Maronan Metals’ PEA confirms silver-rich Starter Zone is first of many courses

Maronan Metals’ namesake project has the potential to be one of Australia’s largest silver producers. Pic: Getty Images

- Maronan Metals delivers strong economic case to develop the Starter Zone

- PEA evaluated constructing standalone, onsite processing facility against toll treatment

- Both options deliver 10-year life of mine (LOM) at 1.2Mtpa mining and processing throughput

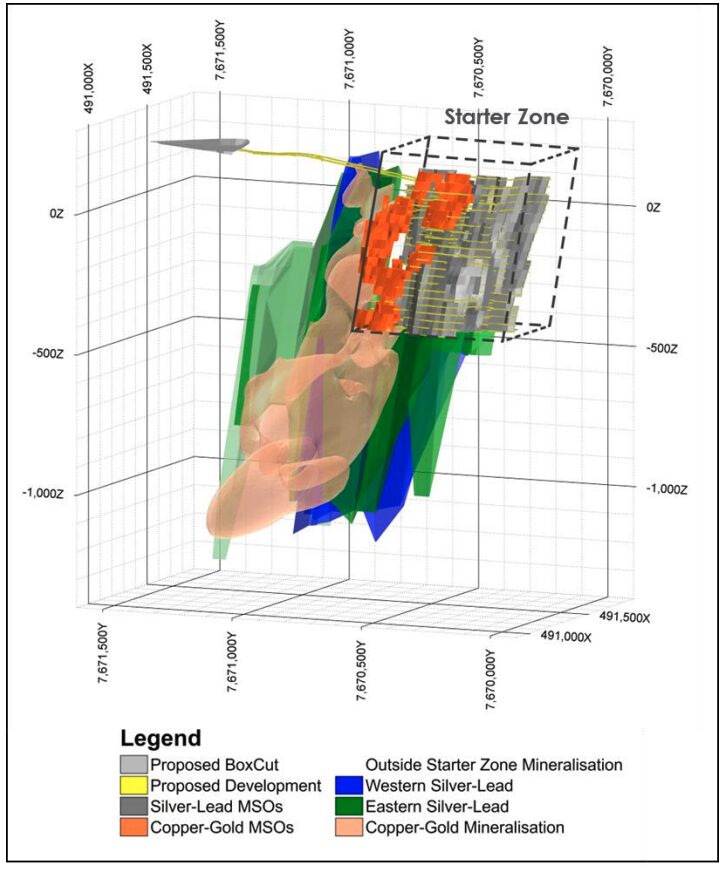

Special report: A small portion of the Maronan polymetallic deposit in Northwest Queensland, the silver-rich Starter Zone, is proving its potential with a PEA pointing to development opportunities for Maronan Metals shareholders.

The study looked at two paths – processing ore onsite through a 1.2Mtpa standalone plant or trucking it to a regional facility in Queensland’s Cloncurry region.

Both approaches include developing an underground decline for bulk sampling and extra drilling to grow the indicated resource, paving the way for a future definitive feasibility study and investment decision.

Maronan Metals’ (ASX:MMA) PEA models $683m in free cashflow over a ten-year mine life, with average annual EBITDA in steady-state production of around $130m.

Pre-production capital is estimated at $266m, with sustaining capital of $32m over the life of the project, and a payback period of just four years from project launch or two years from when mining operations begin.

The planned production target includes 7.4Mt of silver-lead ore grading 103g/t silver, 4.1% lead and 0.1g/t gold, plus 900,000t of copper-gold ore at 0.72% copper, 0.86g/t gold and 9.3g/t silver.

Over the life of the mine, 70% of the mined inventory comes from indicated mineral resources, with the remaining 30% from inferred resources, ensuring early years focus on the higher-confidence material.

The project is expected to deliver 20.7Moz of silver, 258,000t of lead, 4,600t of copper and 9,400oz of gold, with silver driving more than half of the revenue.

Importantly, this PEA only considers a fraction of the total resource; 25.7Mt of silver-lead and 31.1Mt of copper-gold remain outside the Starter Zone, highlighting significant upside potential.

Permitting progress opens path to expanded drilling

Early metallurgical testwork is very encouraging, showing outstanding recoveries of 92% for silver and 95% for lead, producing a high-grade lead concentrate with more than 70% lead and 1,000g/t silver.

Copper and gold are also performing well, with recoveries of 90% and 75% respectively, producing a copper concentrate grading 25% copper and 15g/t gold.

Silver is recovered and payable in the copper concentrate, adding extra value.

Permitting at Maronan is on track, with the company applying to convert part of Exploration Permit EPM 13368 into a Mineral Development Licence.

This would greenlight construction of a boxcut, decline and surface infrastructure – laying the groundwork for a full-scale mining operation – and approval is expected by Q2 FY26.

At the same time, the company is consulting with all stakeholders, including Native Title holders and the Maronan Station landholder, to secure the necessary agreements, which it expects to achieve within the required timelines.

Once the underground decline is in place, it will provide access for diamond drilling of the much larger resource not yet included in the current mine plan.

Accelerating project activities

MMA non-executive chairman Simon Bird said the project has the potential to be one of Australia’s largest silver producers, generating industry leading margins over a long life.

“With the value of only a small part of this project now demonstrated in the PEA and permit applications advancing, we are now able to focus on accelerating key project development activities,” he said.

“These steps will enable Maronan Metals to advance to a definitive feasibility study and capture upside from favourable demand fundamentals for silver, copper and gold.”

This positive sentiment was also echoed this morning from ASX peer Red Metal (ASX:RDM), which is a significant shareholder in MMA with a 44% stake.

“Results show a strong economic case to develop the shallow Starter Zone, which represents less than one third of the global resource base defined at Maronan,” RDM management said in a statement today.

“Importantly, and dependent upon further resource conversion, internal studies show scope to greatly expand the production profile, further enhancing the economies of scale and subsequent project economics.”

More from Maronan Metals: Unlocking one of Australia’s largest silver deposits

Development potential from over 30,000m of drilling

Since listing in 2022, Maronan Metals has completed more than 30,000m of drilling, focusing on infilling the near-surface Starter Zone, boosting confidence in the resource and pinpointing key infrastructure and box cut locations to support project development.

In June 2025, a 12.2Mt resource was revealed, containing 112g/t silver and 5.2% lead, as well as 7Mt of copper-gold ore at 0.71% copper, 0.55g/t gold and 7g/t silver.

This article was developed in collaboration with Maronan Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.