Major miners are running out of gold, and that’s good news for explorers

Pic: Tyler Stableford / Stone via Getty Images

Some of the world’s largest gold producers may be forced to engage in targeted acquisitions or expand their exploration activities to overcome a sharp decline in their gold reserves.

This is despite spending $US69.5 bn on acquisitions and exploration activities since 2010, according to S&P Global Market Intelligence.

“With top producers facing declining production profiles, shrinking reserves and a return to rising production costs, we expect many to expand organic exploration in the near term while leveraging targeted acquisitions to supplement their depleted pipelines,” said report author Robert Anders.

This could be good news for advanced ASX gold explorers who stand to benefit from exploration partnerships with major miners; or even lucrative takeovers, like Cardinal Resources (ASX:CDV) and Spectrum Metals (ASX:SPX).

80 per cent of major gold miners have declining reserves

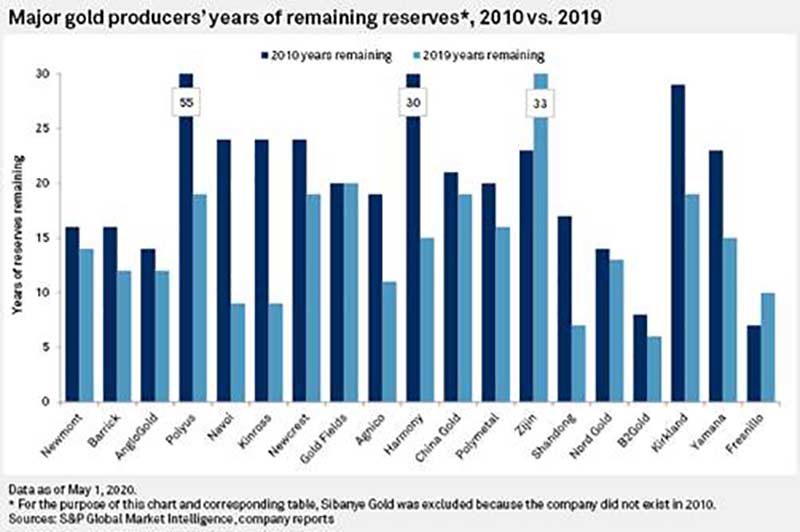

Sixteen of the world’s 20 largest gold producers saw their remaining years of production fall in the 2010 to 2019 period.

Kinross had just 9 years of remaining production in 2019, down from 24 years in 2010.

Two of the 20 largest gold miners had more reserves in 2019 than in 2010, Zijin Mining Group and Fresnillo, and Gold Fields’ remaining production profile was unchanged over the period.

Falling gold reserves stem from not enough exploration

A lack of gold discoveries over the past 10 years is to blame for the steady decline in the mineable gold reserves of the world’s 20 largest gold miners, said Anders.

At the end of 2019, the top 20 gold miners had 668 million ounces of gold reserves, sufficient to last for 14 years at current rates of production.

They did manage to replace 95 per cent of their production over the last 10 years, adding 397 million ounces to their reserves, while producing 381 million ounces.

The average cost of the replacement 397 million ounces was $US175/oz.

Another cause for the decline in gold reserves among the majors has been a focus by some on margin preservation instead of growth-focused strategies, the report said.

“Throughout the 10-year period, some miners relied on acquisitions to replenish reserves or bolster production, although some of their largest deals are now viewed as overpriced, ill-timed or ultimately unfruitful,” said Anders.

Acquisitions pursued by 90 per cent of top miners

Eighteen of the 20 top gold producers were involved in acquisitions in the last 10 years.

These acquisitions accounted for $US51.3bn of spending in the period to replace reserves, and $US18.2bn was spent on exploration, said the report.

At the top of the list for reserve purchases since 2010 is Newmont, which bought 56.3 million ounces of gold reserves, followed by Barrick Gold with 33.5 million ounces.

Adding to reserves through acquisition is relatively more expensive than achieving the same through exploration.

Eighteen of the 20 profiled gold miners undertook some takeover activity in the past 10 years, buying 209 million oz for $US51.3bn at an average cost of $U245.50/oz.

Developing reserves through exploration cost the gold majors an average of $US96.75/oz.

Eleven of the 20 top gold miners reported shares in large gold discoveries over the past 10 years, with Newmont the most successful at 45 million ounces, and Anglo Gold was second with 44 million ounces.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.