Metallica is building Australia’s next bauxite mine for just $1 million

Pic: Schroptschop / E+ via Getty Images

The number of mining companies that can say they have brought projects into production for little more than $1 million is decidedly small, but that is exactly what Brisbane-based bauxite developer Metallica Minerals expects to do in 2018.

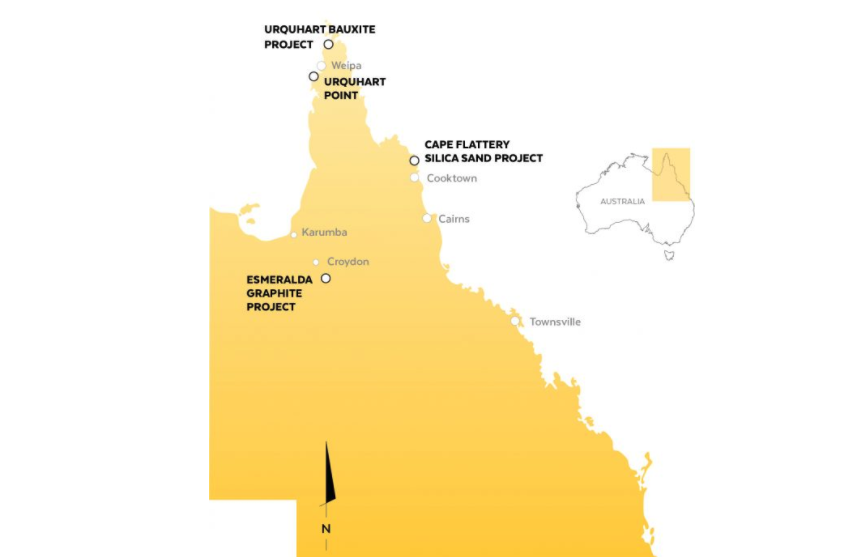

In a 50-50 joint venture with private Chinese company Oresome Australia, Metallica is developing the Urquhart bauxite project on the Cape York Peninsula in far north Queensland.

That part of the world – which is renowned for extensive deposits of high-quality pisolitic bauxite – is where Rio Tinto is investing $US1.9 billion ($2.4 billion) to build its giant Amrun bauxite operation.

In January, after a somewhat frustrating delay associated with the Queensland election, the reinstalled Palaszczuk government granted Metallica a mining lease for Urquhart.

That has left the company awaiting only approval to construct a haul road from the project site to the nearby port of Hey Point — and the end of the wet season — before it can begin development.

How to build a $1 million mine

One of the unique features of the Urquhart project, as it has been progressed by Metallica, is the particularly modest upfront capital requirement.

The pre-feasibility study on Urquhart, completed in late 2016, estimated the joint venture partners would require just $1.1 million in working capital to bring the project into production using a model that transfers risk and capital responsibility to contractors.

In inking agreements with contractor LCR Group and Hey Point port-owner Green Cross Resources, Metallica has achieved what was envisaged in the study.

“Utilising contractors to deliver the mining and having access to the Hey Point barge loading and transhipping facility has ensured a nimble and low capital development option that will allow us to deliver direct shipping bauxite into a tightening global market,” chief executive Simon Slesarewich said.

Urquhart not factored into share price

Metallica’s cash balance was $7.83 million at the end of December, and has an undrawn $2 million standby credit facility in its back pocket, giving it more than enough funds to meet its share of project costs.

This level of cash backing – approximately 2.4c a share – means there is little value currently being attributed to Urquhart in the Metallica share price, which closed at 4.9c on Thursday.

At that price Metallica has an enterprise value of around $8 million, whereas the PFS base case scenario shows that Urquhart will generate $81.8 million in earnings before interest, tax, depreciation and amortisation (EBITDA) over an initial 5.5-year mine life.

A neat little project

The rest of the numbers under the PFS base case scenario support the notion that while Urquhart is at the other end of the scale to Rio’s Amrun in terms of size, it is still a neat little project.

Over the initial 5.5 years, Urquhart would produce 6.5 million tonnes of saleable bauxite for almost $300 million in revenue and at a total operating margin of around $12 a tonne. This delivers a pre-tax Net Present Value of $78.4 million and would allow a payback period of just five months.

If bauxite prices keep pushing above the average Free On Board price of $45.24 a dry metric tonne used in the PFS, the economics will obviously only get better.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The CBIX value-in-use adjusted bauxite index produced by industry research firm CM Group had the price at US$51.50 a dry metric tonne in mid-January, with developments in China suggesting there may be more upside to come.

Chinese bauxite import volumes during the month of December were estimated at a record high of seven million tonnes as the government continues to crack down on environmentally harmful and illegal mining operations.

Metallica noted in its December quarterly that the increased regulation and decline in Chinese domestic grade bauxite is opening new markets, with Shanxi, Henan and Guangxi provinces all looking to import bauxite for the first time.

As it seeks to lock away offtake agreements for product from Urquhart in the March quarter, Metallica is exploring opportunities in both new and traditional Chinese markets.

The company has also indicated it is assessing other bauxite projects around the world that would complement Urquhart and allow it to develop into a more significant bauxite producer.

This special report is brought to you by Metallica Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.