alongside IGO and Albemarle at the world class Greenbushes lithium mine in WA’s South West.

The pain is compounded by its 23% share holding in Chiles’ SQM, another lithium major facing severe losses in recent quarters. Tianqi has notified the HKEX its losses for 2024 will range between RMB7.1-8.2bn, between $1.5-1.8bn Aussie.

IGO booked over $1bn of impairments already in the past couple years, largely thanks to its disastrous $1.3bn cash splash on nickel producer Western Areas right before a collapse in global prices for the battery and stainless steel ingredient.

But it still generates substantial cash from its 24.99% share of Greenbushes and Nova nickel mine, both of which sit at the bottom end of the global cost curve for their commodities. IGO shares lifted 3.1% after it confirmed the pause on Kwinana train 2, with investors bullish that it will redirect capital currently being sunk into a lossmaking enterprise.

IGO will report its quarterly results on January 30. Canaccord’s Tim Hoff, who has a sell rating (unusual for brokers in Oz) on IGO and $4.30 price target said an impairment on the value of TLEA’s assets had been a long time coming. While the capital discipline will be welcomed “by the streets”, he warned it will hurt longer term earnings forecasts baked in by analysts and funds.

But the decision to cease work on the expansion is a blow for Australia and the Albanese Government’s “Future Made in Australia” program. Even with the introduction of a policy that would enable downstream processors to receive a tax credit on value added products, it’s been unable to halt market forces and prevent pain from broader economic conditions.

Albemarle has pulled back investment on all bar one of the four trains at its Kemerton plant in WA’s South West, Alcoa has shut its ageing Kwinana alumina plant and BHP will not operate its Nickel West refinery in Kwinana until at least 2027.

Tianqi operates four plants in China and is constructing a 30,000tpa lithium hydroxide project at its existing Jiangsu base, which can be flexed to produce lithium carbonate, a chemical used in lithium-iron-phosphate battery chemistries growing in popularity for Chinese consumer-end EVs. It has also outsourced processing in recent years to fill processing gaps.

The ASX 300 Metals and Mining index fell 1.39% over the past week.

Which ASX 300 Resources stocks have impressed and depressed?

Making gains

Liontown Resources (ASX:LTR) (lithium) +16.4%

ioneer (ASX:INR) (lithium) +14.1%

Predictive Discovery (ASX:PDI) (gold) +7%

Genesis Minerals (ASX:GMD) (gold) +6.5%

Eating losses

Iluka Resources (ASX:ILU) (mineral sands/rare earths) -12%

Vulcan Energy Resources (ASX:VUL) (lithium) -11.1%

Patriot Battery Metals (ASX:PMT) (lithium) -9.9%

Capstone Copper Corp (ASX:CSC) (copper) -9%

Arafura ran higher after securing a $200 million convertible note deal with a new Australian Government body to complete debt finance for its Nolans rare earth project in the Northern Territory, while Syrah received additional backing from US Government in the form of a US$165m ($268m) tax credit.

Iluka fell after revealing it had chopped 130 jobs in a move to save $20m in costs in 2025. Canaccord clipped its price target on the mineral sands miner from $6.30 to $5.40 on a delayed recovery for mineral sands demand, while insto Perpetual was revealed to have sold down its stake in Iluka from 8.24% to 7.194% via a series of on-market trades.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.