Matador aims to awaken Newfoundland’s gold beast

Pic: Getty Images.

If Matador Mining’s Cape Ray Gold Project in Newfoundland were located anywhere else in the world, there’s a fair chance it wouldn’t be covered on Stockhead.

That’s no slight on the project – its actually the opposite. The reality is, there are few gold projects of Cape Ray’s potential ilk left in First World locations.

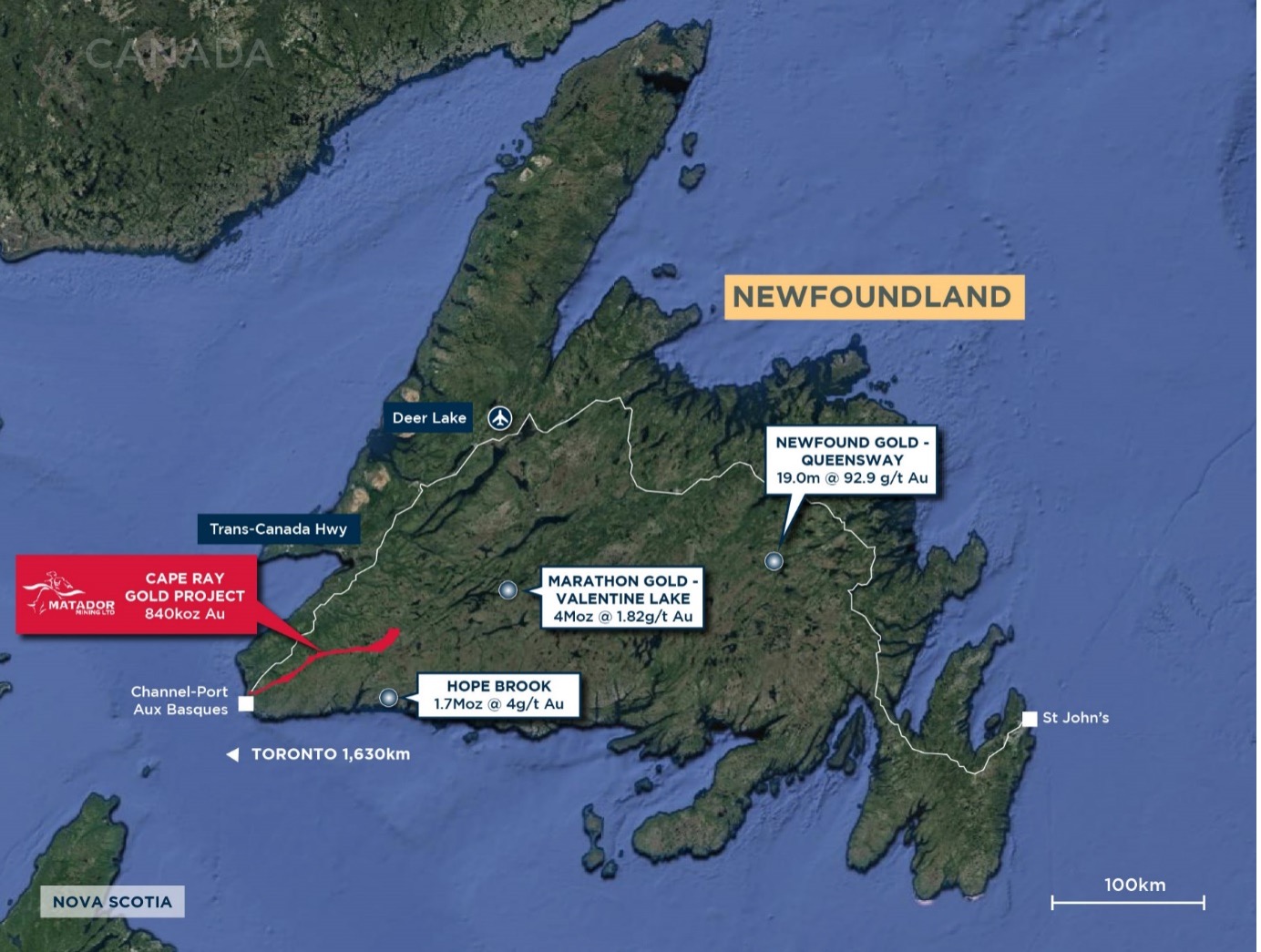

The Cape Ray Project boasts an open-pittable mineral resource of 840,000 ounces at two grams per tonne, 96% of which sits within 200m of surface, in a Tier-One jurisdiction with the largest continuous landholding along the Cape Ray shear zone which also plays host to a 4-million-ounce deposit.

A scoping study carried out last year put forward some impressive metrics. It outlined a gold project with life of mine production of 484,000oz at 2g/t over seven years, including 88,000oz at 2.6g/t in years one to four – particularly high grades for a modern open pit.

That in itself is eyebrow raising, and the exploration results from Matador’s (ASX:MZZ) expansion drilling at the project of late have shown huge potential to grow those numbers much further.

A new deposit, named Angus, was discovered last year – the first of its kind in the area in 20 years – while extensional and infill drilling at the satellite deposit Isle aux Morts exceeded expectation. Extensional drilling at the Window Glass Hill deposit recently hit 8m at 5.5g/t gold from 43m some 70m outside the existing mineral resource wireframes.

The Cape Ray Project comprises 120km of continuous strike along its namesake shear, but only 20 drill holes have been historically drilled outside of the company’s resource area (approximately 15km of strike) and TSX-listed Marathon Gold’s Valentine Lake project – the aforementioned 4Moz behemoth to the north.

Were it in Western Australia, Africa, or even mainland Canada, we may not be talking about it because there’s every chance that with mineralisation so shallow, this project would already be exhausted. At the very least it would be better understood.

But gold exploration in Newfoundland is a relatively newfound development, and while some of the deposits within the Cape Ray Project were discovered by Rio Tinto in 1977 its licences changed hands between prospectors and underfunded explorers unable to carry out the required work.

In Matador, the project’s immense length of strike finally has one consolidated owner, with the cash to explore and better understand the ground’s potential and the gold development experience to match.

Matador’s executive chairman, Ian Murray, has runs on the board when it comes to project development. He led Gold Road Resources (ASX:GOR) in its transition from a junior explorer with a market cap of around $10m to large-scale producer through the 2010s with a market cap in excess of $1 billion today.

Currently in the process of finalising a 2021 exploration campaign on the back of huge results in 2020, and a cashed up balance sheet with A$8m in the bank, he told Stockhead he was excited about what the Cape Ray Project may hold.

“It’s such an underexplored area, and it’s highly prospective,” he said.

“We know the gold is there, and we’re the largest landholder on the Cape Ray shear.

“We’ve got such a fantastic starting point already, with 840,000 ounces which has already had a scoping study probe that it’s very economic and there are no technical roadblocks to developing this project – and then you have this untold exploration upside.”

The company’s geologist recently touched down in Canada, and Matador is in the process of mobilising a team to site. First on the agenda is a large-scale close-spaced aeromagnetic surveying – a process which successfully delivered the discovery of the Angus deposit in 2020 and one which is lacking in the region.

“Historically targeting in Newfoundland has been based on government aeromag, which is conducted at 200m spaced lines,” Murray said.

“We showed last year that close-spaced mags at 25-30m delivers clear targets, as we discovered Angus on the back of that.

“We’re going to fly close-spaced aeromags across the belt, get the targets, follow that up with power auger drilling, which is cheaper and quicker than diamond drilling – the only drilling Canadian miners usually do.

“That’s a quicker and cheaper way for us to get the geochemical data in the key areas identified in the aeromag, which we can then follow up with diamond drilling.”

While the details of the exploration plans are yet to be released, Murray said he expected to do much more drilling than the 10,500m conducted last year, with newsflow to match.

“The key will be greenfields exploration – that’s the gap between our current 840,000oz resource and Marathon’s 4Moz resource along the trend,” Murray said.

“If we find sufficient ounces in the area we’ll have a very different development strategy – it’s a good problem to have.

“It is very rare for a company to have the building blocks we do, with 840,000oz, plus this massive 120km strike where 105km has only ever had 20 drill holes. And it’s in Canada – this isn’t a risky jurisdiction, this is Canada.”

A golden opportunity

As alluded to above, for many years the island of Newfoundland was not considered much of a gold hotspot, and the local regulatory system made it hard for land to be consolidated.

That’s no longer the case, according to Matador head of corporate development Adam Kiley, who said the discovery of Valentine Lake in the early 2010s piqued interest in the region.

The listing last year of New Found Gold Corp on the TSX which has a market market capitalisation today of around C$650 million on the back of a new high grade discovery– 19m at 93g/t Au– really got things moving.

“That was like the Sirius discovery in the Fraser Range in 2012,” Kiley said.

“All of a sudden you had guys pegging left, right and centre in Newfoundland, trying to get ground, and all were getting $20-30 million market caps regardless of what they had.

“Fortunately for us we were one of the first movers and consolidated what we believe is one of the most prospective packages there as well.”

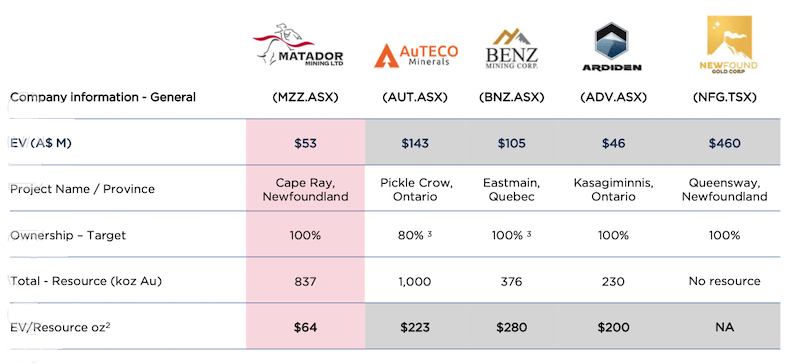

Somewhat hidden from the flurry on the ASX, by comparison with its Canadian peers and those with gold projects in other parts of Canada, Matador appears undervalued – check out the chart below.

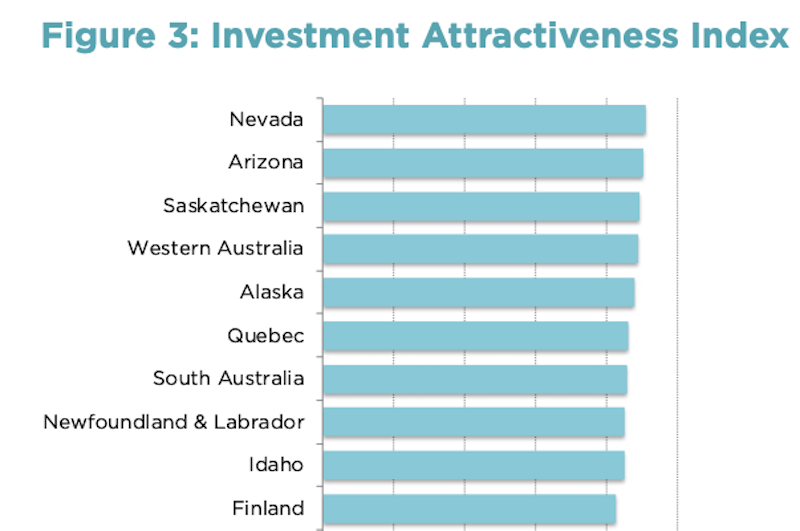

Newfoundland is combined as a mining jurisdiction with Labrador and ranked eighth in the world for investment attractiveness in the 2020 Fraser Institute Annual Survey of Mining Companies – one spot behind South Australia and ahead of Idaho and Finland.

The project sits just 25km from an established town, and average power costs outlined in the scoping study came in at just C6c/kilowatt hour – extremely low, owing to the local utility’s utilisation of a hydropower facility in Labrador.

With so much in its favour and well-funded to explore as it heads into 2021, Matador could well find itself taming a beast of its own at Cape Ray in Newfoundland.

This article was developed in collaboration with Matador Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.