Metallica is on the home stretch to bauxite production after just three years

Pic: John W Banagan / Stone via Getty Images

It takes around five to 10 years to bring a new discovery into production, but Metallica Minerals is now on the cusp of becoming a bauxite producer after little more than three years of hard work.

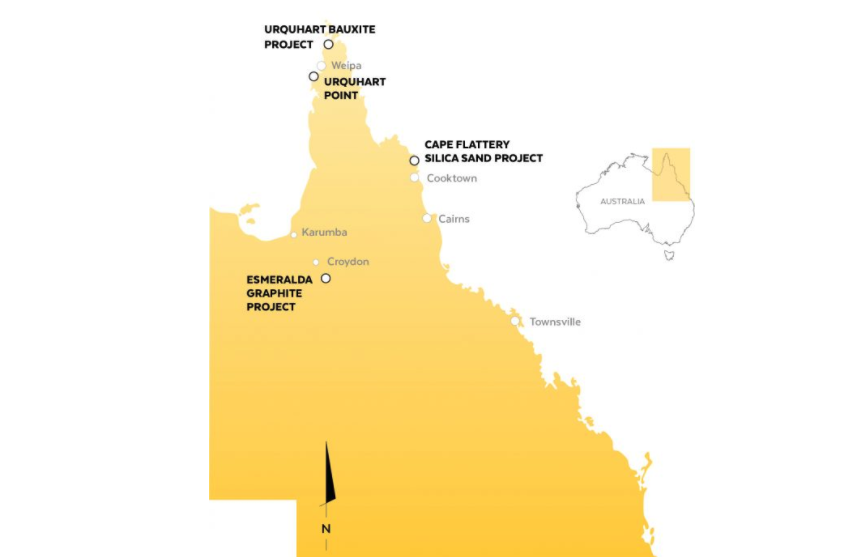

In a 50-50 joint venture with a private Chinese company, Metallica (ASX:MLM) is developing the Urquhart bauxite deposit, which was discovered in late 2014 on the Cape York Peninsula in far north Queensland.

The last 12 months have been transformational for the Urquhart project — a mine Metallica is planning to open for little more than $1 million.

After receiving the mining lease in January, Metallica is now only waiting on approval to construct a haul road from the project site to the nearby port of Hey Point.

Once it has the haul road approval in hand it will take just four to six weeks to bring Urquhart into production.

“Basically, we just need to mobilise equipment and we’re good to go,” chief executive Simon Slesarewich said. “There is no really big infrastructure that’s required.”

Australian Bauxite’s (ASX:ABX) Bald Hill project in Tasmania, which came online in December 2014, was the first new bauxite project in Australia in more than 35 years.

With little else emerging in Australia since then, Urquhart will be the country’s second new bauxite mine in nearly four decades. Australia is the world’s largest producer of bauxite.

Prime bauxite territory

The Weipa region of the Cape York Peninsula – which is renowned for extensive deposits of high-quality pisolitic bauxite – is where Rio Tinto is investing $US1.9 billion ($2.4 billion) to build its giant Amrun bauxite operation.

Weipa is a globally recognised bauxite province favoured by Chinese aluminium producers because of its compatibility with the country’s refineries.

How to build a $1 million mine

One of the unique features of the Urquhart project is the particularly modest upfront capital requirement.

The pre-feasibility study, completed in late 2016, estimated the joint venture partners would require just $1.1 million in working capital to bring the project into production using a model that transfers risk and capital responsibility to contractors.

The rest of the numbers under the pre-feasibility base case scenario support the notion that while Urquhart is at the other end of the scale to Rio’s Amrun in terms of size, it is still a neat little project.

Over the initial 5.5 years, Urquhart would produce 6.5 million tonnes of saleable bauxite for almost $300 million in revenue and at a total operating margin of around $12 a tonne.

This delivers a pre-tax Net Present Value of $78.4 million and would allow a payback period of just five months.

Strong Chinese demand

The bauxite market has been buoyed by China’s crackdown on illegal and environmentally damaging operations, as well as declining grades.

Bauxite is the main source of aluminium, a market which has been consistently on the rise since late 2015.

The increased regulation and a decline in Chinese domestic grade bauxite is opening new markets, with Shanxi, Henan and Guangxi provinces all looking to import bauxite for the first time.

As it seeks to lock away offtake agreements for product from Urquhart in the March quarter, Metallica is exploring opportunities in both new and traditional Chinese markets.

The company has also indicated it is assessing other bauxite projects around the world that would complement Urquhart and allow it to develop into a more significant bauxite producer.

This special report is brought to you by Metallica Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.