Meeka’s circling back to its Murchison gold project with high-impact plans

Meeka has grand plans to deliver resource growth and progress its Murchison gold project towards development. Pic via Getty Images.

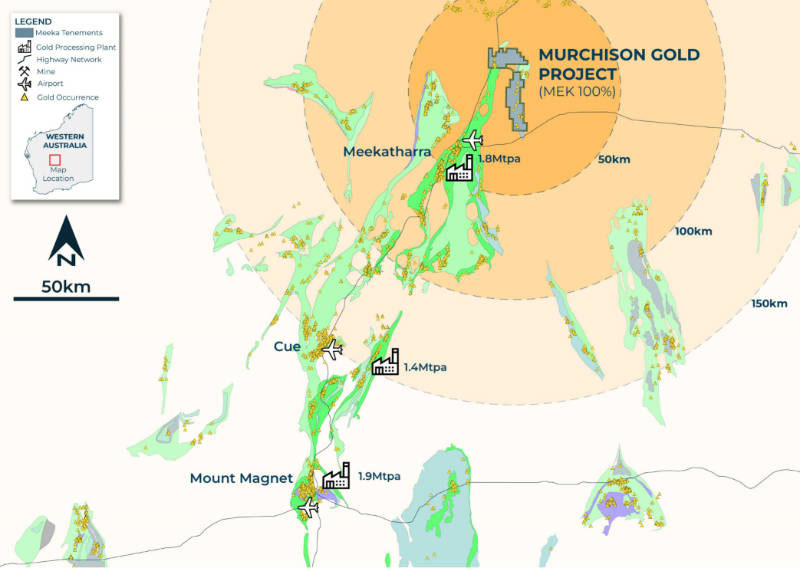

Meeka has enjoyed gold and rare earths exploration successes at its Circle Valley project but its focus remains very much on the flagship Murchison gold project and with good reason.

It is very hard after all to argue with a project that already has a defined resource of 1.2Moz of contained gold on granted mining leases with room for quick growth and a well defined pathway towards development.

Speaking to Stockhead, Meeka Metals (ASX:MEK) managing director Tim Davidson said that once work at Circle Valley was completed early in the March 2023 quarter, the company will go back to the Murchison and continue where it left off in December last year.

This had involved the drilling of the St Anne’s target, which returned thick, high-grade results such as 32m grading 16.07g/t gold from 48m and 20m at 20.47g/t gold from 48m, as well as metallurgical work confirming that conventional carbon-in-leach (CIL) of material from St Anne’s was able to achieve gold recoveries averaging 98%.

“We started to get really broad zones of high-grade gold and we spent six months there between late May and late December drilling 45,000m within about 800m of strike” Davidson noted.

“What we intend to do this year is to go back and pick up where we left off, which is to go and drill a number of other targets that look very similar to what we saw at St. Annes when we started drilling there.”

He added that while the company had a series of 20 targets, it would systematically work through them based on individual prospectivity.

“We have ranked them based on geological, structural and geochemical prospectivity and we’ll work through those sequentially with the most prospective being drilled first,” he explained.

“What we see there (at the targets) is very similar to what we saw at St Anne, and we know what St Anne’s delivered for us – shallow, high-grade gold.”

Major resource growth

Meeka is currently finalising a resource for St Anne’s with Davidson indicating that it will be reported this month, March 2023.

“The intention over the next 12 to 18 months will be to grow our resource to 1.5-2Moz” he added.

“Saying that, we think the 1.2Moz that we’ve got in the ground now gives us enough metal to justify building the mine and that’s what we’re working towards.”

The road to gold development

Meeka had first carried out a Scoping Study for the Murchison project back in 2021.

This detailed a mine that would produce 443,000oz over 8-9 years, with a production rate of around 50,000ozpa.

All-in sustaining costs (AISC) are estimated at around $1,655/oz and the project is expected to deliver roughly $180m in free cash.

“That gave us the confidence to go to the next stage, which is the Pre-Feasibility Study we are now working through. Part of that work was the updateed Turnbury mineral resource, which we released in in January this year, the delivery of the St Anne’s mineral resource, which will come out this month and then finalise all the mining production plans, cash flow models and other technical work on the back of that,” Harrison noted.

“The PFS incorporating all of that work, resource updates, drilling everything will be released in June of this year and from there we will move into a definitive feasibility study, which we will release in calendar year 2024.

Completing a DFS will place the company squarely on the final stretch towards production, allowing it to negotiate terms for funding and secure final approvals for development.

Circling back and creating value

While Meeka’s focus is clearly on exploring and developing the Murchison Gold Project, the company has certainly not forgotten about the Circle Valley project either.

Circle Valley was very much a greenfield project where no systematic exploration had been carried out prior to Meeka pegging the ground in 2020.

The company’s subsequent action to rectify this proved to be highly successful, leading to reverse circulation drilling returning results such as 23m grading 5.09g/t gold from just 13m.

“Whenever you hit that sort of broad high grade gold, that’s a fantastic start and we’re building on that,” Davidson noted.

“The drilling that we’ve done this year has followed up on those broad zones of high-grade gold.”

There is also considerable room for further growth given that the drilling has thus far been focused on just one (Anomaly A) and several large kilometre-scale gold anomalies.

Assays are currently pending for follow-up drilling based on vectors identified from diamond drilling.

But Circle Valley is also known for its clay-hosted rare earths potential with assays currently expected for its recently completed infill and extensional drilling program.

This will in turn lead to the definition of a mineral resource, which will in turn allow the company to assess the true value from the REE mineralisation through economic studies. The Company has also noted it intends to separate the gold and rare earth assets in to separate vehicles.

“The thing is that rare earths and gold don’t necessarily fit together in the same business. Investors that want rare earths don’t necessarily want gold and vice versa,” Davidson explained.

“What we intend to do is move the rare earths into a new ASX listed vehicle and this drilling that we’re doing for the rare earths, the mineral resource reporting, all the metallurgical test work that we’re doing for it, will give us comfort that when we put that project into the new listing, there is enough information and substance that investors can say that there’s actually real value here.

“So the rare earths will get separated out over the next 12 months, and we will end up with two separate companies that will hopefully get us something closer to true value for the gold and rare earths.”

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.