Micros with Majors: Renegade Exploration’s partnership with one of the world’s leading miners

Pic via Getty Images

Micros with Majors is Stockhead’s column profiling, and examining the stories behind, micro-cap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

Joint venture (JV) agreements can be a useful way for small-cap mining companies to prove up, progress and develop what may be considered low-priority, greenfield exploration projects of larger companies.

Often, it’s when the company in question lacks the knowledge, capital, or technology to pursue the project on its own that JVs are entered into, mainly for the purpose of growing their portfolios or, simply to gain exposure to under-explored regions.

In other cases, companies can become participants in JVs by acquiring an interest originally held by another explorer as part of a larger deal, as is the case with Renegade Exploration (ASX:RNX), a small-cap explorer with ground in northwest QLD prospective for Ernest Henry-style iron oxide copper gold (IOCG) deposits.

Renegade’s interest in the Carpentaria JV

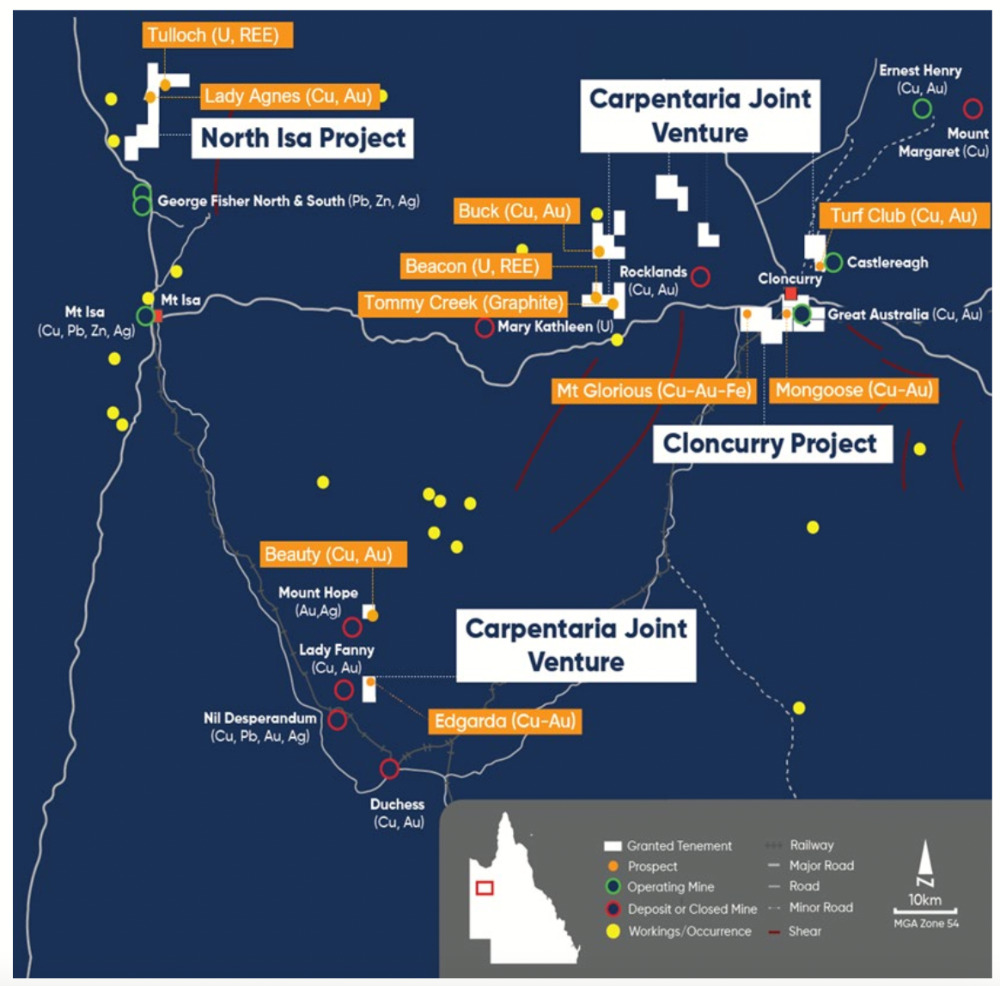

In 2020, RNX acquired a 23% interest in the Carpentaria joint venture (CJV) that Sovereign Metals (ASX:SVM) held with Mount Isa Mines (MIM), a subsidiary of Glencore and Australia’s second largest copper producer.

The JV was originally formed more than 20 years ago, with SVM acquiring its interest in 2007.

It covers five permits – EPM 8588 (Mt Marathon), EPM 8588 (formerly Mt Averice, now Mongoose), EPM 12180 (St Andrews Extended), EPM 12561 (Fountain Range), and EPM 12597 (Corella River).

When RNX picked it up, total expenditure ticked over to $14.5m, with MIM contributing roughly $11.6m and Sovereign contributing $2.9m over that time.

Sovereign eventually elected to cease contributing to the JV, resulting in its interest reducing to 23%.

Benefits of partnering up with a major

Chatting to Stockhead, RNX managing director Rob Kirtlan says the JV was attractive on several fronts.

“All the projects are very advanced and there’s now been over $20m spent on it so a lot of the hard yards have already been done,” he says.

“When we acquired the interest, one high priority prospect – Mongoose – was an immediate drill-ready target along strike from the neighbouring Taipan deposit and Paddock lode mine.

“Since then, Mongoose has become a key focus for us, we’re currently drilling a 1,600m hole which is amazing for a small company and that’s half funded by the government.

“Another bonus is the amount of data and information we get with anything from drill hole information to geophysics to soil sampling, gravity surveys, you name it – we get an awful lot of data which we paid only $350,000 for.

“It’s great, we don’t have to try and track down companies that haven’t lodged the data, we just go straight to our partner, and they are happy to give it to us because at the end of the day, if we make a discovery and it gets mined, it will probably end up in their plant in Isa.

“That’s the natural pathway.”

Processing optionality with Glencore smelter nearby

MIM is the hub of Glencore’s copper and zinc operations, which includes underground mines, mineral processing and smelting operations, power generation and support services.

It produces copper at the Enterprise and X41 underground mines in Mount Isa, which after 60 years of mining will close in the second half of 2025.

RNX’s JV interests are between 60km to ~100kms from MIM’s operations via sealed roads, providing the junior with processing optionality and lowering the resource threshold required for development.

“MIM were attracted to the project for the same reasons we were, which is the geophysics, and carried out their initial drilling on the asset looking for sulphide deposits but weren’t interested in it because, in general, it’s too small for them,” Kirtlan says.

“They are after the big stuff.”

Mongoose Deeps drilling

After reaching an agreement with MIM last year, RNX is now the sole operator of one of the five permits – EMP 8588 – otherwise known as the Cloncurry project, which hosts the Mongoose prospect, as well as several other advanced copper prospects.

“We are working on hitting the golden treasure with this current Mongoose Deeps hole,” Kirtlan says.

“IOCGs are notoriously difficult – they’re a bit like porphyries. Often you drill a hole and can’t replicate it but if you hit a good one like Ernest Henry, just 35km north of Mongoose, they can be big and rich.

“We are in a very big system and all of the work that we have done to date is telling us that have a signature similar to Ernest Henry.”

In April, RNX raised $2.3m in a placement to fund high-impact drilling at Mongoose Deeps as well as continue planned programs across its NW QLD acreage.

“Once drilling finishes up there, we will start an 1-2,000m RC drilling program at Mongoose West and commence planning our follow-up drilling for Mongoose deeps, anticipated to start this coming August.”

At Stockhead we tell it like it is. While Renegade Exploration is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.