Matador’s new targets to supercharge Cape Ray gold exploration

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

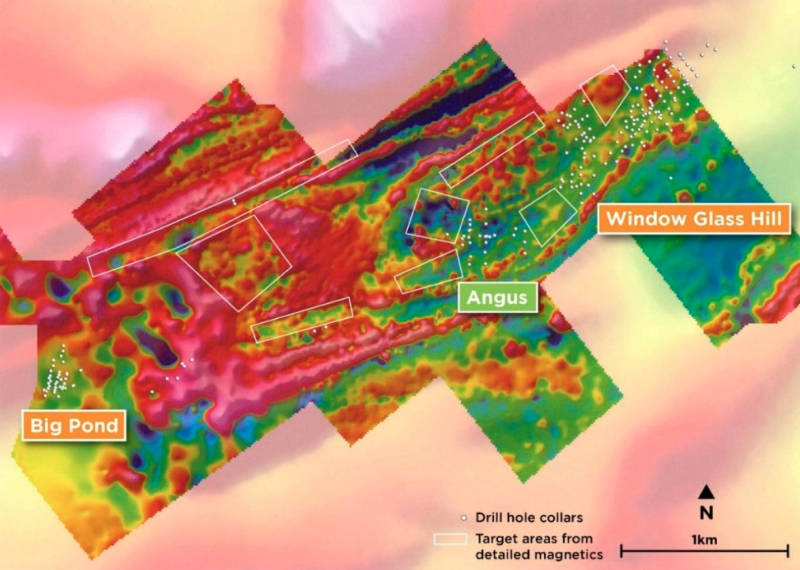

Matador has a full schedule ahead after generating eight new priority geophysical gold targets close to the Window Glass Hill deposit at its Cape Ray project.

The targets are all located under shallow cover and share similar geophysical characteristics to the greenfield Angus discovery.

Executive chairman Ian Murray noted that the high-grade Angus discovery in 2020 had demonstrated Matador Resources’ (ASX:MZZ) ability to find new gold mineral systems under cover that are close to its existing resources.

“The project has undergone minimal exploration outside the known deposits and our increased understanding of their geophysical, geochemical and structural footprints should result in additional exploration success,” he added.

“We are initially focused on areas that are within trucking distance of the proposed Central Processing Facility, due to the lower economic hurdle, but remain excited about the medium term prospectivity of our wider tenement package.”

Matador plans to test these targets over the coming weeks with power-auger drilling and multi-element geochemistry to increase the probability of success with its planned 2021 diamond drilling program.

It will also accelerate its planned regional geophysics program with a 30m line spaced heli-magnetic survey encompassing the central 45km of the tenement within trucking distance of the proposed CPF.

Additionally, the company will integrate its planned accelerated geophysics program and follow-up power-auger pathfinder geochemistry to expedite the generation of additional higher probability drill targets.

Cape Ray gold project

The Cape Ray project in Newfoundland currently has an open-pittable mineral resource of 840,000 ounces of gold, most of which sits within 200m of the surface.

However, much of the 120km Cape Ray shear zone remains underexplored with just 20 holes drilled outside Matador’s resource area and Marathon Gold’s 4 million ounce Valentine Lake project, paving the way for exploration to grow resources.

A scoping study for a project with life of mine production of 484,000oz at 2g/t over seven years has already outlined robust economics with estimated post net present value and internal rate of return – both measures of profitability – of $174m and 51 per cent respectively.

This article was developed in collaboration with Matador Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.