Micros with Majors: Who’s saddling up with two multi-billion heavyweights in critical minerals exploration?

Pic: Getty Images

Micros with Majors is Stockhead’s new column which profiles and looks at the stories behind microcap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

The odds of hitting a wall are much higher than hitting pay dirt in the mining exploration game.

Some companies can drill for years before identifying a resource worth posting while even large claims in so-called ‘elephant country’ can turn out to be little more than red dirt.

The path from discovery to development also becomes increasingly expensive once engineering and permitting come into play which is why for junior resources companies, it makes sense to bring in quality partners who can provide significant capital.

In its search for Tier-1 style deposits, $6m microcap explorer Strategic Energy Resources (ASX:SER) has teamed up with a couple of big players including FMG Resources, the subsidiary of $61bn iron ore giant Fortescue Metals Group (ASX:FMG), and $6.52bn market cap gold and copper developer Evolution Mining (ASX:EVN).

The deals are a massive feather in the cap of the junior explorer and show just how keen mining majors are to boost their exposure to copper, singlehandedly considered the most important metal for decarbonisation.

‘Project generator’ business model

SER’s partnerships with both companies also allows the company to drill multiple targets, something it wouldn’t be able to achieve alone, given their size and scale.

Unlike most ASX companies, SER works under a “project generator” business model which seeks to identify projects of scale via technical exploration methods.

The idea is to prove up the project’s potential before putting them into the hands of a major who can then spend the countless amount of dollars it takes to drill targets.

With a joint partner shouldering much of the expensive later-stage exploration and development costs, a “project generator” or “prospect generator” as it is commonly called, can have numerous exciting projects on the go at the same time.

It also minimises risk for junior explorers, but for some reason it’s not a hugely popular concept in Australia.

Sitting down with Stockhead, SER managing director David DeTata says the reason why that is, simply comes down to the fact that there aren’t many companies doing real greenfields frontier exploration.

“Our exploration space is those undercover areas where junior exploration companies typically fear to tread because it is so deep and so expensive,” he explains.

“We are looking for deposits that would appeal to the largest mining companies in the world.

“We’re looking for large targets where the search space isn’t crowded and that’s the deep undercover targets because the easy to find targets at surface have already been taken.

“Our point of difference is our ability to rapidly interpret those freely available geophysical data sets, which are provided by the geological surveys throughout Australia.

“They’ve invested a lot of money on geophysical surveys such as gravity and magnetic surveys to try and give explorers a base set of data that allows them to then enter the region with some level of confidence that there might be something worth chasing.”

Deals with FMG

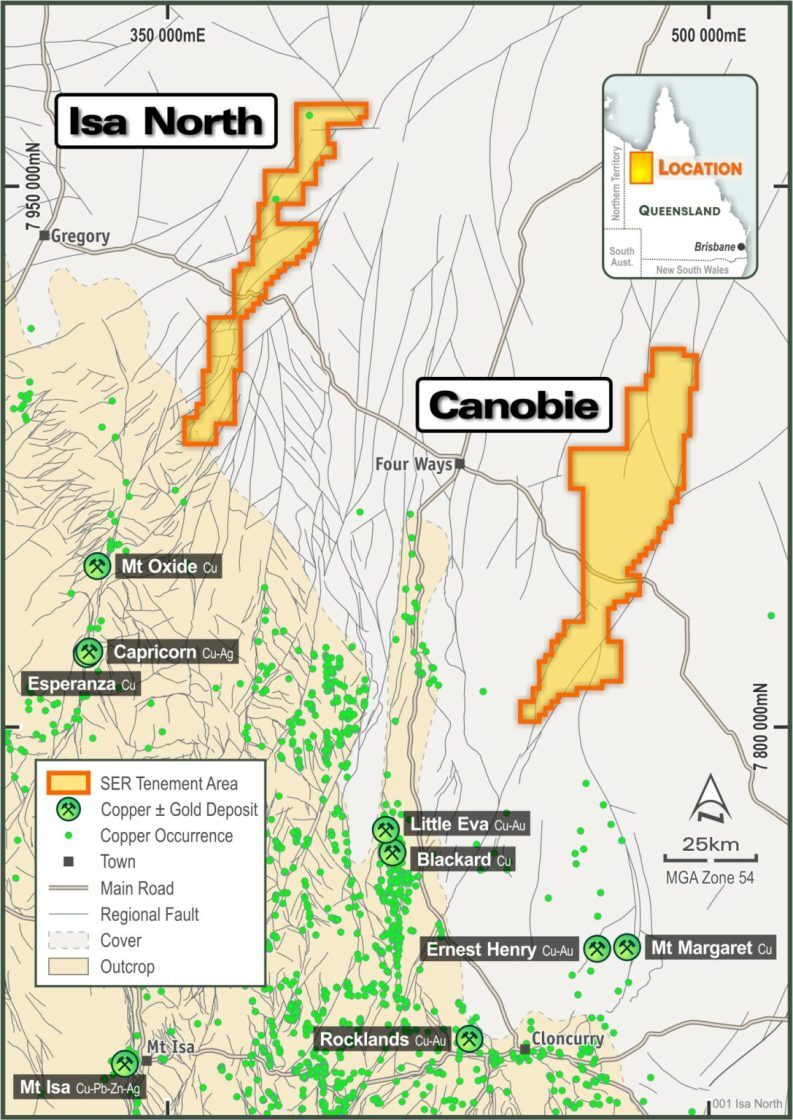

SER officially entered into a farm-in JV with FMG Resources in June this year, with the bigger fish spending up to $8 million over six years to earn up to an 80% stake in the Canobie project, which is within the same geological domain as the Ernest Henry mine.

Ernest Henry Mine is one of the largest copper reserves in Australia with its latest PFS highlighting an increase of 126% in ore reserves to 77.4Mt since Evolution Mining acquired Glencore’s stake in the mine 18 months ago.

The iron ore giant will fund up to 6,000m of basement drilling during that time, with the first part of the program (4,000m) due to kick off within a matter of days to test one magmatic nickel copper sulphide target and three Tier 1 Ernest Henry-type iron oxide copper-gold IOCG targets.

“Once you step undercover, there’s this potential that hasn’t been tested,” DeTata says.

“That’s why we think FMG picked our Canobie project and also why they surrounded us at our Isa North project, 150km away.”

But this isn’t the only deal SER has nabbed with FMG.

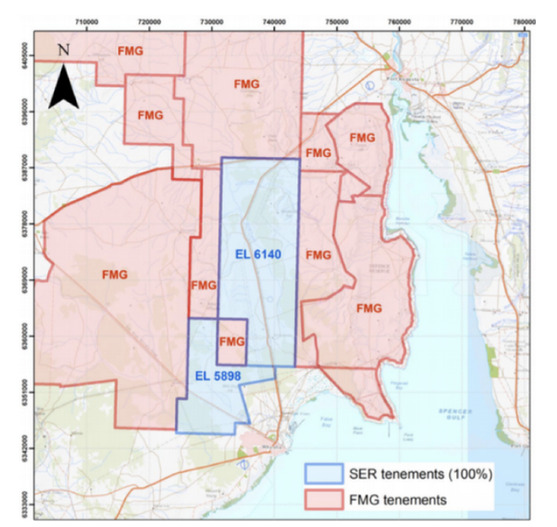

Its first farm-in and JV with the major was back in 2019 to explore the group’s Myall Creek copper-gold project in the renowned Olympic Dam IOCG corridor of South Australia.

Myall Creek is at the southern end of the Gawler Craton, home to BHP’s Olympic Dam, Prominent Hill and Carrapateena mines, as well as the recent major Oak Dam West copper-gold discovery.

As the map shows, much of SER’s tenements are already abutted by Fortescue, which considers the broader region as highly prospective.

FMG must undertake a minimum of 1,500m of drilling across the project area to ensure all defined targets get drill tested before it earns an interest.

Deal with Evolution Mining

SER signed an option agreement with Evolution Mining for a 2-year Option to purchase its tenements nearby to the major’s operating Cowal gold mine.

In the year since the Option Agreement was signed, Evolution has progressed desktop targeting reviews of the Cowal Projects whilst the areas have been inaccessible for on-ground activities due to weather conditions.

Evolution has provided formal notification of withdrawal from the Option Agreement with respect to EL9057 but regarding EL9368, assessment of historical datasets (including geophysics and historical drilling) has progressed.

“Forward exploration activities may include drilling or additional geophysics,” DeTata says.

“Within the next 12 months, they need to make a decision on whether they want to hang on to the ground and if they do, that’s a $1 million pay day for us.

“The main reasons why they are looking at our ground is the close proximity to its Cowal project as we are right on the border of their program and the potential for our tenements to host large economic gold-copper deposits.

“If the area has multiple anomalies deep undercover, then we like to think there’s potential for something that is economic even at depth – it is what the majors are chasing.”

Strategic Energy Resources share price today:

At Stockhead, we tell it like it is. While Strategic Energy Resources is a Stockhead client, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.