Monsters of Rock: Could this logical merger finally get Australia’s vanadium sector off the ground?

Pic: Doucefleur/iStock via Getty Images

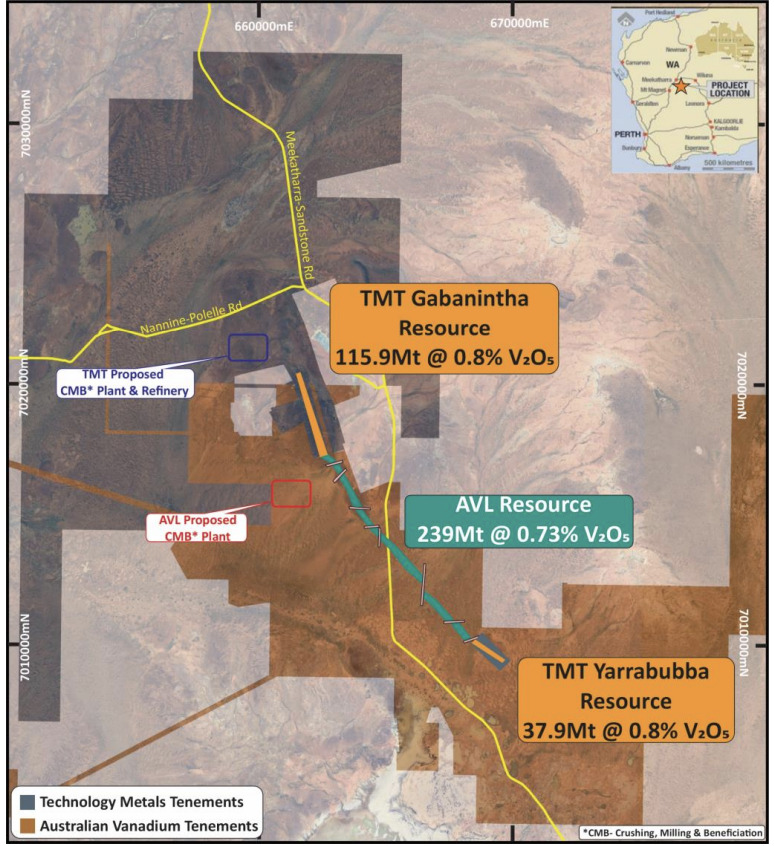

- Two vanadium players who own three parts of effectively the same orebody in WA’s Mid-West will merge

- Technology Metals Australia shareholders resoundingly voted up a 14-for-1 deal that will see the company merge with Australian Vanadium via a scheme of arrangement

- Miners pulverised in red day on ASX

Over in Perth Technology Metals Australia (ASX:TMT) shareholders have gathered to vote up a merger that will see a single orebody separated by a tenement boundary pulled together in the hope it can spark a new WA industry into life.

They voted up a deal that will see them receive 14 Australian Vanadium (ASX:AVL) shares for every TMT share they hold, a mark-up from an initial 12-for-1 offer that will give TMT investors 42% of the merged company if the WA Supreme Court approves the scheme.

It is, so to speak, a deal that makes sense.

Regardless of the possible financial value for shareholders, whatever that is down the line, it cuts across the illogic of having a single deposit effectively split in half by the vagaries of a tenement boundary.

Located in the Mid-West, the Resource Capital Funds backed firms were each planning to construct their own Gabanintha project.

Here’s what that would have looked like.

TMT’s two resources, Gabanintha and Yarrabubba, coming in at a combined 153.8Mt at 0.8% vanadium pentoxide literally sandwich AVL’s own Gabanintha orebody of 239Mt at 0.73% V2O5.

Two plants doing the same thing literally kilometres from one another as well. AVL has some additional benefits, including a $49 million grant from Canberra to support the development of its proposal, awarded back in 2022.

V2O5 prices spiked incredibly from long term lows of around US$2.50/lb to almost US$30/lb in a brief boom in 2018 only to slide back to long term levels aside from a run to more than US$12/lb in the commodity run following Russia’s invasion of Ukraine in March 2022.

They have since fallen back to around US$6/lb. The vast bulk of the end market for vanadium is as a steel additive to create hardy materials like armour plate, axles and tools, but the biggest growth sector is in battery storage applications.

A bankable feasibility study in 2022 put a C1 operating cost of US$4.43/lb on the Australian Vanadium Project, estimating it would cost US$435m ($604m) to construct the project containing a mine, concentrator and separate process plant near Geraldton producing 24.7Mlb of V2O5 and 900,000t of FeTi co-product each year over an initial 25-year mine life.

The second court hearing to approve the deal is due to take place on January 19.

$68m TMT’s shares rose 6% in late trade, while $100m capped AVL was unchanged.

Technology Metals Australia (ASX:TMT) and Australian Vanadium (ASX:AVL) share price today

And on the markets

A decision from China not to cut interest rates to stir up its economy seems to have helped tank the materials sector on a rough day on the bourse.

The big miners fell 1.52% with South32 (ASX:S32), Fortescue (ASX:FMG) and Evolution (ASX:EVN) among the hardest hit, copping 4.21%, 2.17% and 3.35% downgrades respectively.

Mid-tier miners fared little better, with high grade iron ore producer Champion Iron (ASX:CIA) among the biggest laggards at a 4.18% drop, with only some bullishness around Pilbara Minerals (ASX:PLS) and a bizarre 20% lift at do nothing uranium clean up play Energy Resources of Australia (ASX:ERA) lighting up the mining space.

Monstars share prices today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.