Micros with Majors: Which battery maker is sniffing around these two ASX juniors for lithium supply?

Pic: Getty Images

Stockhead’s Micros with Majors column looks at the stories behind microcap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

Car makers and battery manufacturers are increasingly turning to WA’s mineral rich outback, home to over half of the world’s lithium raw materials, to power a growing global fleet of electric vehicles – the key technology at the heart of the transition from fossil fuels to renewables.

These companies – the BYDs, Fords, CATLs, and Teslas of the world – are taking supply into their own hands, entering joint ventures, partnerships, and offtake agreements with mining companies to secure raw materials in a more direct way and ensure control over their supply chains.

The latest example comes from one of China’s top 10 battery manufacturers, Sunwoda Electronic Co.

Sunwoda eyes SCN and SGQ

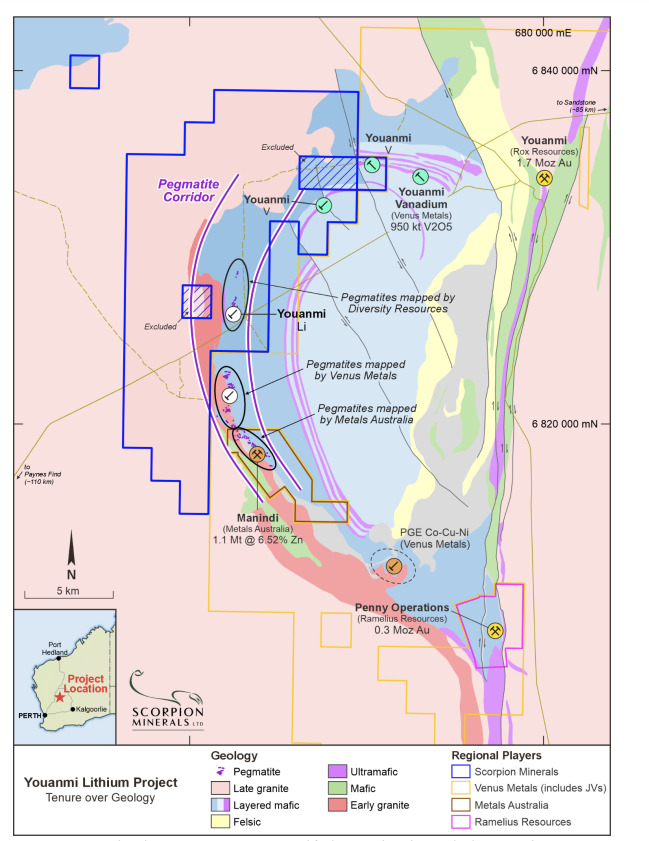

Its interest in Scorpion Minerals’ (ASX:SCN) Youanmi project in WA’s Murchison region, 450km northeast of Perth, led to the signing of an MOU in July to advance discussions for potential investment, off-take agreements and development opportunities.

MOUs are essentially an early-stage expression of interest by the relevant parties in working together to reach a binding commercial agreement.

For Sunwoda, the intent is to work together with Scorpion to rapidly develop its assets and bring them into production faster so the company can receive production or supply.

The deal follows the $2m strategic investment in St George Mining (ASX:SGQ) by Sunwoda in December 2022, underpinning an MOU to consider partnering on lithium business opportunities.

SGQ’s Mt Alexander project, which is down the road and along strike from Delta Lithium’s (ASX:DLI) 12.7Mt Mt Ida project, sits in a relatively under-explored 15km long stretch of LCT pegmatite corridor.

Who’s Sunwoda?

Sunwoda is a $33.16b market cap high-tech enterprise specialising in the design, production and sale of lithium-ion battery cells and modules for use in a range of applications such as electric vehicles, mobile phones and laptops and energy storage devices.

The company has seven manufacturing bases in China and abroad, technical centres in the US, Germany and Israel, and counts Xpeng, Mercedes, and Guangzhou Automobile Group among its biggest clients.

It signed a contract with the Yichuan Municpal People’s Government to invest 16.5b yuan for the construction of lithium battery industry chain projects and has plans to build a power battery factory in Hungary for EVs, with initial investment up to 1.96b yuan.

Michael Langford, founding partner and executive director of boutique corporate advisory firm Airguide International, says battery manufacturers with large expansion plans are looking to early-stage exploration companies to source supply with three key elements in mind.

“First is geography, projects in Australia are going to be inherently less risky than other locations globally.

“Australia’s weather, infrastructure, proximity to end users, incumbent workforce, and native title agreements make it the location of choice for project development.

“The second thing is resource; you need to have done some drilling and have some level of confidence that a project can become commercial or reach production.

“And the third thing which most people underweight is, in my opinion, the most fundamental point, the management team.

“Companies like Scorpion Minerals ticks all those boxes.”

Scorpion Minerals’ Youanmi project

Youanmi sits at the northern end of a 20km long corridor of lithium-caesium-tantalum (LCT) pegmatite intrusions that have delivered significant results for previous explorers at the southern end of the trend.

Latest drilling results has confirmed high-grade lithium mineralisation up to 2.9% Li2O in stacked LCT pegmatites.

The company is moving towards establishing a maiden JORC resource at the project within the next three to six months and aims to systematically infill intervening sections along an initial 1000m of strike during its next phase of drilling over Q3 and Q4.

Langford says Youanmi’s geology boasts similarities to Allkem’s (ASX:AKE) hard-rock 12.1Mt Mt Cattlin project, discovered and previously owned by Galaxy Resources.

“The two projects have similar proximity to surface, similar grade, and similar widths, there’s still a lot of work that needs to be done to provide final confirmation, but it seems to be trending in the right direction,” he says.

Mt Cattlin ranked as one of the world’s top 10 lithium mines by production across the world in 2022, producing ~26,800t of lithium for that year.

According to Langford, Sunwoda’s MOU with Scorpion is an indicator to the market that they believe that what Scorpion is sitting on is worthwhile exploring.

“They have confidence that Scorpion would be able to supply them in the future,” he says.

“And a key part of that comes back to Michael Fotios.”

Skin in the game

Scorpion Minerals CEO Michael Fotios is a second-generation geologist with a long history in the lithium market.

“He started Galaxy back in 2006/2008 and left when the company got into trouble, came back later and rebuilt it,” Langford says.

“He has a a very good reputation in China for being a good stand-up operator and is one of the few people that actually went out specifically looking for lithium, found lithium, and took the Mt Cattlin project from exploration to production.

“From my point of view, he would only be getting involved in this project if he knew it had the critical elements to go into production, because he’s done it all before.

“It’s not like he’s guessing or hoping, it’s just a case of timing.”

How much weight does Sunwoda’s MOU with Scorpion have?

The process of completing MOUs in China can take longer than the finalisation of a final binding agreement, Langford says.

“A Chinese groups board and investment commitments need to make a decision as to whether or not they want to devote resources to progressing an opportunity,” he says.

“The signing of this MOU was a nine-month process, it’s not something they take lightly and they are only going to go ahead with it if they genuinely believe that these things are going to get into production.

“Their reputation is really important to them, and they also appreciate that when they attach their name to it, it will mean competitors like LG and others will also take an interest in it.

“I’m really excited for the company and although the preliminary work hasn’t been completed yet, I would love to see the project come online within the next couple of years.”

Scorpion Minerals share price today:

At Stockhead we tell it like it is. While Scorpion Minerals is a Stockhead client, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.