MinRes is sniffing around its Bald Hill mine, right near where Torque Metals has intersected high grade lithium

The pegging rush is real around the rejuvenating Bald Hill lithium mine. Pic via Getty Images

- The Bald Hill acquisition has created a flurry of exploration activity in the surrounding region

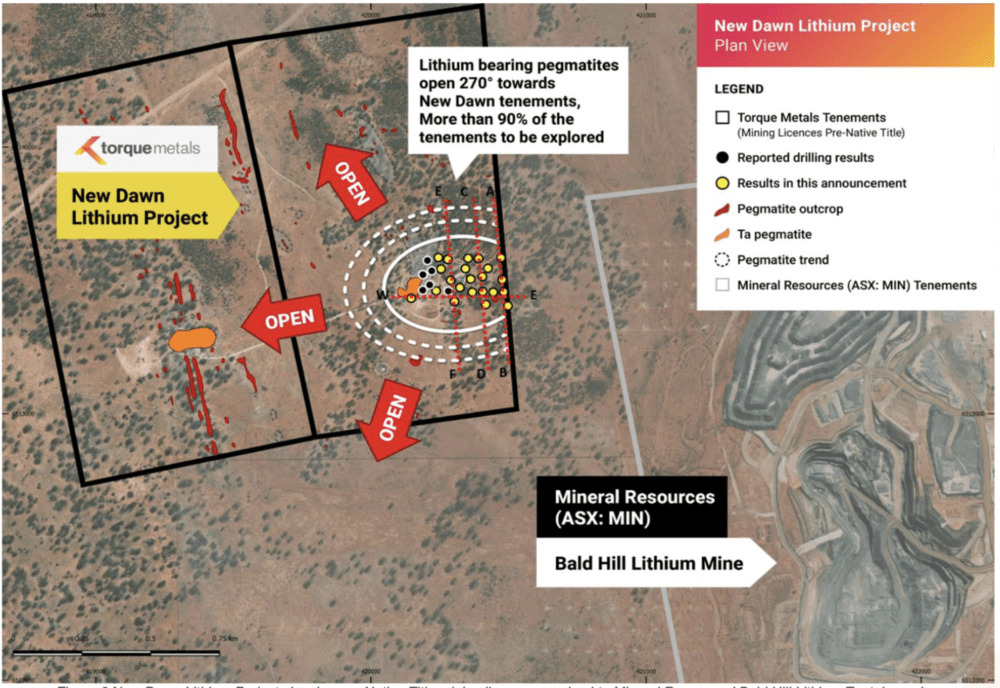

- Torque’s New Dawn consists of two development-ready mining and nine exploration licenses

- Drilling has intercepted 35m (cumulative) of lithium-mineralised pegmatites grading up to 3.99% Li2O

- MinRes-backed Kali Metals’ tenements are adjacent to Torque’s New Dawn lithium project

- New Dawn is right next door to the rejuvenating Bald Hill mine

Juniors are rushing to prove up lithium resources around Mineral Resources’ rejuvenated Bald Hill mine, with the newly listed Kali Metals entering the fray in the same vein as Torque Metals – which is already drilling lithium targets at its own mine-adjacent tenements.

Chris Ellison-backed Kali Metals (ASX:KM1) is now minted into the ASX after a successful $15m IPO also heavily supported by $1bn-capped Canadian gold miner Karora Resources and is looking to prove up the lithium potential of its tenements adjacent to Mineral Resources’ (ASX:MIN) Bald Hill operation.

It’s a strong indication that Ellison is looking to expand on opportunities around the recently acquired Bald Hill mine – and right next door is Torque Metals’ (ASX:TOR) highly prospective and more advanced New Dawn project, which also abuts KM1’s landholdings.

Bald Hill is back

Tawana Resources developed the Bald Hill mine in a 50/50 JV Singapore-based Alliance during the world’s first lithium rush of the millennium before ultimately merging and becoming Alita Resources.

Due to mine issues and the tanking of lithium prices after the boom, Alita went into administration around 2019.

Shrouded in mystery since, the mine was shuttered then restarted privately by Chinese operators. MinRes took ownership late last year after a proposed sale to China-linked Austroid Corporation was blocked by Federal Treasurer Jim Chalmers.

Up-to-date info on the size of the prize at Bald Hill is sketchy at best, with the last known resource update being 26.5Mt at 1.0% Li2O (using 0.3% Li2O cut-off) and 149ppm tantalum (Ta2O5) back in 2018.

Alita also defined an exploration target immediately west of the main pit (Pegmatite 3 West) of 17-24Mt @ 1.25-1.4% Li2O for between 140-220m below surface – towards TOR’s New Dawn project.

Explorers with landholdings around the mine are keenly proving up their own nearby resources in the hope they can be fed into the Bald Hill operation in the future – which could amount to a big payday for these ASX juniors.

Growing Goldfields lithium

With processing facilities, producing lithium mines and well-built infrastructure, the Goldfields’ lithium precinct is becoming a global heavyweight in its own right.

Mining majors Hancock Prospecting, SQM, BHP and MinRes are spending billions of dollars in the region to feed WA’s lithium and critical minerals exports and develop downstream processing industries.

US, Chinese and Australian-owned hydroxide processing plants are ramping up near Perth, of which Kalgoorlie has direct infrastructure to port for either plant feed or direct shipping ore (DSO) to global markets.

Kali Metals IPO

A spinoff of gold-focused Karora and Kalamazoo Resources (ASX:KZR), KM1 has just hit the ASX after a successful $15m IPO.

KM1 has a 3,854km2 portfolio of lithium projects in both WA and NSW. In WA’s Pilbara, it has the DOM’s Hill, Marble Bar and Peak Creek projects; in the Eastern Yilgarn it owns the Higginsville project and in NSW/Victoria, the new float has collared the Jingellic and Tallangatta projects.

Funds from the oversubscribed $15m IPO will be used to explore and develop KM1’s lithium exploration tenure, with a strong focus at the Higginsville project.

Notably, two of Kali’s three Pilbara projects – DOM’s Hill and Marble Bar – are fully funded by lithium heavyweight SQM as part of a JV.

Exploration programs are underway, with an initial drill program anticipated to start in the first half of this year.

We need to Torque about New Dawn

With the Bald Hill lithium mine just 600m away to the east, it’s easy to see why TOR considers New Dawn ripe for lithium prospectivity across the two mining licenses.

Exploration in the last few months has identified multiple pegmatite targets at New Dawn, with the junior recently completing a 21-hole maiden drill program that included 19 RC and two diamond holes showing peak lithium hits of up to a whopping 35 meters (cumulative) of lithium mineralised pegmatites including 10m @ 1.51% Li2O, from 51m with 1m @ 3.99% Li2O.

The peak assay was recorded in hole 23NDRC016 and is interpreted to continue up-dip to the west within New Dawn tenements.

Mineralised intervals remain open in all directions, showing:

10m @ 1.51% Li2O, from 51m including 1m @ 3.99% Li2O from 52m

15m @ 1.17% Li2O, from 220m including 7m @ 2.12% Li2O, from 221m

10m @ 1.15% Li2O, from 265m including 6m @ 1.76% Li2O, from 267m

“Beyond its geological attraction, New Dawn boasts proximity to infrastructure, sharing a thoroughfare with major gold, nickel and lithium producers optimising logistical aspects and its mining licences expediting a pathway to production,” TOR MD Cristian Moreno said.

Collectively, TOR has 12 mining-ready licenses across what its calls its Penzance mining camp – which crucially speeds up the development process.

A flurry of news is expected from the ASX junior in the near future regarding its ongoing intensive exploration campaigns as it works towards a maiden resource estimate for lithium for the New Dawn project.

Others in the region

After a $7m IPO in January last year, Dynamic Metals (ASX:DYM) has been accelerating lithium exploration at its Widgiemooltha project.

The company says it’s systematically working through the lithium potential of the sizeable 880km2 tenure.

The project’s four prospects – Pioneer Dome West, Franks Far South East (FFSE), Mandilla East and Spargos East – straddle an emerging and significant lithium belt in WA’s Goldfields region.

Soil sampling assays received last month from 800 samples at the Spargos and FFSE prospects – showed up to 409ppm Li2O.

That comes on the back of recent augur drilling results at Pioneer Dome West – adjacent to Develop Global (ASX:DVP) 11.2Mt Dome North project – which confirmed a 2.8km trend of elevated lithium and pathfinder elements.

Earlier this year, St George Mining (ASX:SGQ) snapped up 14 exploration licenses over 653km2, including the Buningonia and Buningonia North projects, located in the same lithium province as Global Lithium Resources’ (ASX:GL1) Manna project and the Bald Hill mine.

It also nabbed the Ten Mile West project, east of Liontown Resources’ (ASX:LTR) Buldania deposit.

At Stockhead, we tell it like it is. While Torque Metals is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.