Meeka’s Murchison gold project is a cash machine with plenty of room to grow

Pic: Stockhead, via Getty Images

Meeka’s Murchison gold project in WA will produce 660,000oz over an initial 9.3-year life, netting the company $363m in free cash flow at a conservative gold price of $2,750/oz.

At a $3,000/oz gold price, total profits jump to $521m.

This is according to the new project feasibility study – an advanced look at the economics of building a project – which envisages average production of 80,000ozpa over the first eight years, with peak production of 103,000oz in year six.

Stockpiles will then be processed for an additional 1.3 years.

This 663,000oz of recovered gold is a massive 57% improvement on the scoping study released December 2021, Meeka Metals (ASX:MEK) says.

Pre-tax Net Present Value (NPV) and internal rate of return (IRR) are $249m and 40% respectively at a $2,750/oz gold price.

This jumps to $371m and 56% at $3,000/oz, thanks to a solid all-in sustaining cost of $1,684/oz.

NPV and IRR measure the profitability of a project – the higher they are above zero, the better.

The project would cost $137m to build. It would take between 22 months (~$2,750/oz) and 16 months (~$3,000/oz) to pay that off.

This is a straightforward development strategy that delivers meaningful production and financial outcomes for Meeka and its shareholders over the initial mine life, managing director Tim Davidson says.

“With over 92% of production in the first three years coming from the higher confidence Measured and Indicated Mineral Resources, and the release of a 410koz Ore Reserve with this study, we believe we have a strong foundation on which to develop,” he says.

“We are now progressing the remaining environmental studies required to permit the project and investigating opportunities to accelerate the project development timeline through toll milling of higher-grade starter pits.”

Plenty of ounces left to discover

Since Meeka acquired the project in 2021, it has expanded the resource by over 50%. There’s a lot more where this came from, Davidson says.

There is substantial opportunity to build on this 660,000oz of base case production plan prior to development.

“The mineral resources that support the planned underground mines remain open at depth with strong opportunity to grow,” he says.

“Drilling for Mineral Resource upgrade and growth will also advance over the coming months.”

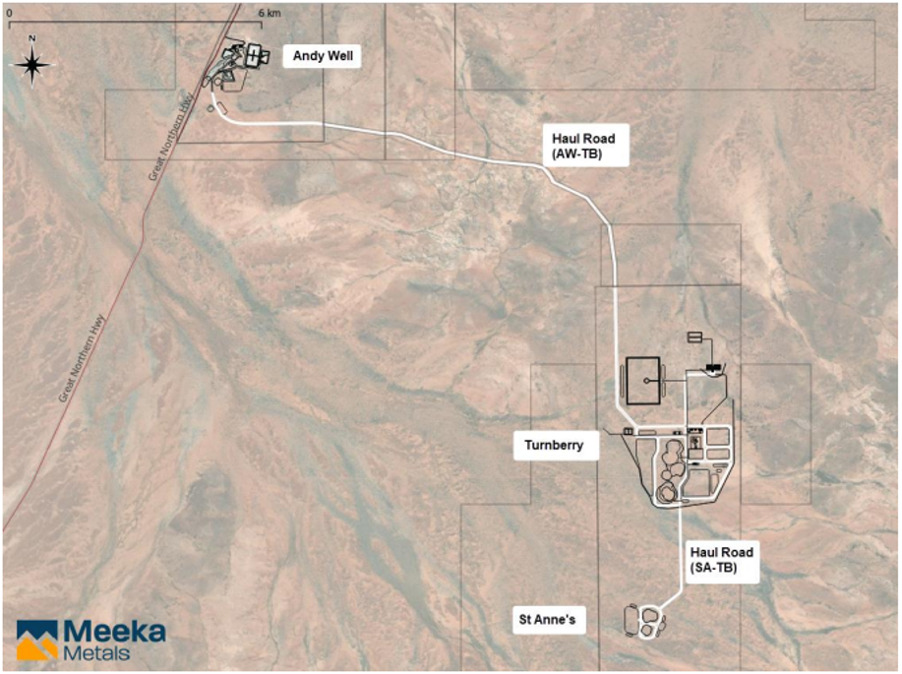

Both Turnberry and Andy Well mines remain open at depth, with drilling hitting high grades at Andy Well – like 0.4m at 25.7g/t – below the current resource.

There is another 518,000oz of gold not included in the study – the total Murchison resource sits at 1.2Moz – which could be upgraded with more drilling to increase mine life and production rates.

There is also 14,300oz of in-pit Inferred Mineral Resources at the 685,000oz Turnberry pit which were treated as waste in the production plan to meet ASX reporting requirements.

Close spaced infill drilling will target this gold for upgrade and inclusion in the production plan, MEK says.

And then there’s the highly fertile 7km gold shear system extending from Turnberry to St Anne’s which has only had sparse, broadly spaced reconnaissance drilling.

This is a near term growth target, the company says.

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.