Meeka raises $3.5m to grow 1.2Moz resource, progress Murchison gold project to ‘shovel ready’

The funds will progress drilling and permitting for the project. Pic: via Getty Images.

- Meeka Metals is raising $3.5m to grow and develop the 1.2Moz Murchison gold project

- Drilling will target resource upgrades and growth

- Project feasibility study highlights straightforward development strategy

Meeka Metals has received firm commitments to raise $3.5m via a placement at $0.04 per share to fund the next phase of drilling and bring its Murchison gold project to ‘shovel ready’ status.

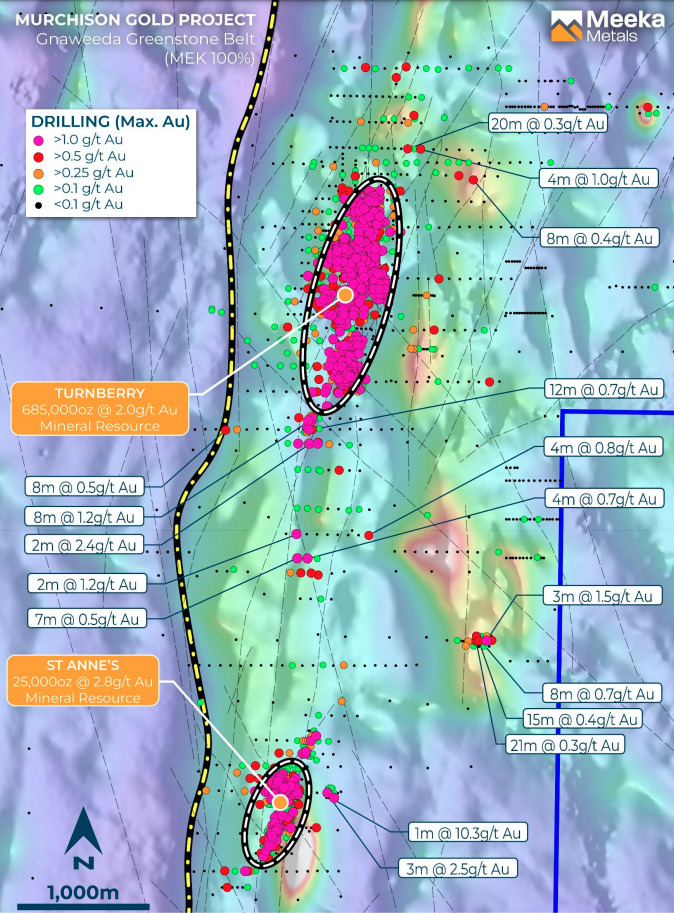

The 281km2 project in the prolific Murchison Gold Fields hosts a large, high-grade +1.2Moz resource, which the company is actively growing and progressing towards production.

In July, a feasibility study outlined a project which would produce 660,000oz over an initial 9.3-year life, netting the company $363m in free cash flow at a conservative gold price of $2,750/oz.

At a $3,000/oz gold price, total profits jump to $521m.

Since Meeka acquired the project in 2021, it has expanded the resource by over 50% and the company believes there is more gold to find.

This new funding will support the next phase of drilling along the 7km shear system that already hosts 710,000oz between St Anne’s and Turnberry, as well as targeting upgrade and growth of existing mineral resources, Meeka Metals (ASX:MEK) MD Tim Davidson said.

“The funding will also take our Murchison gold project through permitting, bringing it to a ‘shovel ready’ state,” he said.

Directors and management will also contribute $210,000 toward the placement, subject to shareholder approval, and increasing their total investment in the company to $3m.

Gold development strategy

Proceeds from the placement will fund exploration and infill drilling, along with the completion of key permitting activities.

Notably, drilling targeting shallow, lightly drilled areas on the periphery of the Turnberry resource (685Koz at 2.0g/t Au) is already underway with assays due from early November 2023 onwards.

All remaining environmental studies required to permit the project are underway, and MEK is also investigating opportunities to accelerate the project development timeline through low capital options including toll milling of higher-grade starter pits and scalable processing.

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.