Moho extends high grade gold mineralisation at East Sampson Dam

Pic: Schroptschop / E+ via Getty Images

Special Report: Moho Resources has extended known gold mineralisation at its East Sampson Dam gold prospect, within its Silver Swan North project, during the latest round of resource definition diamond drilling.

The latest diamond drilling assays from Moho Resources’ (ASX:MOH) East Sampson Dam returned some seriously impressive numbers.

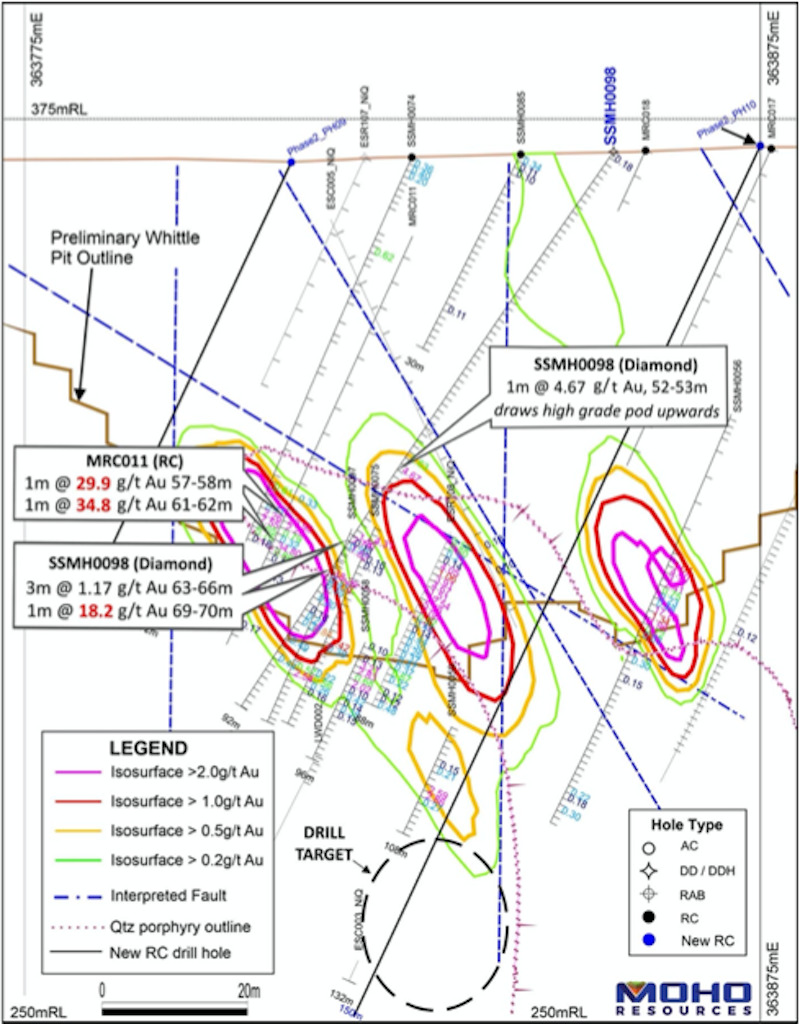

Highlights included the following hits – all recorded in drill hole SSMH0098:

- 1m at 18.2 grams per tonne gold from 69m;

- 1m at 4.67g/t gold from 52m;

- And 3m at 1.17g/t gold from 63m.

SSMH0098 was drilled to clarify high grade gold mineralisation previously intersected at East Sampson Dam, and discovered a significant number of gold intercepts with high correlation to adjacent holes.

The company said the hole was able to extend the modelled high grade mineralisation reported in previous drilling, including 1m @ 34.8 g/t Au from 61m and 1m @ 29.9 g/t Au from 57m. Significant structures noted by Moho geologists will be incorporated into a resource model expected in early 2021.

Moho managing director Shane Sadleir said the latest assays were a promising development.

“These new diamond drilling results are very positive and highlight the quality of preliminary modelling of mineralisation at Moho’s East Sampson Dam prospect,” he said.

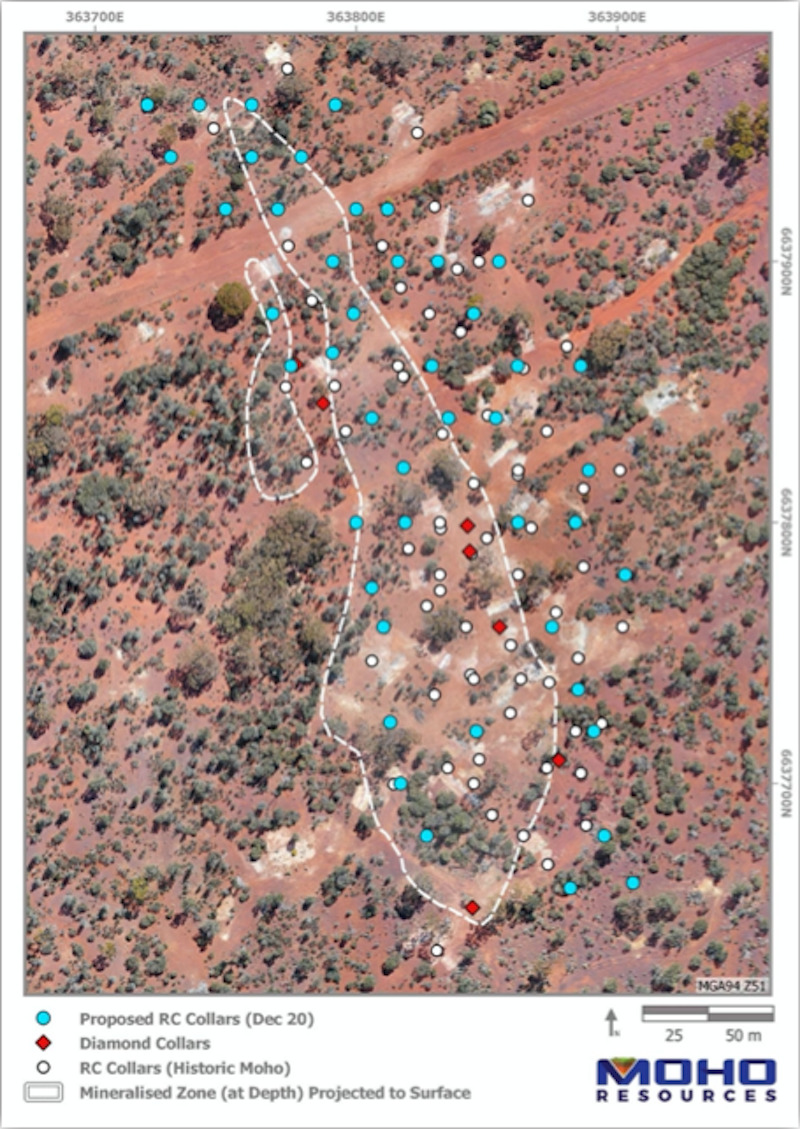

An expanded second phase of resource definition drilling is now underway at the prospect, with 45 RC holes planned for 3800m to infill the current resource drilling.

The program will also test for mineralised extensions to the north and south and include deeper holes in search of potential mineralised stacked shoots.

Assays are pending for the last three holes from the current round of diamond drilling at East Sampson Dam and are expected this month. Assays from the second phase of RC drilling are expected in February next year.

Moho is also reviewing downhole logging and diamond drill data at East Sampson Dam to work out the structural controls of gold mineralisation at the prospect this quarter. Aircore drilling of historic auger gold anomalies north of the prospect is planned for the first half of 2021.

Finally, a resource model and JORC resource are expected in Q1 next year – expect no shortage of newsflow from Moho into the new year.

Placed for success

East Sampson Dam isn’t the only prospect Moho is following up, having recently received Western Australian government funding to assist with the drilling of its Crossroads gold prospect on the nearby Burracoppin Project in the state’s Wheatbelt.

RC and diamond drilling will begin there in early January, in follow up to significant drill results from a maiden aircore campaign earlier this year which yielded assays of up to 0.61g/t gold and 5.53g/t silver in bedrock at the end of the hole.

Moho owns 70% of Burracoppin as part of an joint venture with IGO Ltd (ASX:IGO), which covers exploration and potential development on the tenement covering Crossroads.

IGO’s stake will be free-carried until the completion of a prefeasibility study, at which time it can either contribute pro-rata to project work or reduce its holding to a 10% free-carried interest.

Like Moho’s East Sampson Dam gold prospect which is within 100km of actively producing gold plants, the Crossroads gold prospect at Burracoppin is located less than 25 km from Ramelius Resources’ Edna May gold mine at Westonia.

This article was developed in collaboration with Moho Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.