Monsters of Rock: Big miners ready for the weekend as sentiment turns positive

Pic: mediaimages/E+ via Getty Images.

It’s been a tough week for the big miners, who have borne the brunt of volatile iron ore and gold prices.

The materials sector has contracted by some 3.22% over the past five days and more than 10% over the last month.

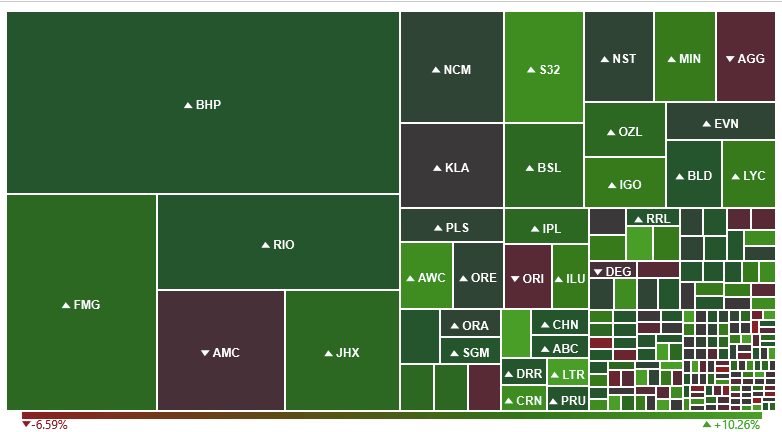

But finally a bit of joy for resources investors today as the industry swam in sea of soothing green.

Iron ore stocks received a shot in the arm from news a slow ramp up at its operations in northern Brazil means Vale will be unable to hit its planned 400Mtpa production capacity next year, knocking down its forecast 2022 runrate to 370Mtpa.

The iron ore miners were led by the Pilbara’s fifth wheel Mineral Resources (ASX:MIN), which jumped more than 5% to pare back losses for the week.

The biggest winners today were again aluminium stocks, with Alumina (ASX:AWC) and South32 (ASX:S32) basking in the afterglow of a 1.9% rise in LME aluminium prices to 13 year highs of US$2829/t while nickel was up 2.5% to push through the US$20,000/t barrier and tin rose 4% to US$34,092/t.

Battery metals stocks prospered with IGO (ASX:IGO), Vulcan Energy (ASX:VUL), Nickel Mines (ASX:NIC), Lynas (ASX:LYC) and Australian Strategic Materials (ASX:ASM) all among the top performers in the large and mid cap space.

RAMELIUS RESOURCES (ASX:RMS)

Gold miners also saw signs of life.

Ramelius Resources was up slightly after announcing a 15% increase in resources at its WA gold operations to 5.4Moz.

Mark Zeptner’s Ramelius, which owns the Edna May and Mt Magnet gold mining hubs, also maintained reserves at record levels of 1.1Moz albeit with a drop in grade form 2.1g/t to 2g/t.

The ~275,000ozpa gold producer says work is under way to convert resources to reserves.

RBC Capital Markets analyst Kaan Peker said the resource upgrade was largely positive, boding well for future underground developments at the Eridanus and Galaxy deposits at Mt Magnet.

“The increase in resources at Eridanus below the current Stage 2 Pit bodes well for the potential conversion to underground mining at the operation, especially with some of the high grade intercepts that have been hit recently including 45m at 3.23g/t gold,” he wrote.

“Ramelius has completed scoping study work on the potential for an underground at Eridanus (FY25 start, LHOS, Capex A$38M, production 119koz), but at this stage, we don’t include this in our forecast until further infill drilling and pit deepening have been completed.

“The Galaxy Resource increase provides a platform for Scoping study work that is expected to commence in December 2021. Previous scoping work (July 2021) envisioned mining the Galaxy Resource from FY24 for an initial 6-yr life, producing 179koz at an AISC of A$1,689/oz with minimal upfront capital expenditure of A$40m.

“With no ongoing open pit work above the potential Galaxy undergrounds (See Exhibit 2), we believe there is potential to bring forward the start of underground mining at Galaxy once additional studies and drilling have been completed.”

Ramelius Resources share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.