Monsters of Rock: China could expand coal production by 500 MILLION TONNES in 2022, Macquarie says

Pic: Tyler Stableford / Stone via Getty Images

- Chinese coal production on track to beat 2021 levels by 500 MILLION TONNES: Macquarie

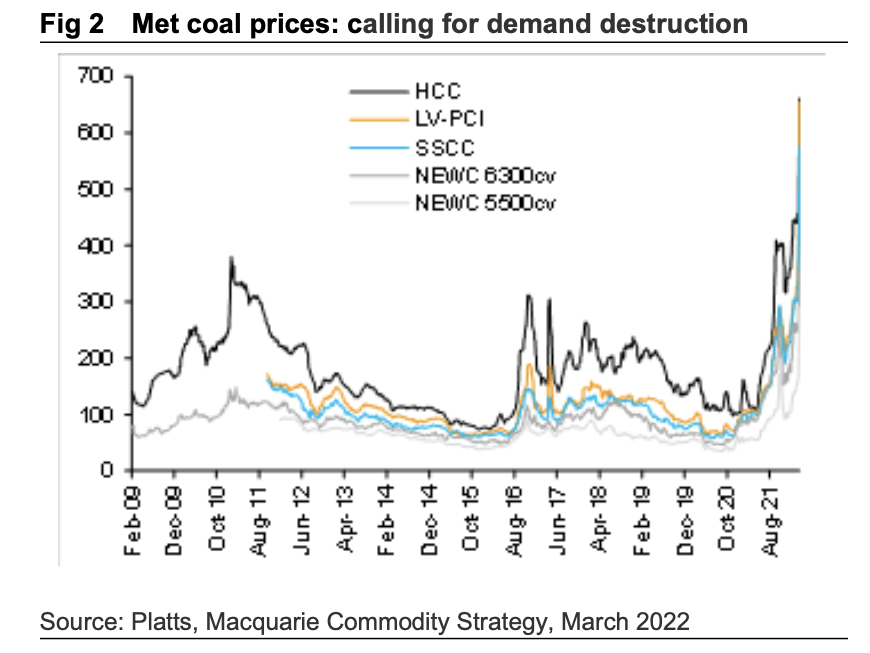

- Demand destruction needed to bring hot coal market into balance as coking prices top US$650/t

- Russian coal still finding its way out of the heavily sanctioned nation

China last year set a Net Zero target for 2060 and Xi Jinping gave a big pontificating speech at COP26 in Glasgow in November calling on developed nations to “provide support to help developing countries do better.”

In a case of do as I say not as I do, China is on track to blow its coal production records out of the water.

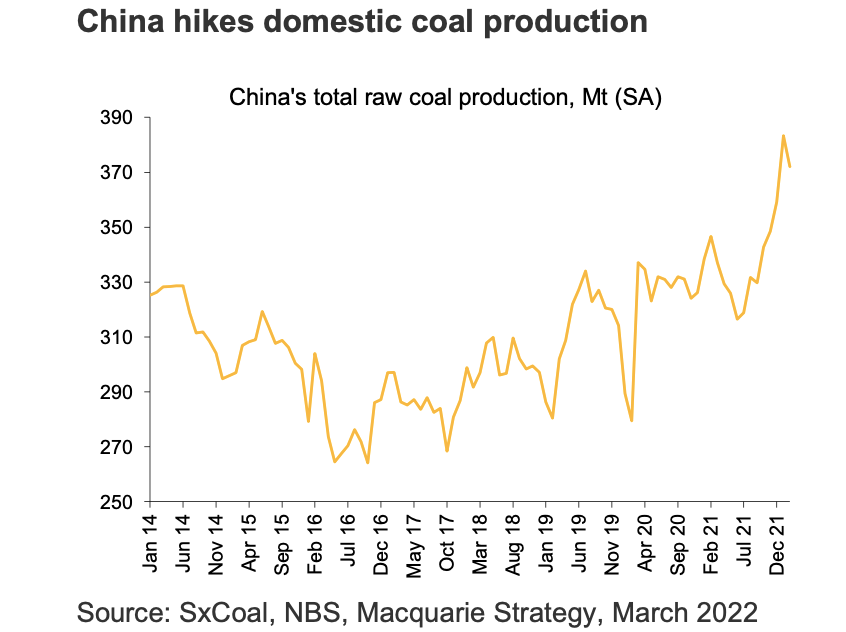

It has produced 687Mt across January and February, 10% up year on year.

According to analysis from Macquarie Bank after seasonal adjustment that would imply a growth rate of a whopping 500Mtpa, two and a half times Russia’s total exports in 2021.

China ordered a massive ramp up of thermal coal mines last year as an energy shortage caused power prices to soar.

Output had waned due to decisions to shut coal mines for safety reasons, but pressure to maintain cheap power supply had grown amid a shortage exacerbated by its decision to lock out imports from Australia.

“There remain questions about both data quality and whether this exceptionally strong run rate for production can be sustained,” Macquarie said.

“Nonetheless, at face value, today’s data challenges the “consensus” view that global coal supply is constrained by lack of investment: that is certainly true in certain seaborne jurisdictions, but after China’s (and India’s) massive domestic markets are considered, the picture appears substantially different.”

The data follows IEA predictions at the end of last year that domestic production increases in China and India will make 2022 the highest coal producing year on record.

‘Demand destruction’ needed to bring coal market into balance

Coal prices have spiralled out of control since Russia’s invasion of Ukraine began, with Australian premium hard coking coal topping US$650/t and thermal coal climbing to levels over US$400/t.

Good if you can get it.

Macquarie says coking coal spot prices are now at “scarcity levels” and demand destruction, that is buyers being unwilling to just pay anything to secure materials, could be the only way to balance the market.

But China’s radical increase in production could be a way out as well, either by displacing expensive imports from the Chinese market or increased exports from China to other countries.

Seaborne met coal markets are heading for a 16Mt deficit this year after a 30Mt deficit in 2021, but there is little marginal production coming into the market outside China (and to a lesser extent India).

Russian coal still finding buyers

Vessel tracking data accessed by Macquarie shows Russian coal exports are still humming along despite reports buyers in Europe are looking for alternative sources of steelmaking coal.

Russia exported around 32Mt of coal for steel making, 10% of the seaborne market, and 3.3Mt of metallurgical coke in 2021.

Coking coal demand could rise as buyers shun Russian and Ukrainian exports of steel as well, with European hot rolled coil prices increasing by 400 Euros since the start of March.

But it will depend on who fills the gap and how reliant they are on imported coking coal to boost their steel production, Macquarie said.

Resources stocks recover on Chinese economic support

Reports China will move to end a precipitous drop in its local share markets by backing property developers has reversed recent weakness in commodities.

It send iron ore futures higher today, with the major iron ore stocks all in the green, led by Fortescue Metals Group (ASX:FMG) at +4.28%.

The ASX200 Resources index rose 58.6 points or 1.07% to 5539.3 at 4pm AEDT, reversing a downward trend since hitting a three month high of over 6000 points on March 7 when base metals prices hit their recent peak.

Lithium stocks pulled back from early gains but Vulcan Energy (ASX:VUL) and Lake Resources (ASX:LKE) were still on the winner’s list in the mid-cap space, up more than 5% each.

$1.15 billion capper high grade Tasmanian iron ore producer Grange Resources (ASX:GRR) was up 5.32%.

Monsters share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.