MoneyTalks: Hedley Widdup’s mining clock has hit midnight. Here’s how resources investors can keep the lights on

Pic: jgroup/iStock via Getty Images

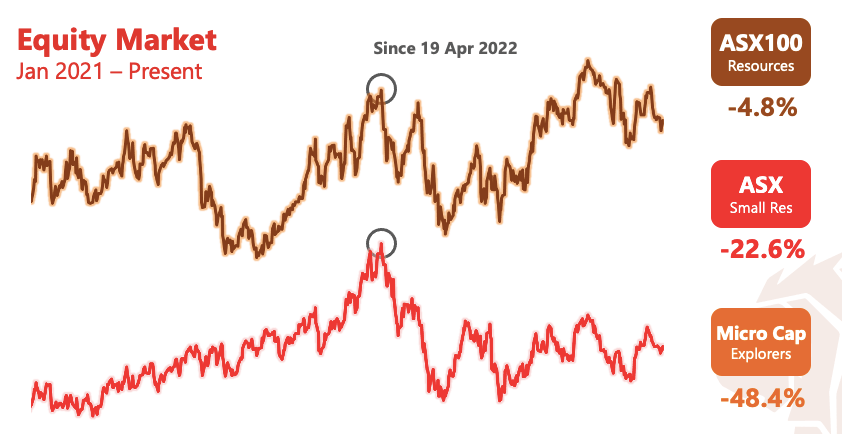

- Hedley Widdup’s mining clock has ticked past midnight, suggesting we’ve seen the top of the cycle

- Of 664 mining microcaps tracked by Widdup’s Lion Selection Group just 13% are in positive territory since April 19 last year

- But there are opportunities for liquid investors to support explorers with stories they believe in, with the fundamentals for gold especially positive

Mining boffin Hedley Widdup is best known for his mining clock, the tool the Lion Selection Group (ASX:LSX) executive director uses to show how close we are to the top of the cycle.

Speaking at the Resources Rising Stars Conference on the Gold Coast yesterday, Widdup now says that clock has ticked past midnight, pegging the date the bell tolled for the recent boom as April 19 2022.

“In this case, since the last time we talked about it, we’ve seen a hell of a lot of liquidity come into the market, so we’ve seen things like big IPOs, we’ve started to see big M&A deals, which are often a long time in the making,” Widdup told Stockhead.

“They’re signals of going through the top of liquidity.

“We’ve also seen liquidity start to drop away. So in 2023, the small companies are suffering, they find it harder to raise money, and their share prices have detached themselves from the bigger brother trading patterns. So that says to us liquidity is falling.

“When liquidity falls, the cycle turns over.”

Since then the ASX 100 Resources index is down 4.8%, small resources down over 22% and microcaps down 48% amid a stagnation in the share prices of the majors and falling liquidity for those at the bottom of the market.

Of the 664 mining and metals companies with market caps of less than $200 million identified by LSX, 87% are in negative territory since that date.

“Which is a huge proportion. It’s a lot bigger than it is in an index normally — 30% or 40%, would sort of be peak of the market, because there’s a lot of companies in there which aren’t doing much as well,” he told Stockhead.

“But 87% is huge, it’s getting a bit too close to all of them.”

How can you play the game?

Here at Stockhead we’re not all about the doom and gloom. And even in times like these there will be winning strategies.

Cash is making 4% at the moment, outperforming the market, Widdup notes.

But Widdup says there will be opportunities for investors who are liquid and can support explorers with stories they believe in.

Having a decent amount of cash to play with is key though, given juniors will have to raise cash at higher discounts to tick along, raising the risk of dilution for shareholders who can’t top up.

“I speak for a fund which is holding mostly cash at the moment and that’s making 4%, so it’s outperforming the market,” Widdup said.

“I’m not saying sell everything and go to cash … we have the luxury of being able to do that. But we’ve also got the luxury of having had some fairly attractive assets, which we could sell through the top of the cycle.

“(Investors) need to make a decision about whether they want to hold risky things and portfolio balancing for them is always going to be about when do I want to hold the most risky things?

“The issue that they have at the moment with micro caps is that you can have something which you really believe in, but you can still have your investment performance eroded by being diluted by not being able to reinvest, if you’re not liquid.

“So being liquid, having enough cash to be able to follow your investment on the basis that you believe it, is going to be very important. For me, it’s them looking for whether or not they’ve got enough cash — not having to have all cash.”

Good as gold

Diversification is a key, Widdup says, to trade the mining thematic right now.

But he is supportive of gold in an environment of still negative real interest rates.

“Gold’s trading with a reasonable fundamental on the basis that the outlook for interest rates is probably low to negative real yields for quite some time,” he said.

“There’s not a lot of political willpower for interest rates to go hard and try to get it head and shoulders above inflation. That fundamental gold loves.

“I think gold probably collects believers along the way and when believers pile in on gold it performs well so I think that’s a good one, there’s a lot of gold stories in the market.

“You’ll always create more value in a company if you discover something which is genuinely good looking, than just by trying to trade the leverage thematic.

“If you like gold for that reason, then you’ve got to think about whether you want the producers for the leverage, or the explorers for the chance to find something which is really sexy.

“And there’s enough work going on in the gold sector, there will be some good discoveries over the next couple of years even as the market is weak.”

Widdup says commodities like gold, nickel, copper and lithium have the benefit at this stage of the cycle of being metals where companies can develop mines at relatively low capex.

Any picks in the sector?

Widdup says there are two gold companies LSX have taken punts on on his watchlist.

“One is (WA gold explorer) Great Boulder Resources (ASX:GBR),” Widdup said.

“You could probably chuck a rock from their project and almost hit some of the nearest mills, they are that close.

“You can have lunch in Meekatharra in the pub, one of the best chicken parmis in Australia I might add, and you can be on their project by the time the coffee you brought outside is still warm.

“They’re looking on the right hand side of what looks to be a fold which has a very prolific gold field down the Western Limb. And here’s them on the east in an area which hasn’t been explored and they’re finding gold, finding it at shallow levels.

“Some of it looks very attractive, some of it looks like it’s just an indication.

“But the interesting thing is when people have mined shallow indications of gold in the past, and then someone comes along 10 years later and drills under it, they often find something, so these guys are finding the things that they now need to drill under.

“So I see a very bright discovery pathway for them in that part of the world and the geologists who are running that company are personally wonderful as well, so I’ve got a lot of time for them.”

Widdup said LSX has also invested in an unlisted gold explorer called Plutonic, which boasts sites at Champion in the Northern Territory, Georgetown in Far North Queensland and Porters Mount in the Lachlan Fold Belt.

“We bought into this very cheaply but the target is enormous. So we’ve gone looking for something there which was a huge payoff for very little upfront investment if they get it right,” he said.

“And there’s a lot to get right in geology, you can be right about your theory and wrong about where you put your holes.

“So we’re not discounting that risk.

“The only way you get access to that is by buying Lion, so I don’t know if that’s a recommendation or not but we like that for that reason.”

Lion Selection Group (ASX:LSX) and Great Boulder Resources (ASX:GBR) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.