Merger of gold producers Doray and Silver Lake gets a muted response

Two cars merging at once. Pic: Getty

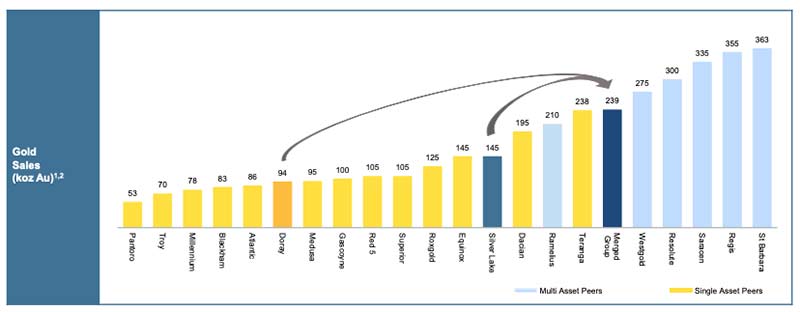

A merger of West Australian gold miners Silver Lake Resources and Doray Minerals would create a 240,000-ounce per year mid-tier producer.

But the mooted deal didn’t do much for share prices after it was uneviled today.

Doray (ASX:DRM) dropped 5 per cent to 34c while Silver Lake (ASX:SLR) fell slightly to 51.5c.

Still, both companies have enjoyed strong share price increases over the past year. Doray is up by almost 90 per cent and Silver Lake by about 44 per cent.

“Both companies have recognised the challenges of being a significant producer in the gold business and this transaction puts usin a position to not only compete, but to be a sustainable and relevant player in the global gold industry,” said Doray boss Leigh Junk.

Silver Lake boss Luke Tonkin said the merger was being done for the right reasons to create “a stronger company in a low- risk jurisdiction with financial strength and further growth opportunities”.

The deal will be done through a scheme of arrangement under which Silver Lake ($265 million market cap) will get all Doray shares ($163 million market cap).

A scheme of arrangement means a bidder (Silver Lake) acquires all the shares in the target company (Doray) in exchange for cash, shares or a mix.

It must be approved by target shareholders at a meeting and then by the court.

The deal will combine Doray’s 85,000 oz per year Deflector mine and Silver Lake’s 150,000oz per year Mt Monger operations.

Doray shareholders will receive 0.6772 Silver Lake shares for every Doray share held.

This means Silver Lake and Doray shareholders will own 62.7 per cent and 37.3 per cent, respectively, of the new company.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.