Mining Green Metals gears up to list with a sweet suite of projects in WA

The company plans to drill at the Coats project later this year or early next year. Pic via Getty Images

Explorer Mining Green Metals plans to list on August 4 after IPOing at $5m at $0.20 per share with an attractive suite of green metal projects including lithium, PGEs, nickel, vanadium and uranium in WA.

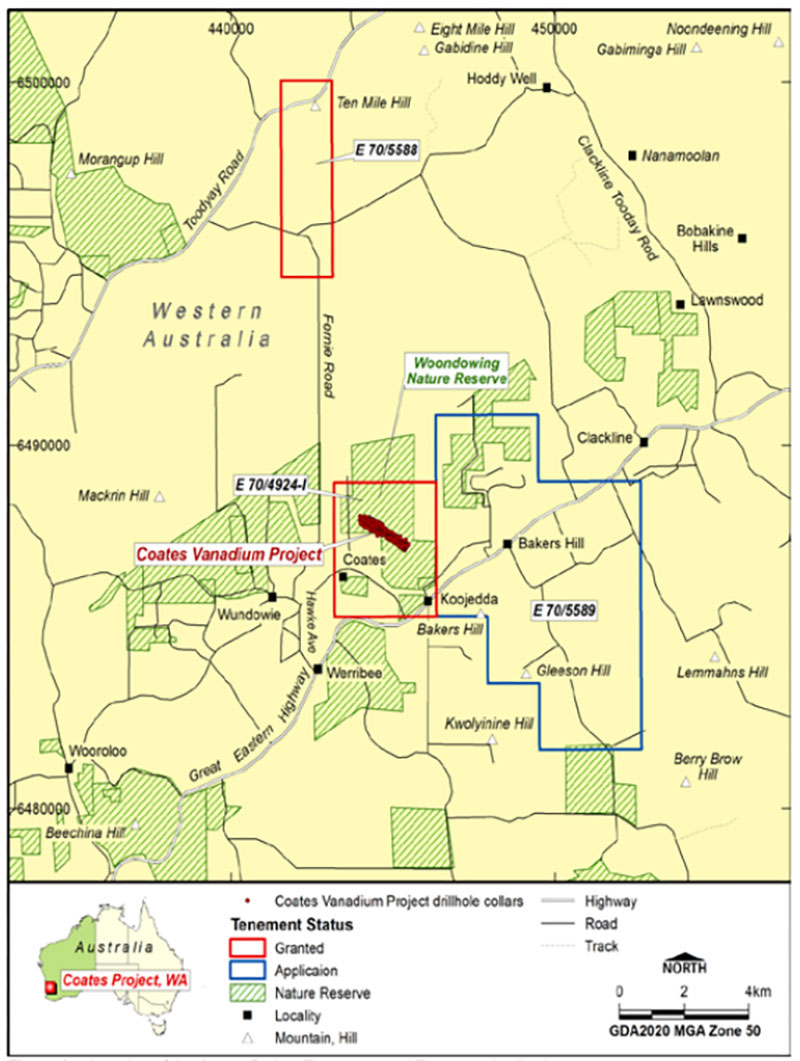

The company has entered into three option agreements for three projects, with the priority project coming out of Australian Vanadium (ASX:AVL) in the Coates PGE copper, nickel and vanadium project – which is just 20km SSE of Chalice Mining’s (ASX:CHN) Julimar project.

From Bryah Resources (ASX:BYH) is the Lake Johnston lithium and nickel project, close to Wesfarmers (ASX:WES) and SQM’s Mount Holland Lithium Mine and the historic Maggie Hays/Emily Ann Nickel deposits held by Poseidon Nickel (ASX:POS), along with Charger Metals’ (ASX:CHR) Lake Johnston Project.

And also out of AVL is the Nowthanna uranium-vanadium project which is adjacent to Toro Energy’s (ASX:TOE) Nowthanna project and has a uranium JORC Compliant mineral resource on a granted mining license.

Backed by AVL and BYH’s experienced team

Post IPO, AVL and Bryah will hold circa 22% between them with AVL MD Vincent Algar coming on as non-executive director to steer the company’s technical direction.

“Vince picked up the Coates project as a vanadium resource prior to the Chalice discovery but it’s on what, we now know to be, a continental size terrain perspective for nickel, copper and PGEs,” Mining Green Metals (ASX:MG1) MD and CEO Ian Stuart said.

“With the benefit of that world class discovery, we have done some more geophysical and geological interpretation and AVL did a reconnaissance drilling program in October last year across the most prospective part of the tenement which returned elevated copper and nickel, and visual sulphide observations.”

Hitting the ground running post-IPO

Stuart said the results were very encouraging, and that the company has a very high-impact target right off the bat to follow up post-IPO.

“We work with Australian Vanadium and Bryah Resources, and we share offices and admin staff, and the technical team, so unlike a lot of IPOs getting up, we’ve got a team in house,” he said.

“It’s a way of working that is very efficient and keeps costs low.

“And when we were saying we’re going drilling, post-IPO, we are – we’ve got the team ready to go and we’re permitted.”

The company also plans to kick off drilling in the near-term at the Lake Johnston lithium and nickel project, which Stuart says is in a very attractive and very underexplored area.

“We’ve noted to the south that Charger has had some success with early stage exploration, and immediately post IPO we’ll send a team up there to do initial drill target generation heading for a drill program Q4,” he said.

Ready for any uranium permitting changes

Then there’s the Nowthanna project, which Stuart says is a very low-cost option poised to capitalise on any changes in uranium permitting – and uranium pricing globally due to supply shortages.

“It’s a mining tenement that abuts Toro Energy’s project which has a resource and DFS study completed on it,” he said.

“It’s fairly simple, there’s a very good resource done on it, so that’s ready to go.

“Plus, the fact that it’s on a mining licence means that any change in permitting potentially gives you a massive uplift.”

There is currently a prospectus, and the offer is open until 19th July. The company says IPO funds will take advantage of AVL’s prior work at Coates with follow-up drilling later this year or early next year, generating drill targets at Lake Johnston – along with completing some desktop study work at Nowthanna.

This article was developed in collaboration with Mining Green Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.

Further information can be found on the Website of Mining Green Metals at https://www.mininggreenmetals.com.au/. Any queries regarding Mining Green Metals should be directed to Mining Green Metals and not to Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.