Monsters of Rock: IG’s top two miners to watch this week

Pic: Getty

Whitehaven Coal (ASX:WHC) and Northern Star Resources (ASX:NST) are two large cap miners worth keeping an eye on in the week ahead, according to trading platform IG Markets.

Despite general concerns about global growth and subsequent drop in global bond yields, gold prices fell throughout last week.

The drop in the value of the yellow metal weighed on Aussie gold miners like Northern Star.

Northern Star’s share prices fell to two-year lows as investors reduced exposure to gold-mining stocks, to close below what was price support at roughly $8.80 per share.

“The technicals look quite poor for the stock now, with the trend and price momentum skewed to the downside,” IG analyst Kyle Rodda says.

“The next major level of long-term price support looks to currently sit at around $7.65 per share.”

The stock was down another 1.15% in Monday trade.

At the other end of the spectrum was Whitehaven Coal, which surged last week.

Global coal prices jumped to a record high as energy demands spikes on what is an unfolding and worsening energy shortage globally.

“Whitehaven shares look to be forming a primary uptrend now, with the weekly RSI showing a stock that is technically overbought, but that that is not signalling yet a meaningful slowdown in momentum,” Rodda says.

“WHC shares probably remain highly tied to the budding energy crisis now and any further upside in coal prices, and in the short-term, risk-reward appears skewed to the downside given the stock’s overbought technicals.

“A re-test of previous price resistance now support at around $2.50 may indicate whether the stock’s longer term uptrend remains in play.”

WHC was down 2.5% in late arvo trade.

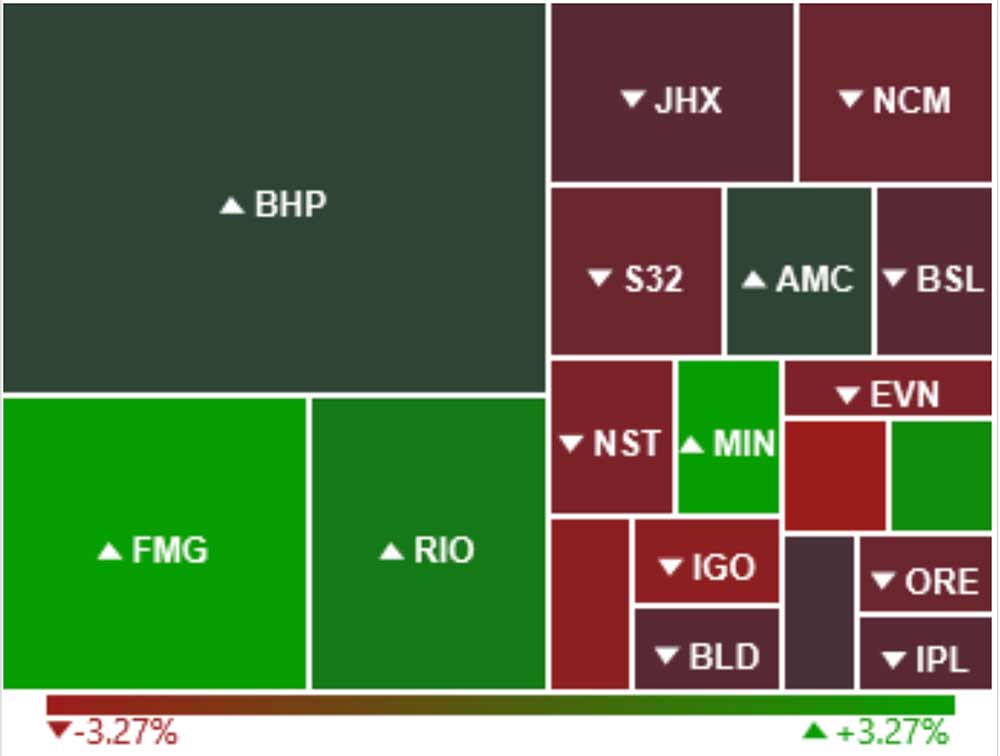

Iron ore miners up as Materials ekes out small gain

The ASX 200 Materials index was up ~0.15% at close of play Monday, dragged higher by the major iron ore miners BHP (ASX:BHP), Rio Tinto (ASX:RIO), FMG (ASX:FMG) and Mineral Resources (ASX:MIN).

The benchmark iron ore price – down 30% year-to-date – has staged a small comeback to ~$US110/t since going into the low 90’s on September 21.

In the mid cap space, +$1bn market cap lithium hopeful AVZ Minerals (ASX:AVZ) led the winners after securing a “cornerstone investor” for its Manono development in the DRC.

Private Chinese company CATH will pay US$240 million cash for an initial 24% equity stake in the project.

“Proceeds from the transaction will fund a majority of the total project financing required, whilst AVZ will retain a controlling 51% interest in the Manono Project post-completion of the transaction and its position as lead developer of the Manono Project,” the company says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.