Is the Crossroads anomaly the tip of a golden iceberg for Moho?

Pic: Getty Images

Special Report: Moho Resources to commence drilling at its Crossroads gold-silver prospect in Western Australia’s Wheatbelt, chasing extensions of recently intersected shallow bedrock mineralisation.

A round of 25 deeper reverse circulation totalling 2500m and three diamond holes spanning 600m will begin in early January, Moho Resources (ASX:MOH) said.

The program follows up exciting drill results released in June from its maiden aircore drilling campaign which returned assays up to 0.61 g/t gold and 5.53 g/t silver in bedrock at end of hole.

The initial results suggested the gold/silver mineralisation at Crossroads was open to the south, east and at depth, and located on the northern margin of a pronounced gravity low that the company believes may represent a felsic intrusion.

Moho has also been awarded a co-funded grant worth up to $147,526 from the WA Government’s Exploration Incentive Scheme to further its exploration at the Crossroads prospect which is situated about 22km west of Ramelius Resources’ Edna May gold mine.

“Moho greatly appreciates the WA government’s financial assistance under the Exploration Incentive Scheme to test the Crossroads gold/silver prospect for a potential intrusive mineral system,” Moho Managing Director Shane Sadleir.

“We are looking forward to implementing our maiden RC and diamond drill programs early next year.”

A joint venture partnership

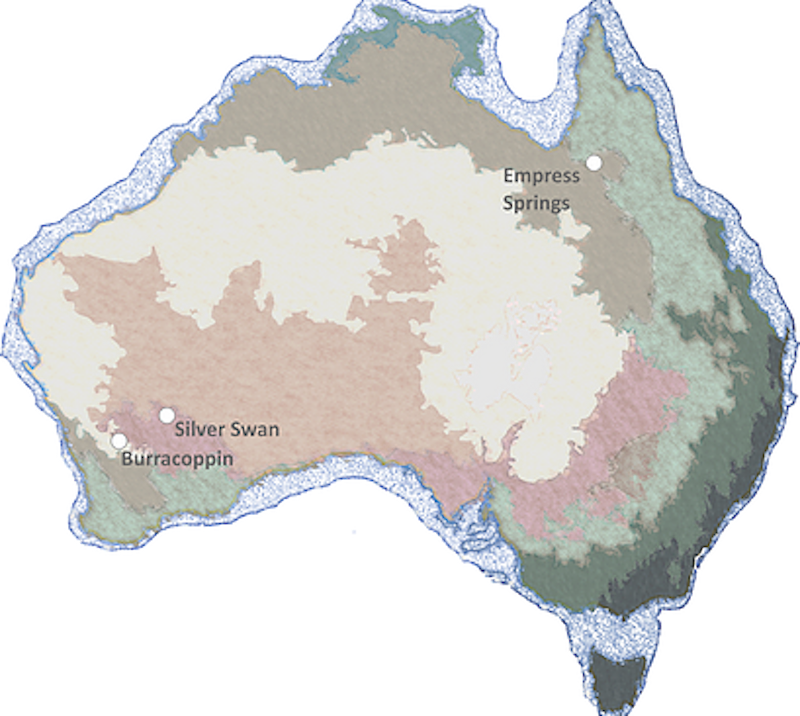

The Crossroads prospect sits within the broader Burracoppin Project, part of which Moho recently formed an unincorporated joint venture with IGO Ltd (ASX:IGO).

The IGO JV covers exploration and potential development and mining on tenement E70/4688 – the tenement covering the Crossroads prospect – with IGO retaining a 30% stake to be free-carried until the completion of a prefeasibility study.

Once a prefeasibility study is completed, IGO can either contribute pro-rata to the project’s ongoing work or convert its 30% interest to a 10% free-carried interest.

Moho earned its 70% stake in the tenement in July, having first inked a farm-in JV with IGO in 2015.

Moho owns a large ground holding around the tenement JV, with a 100% interest in granted exploration tenements E70/5154, E70/5300-5302, and applications ELA70/5299 and E77/2671.

Potential aplenty

The grant of exploration incentive funding at Crossroads is the latest in a flurry of promising activity by Moho across its prospective projects, with significant work done at the East Samson Dam prospect within the Silver Swan North project in recent times.

Assays released to market on November 19 from a recently completed program of eight diamond drill holes showed promising high grade gold mineralisation at East Samson Dam.

The company said last week that a second phase of RC drilling (~40 RC holes; ~4,000m) should lead to its first JORC mineral resource in the first quarter of 2021. It would also target further gold mineralisation around the prospect with aircore drilling of extensive auger gold anomalies in the first half of 2021.

It would be fair to expect plenty of news flow from Moho as we enter the new year.

This article was developed in collaboration with Moho Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.