Magnis’ operational lithium-ion battery plant makes it truly unique on the ASX

Magnis is already a jump ahead with a commercial lithium-ion battery plant on its books. Pic via Getty Images.

The ASX is awash in companies in the battery minerals space, so much so that it’s difficult to move in that crowd without jostling someone’s elbow.

What’s a lot rarer – to the point that we can count them on one hand with room to spare – are companies with actual, honest to goodness lithium-ion battery manufacturing capability.

Enter Magnis Energy Technologies (ASX:MNS) and its iM3NY battery plant in New York state, which is held in a 61/39 joint venture with technology partners C4V and designed with the capacity to produce 1.8 gigawatts of lithium iron phosphate batteries per annum.

Production is currently ramping up to meet the requirements of its offtake customers following receipt of UN38.3 certification for batteries produced at the plant, which allows them to be transported within the US and internationally.

“One of the largest independent battery factory in the US. Although we can produce batteries for the electric vehicle market, we would like to focus on other applications like battery storage – that’s huge,” group communications manager Con Hoursalas told Stockhead.

The iM3NY plant also has exclusive rights in the US to produce lithium-ion cells using proprietary cathode technology from C4V and has a primarily North American supply chain, which allows it to benefit from the US Inflation Reduction Act.

There are also aggressive plans to expand total plant capacity up to 38GW over this decade.

Customers such as Sukh Energy are poised to take delivery of batteries from the second half of 2023.

iM3NY also has a JV with Omega Seiki Mobility (OSM) to manufacture and sell lithium-ion battery packs in India for use in OSM’s two, three and four-wheeler EV vehicles.

OSM will control the local operation and funding while iM3NY, which has a 26% interest in the JV, will provide technology and expertise.

More than just battery production

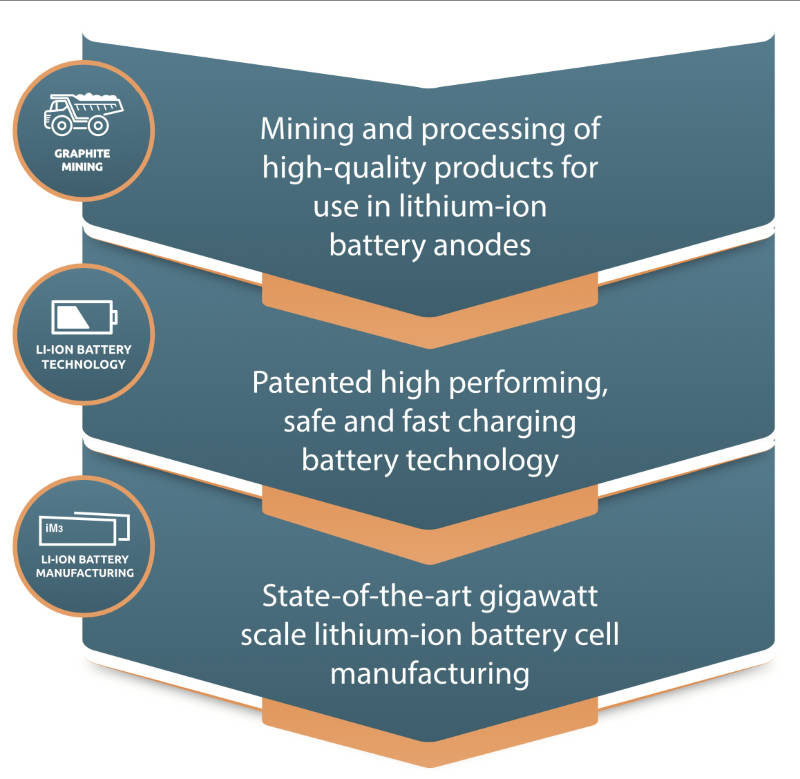

While possessing an operating commercial lithium-ion battery manufacturing facility is certainly impressive for a company of Magnis’ size, it is by no means a one trick pony.

“We make investments in the energy space – specifically the electrification supply chain,” Hoursala said.

“That means anything in that area. We have an investment in Tanzania to pull out graphite from the ground and in a soon to be announced location in the US, we are going to be building an anode active material plant.”

This initiative is every bit as exciting as the company’s battery manufacturing capabilities given that it already has a binding offtake agreement with none other than Tesla, the world’s largest EV manufacturer.

Under this deal, Magnis will supply at least 17,500t of AAM per annum from February 2025 for a minimum term of three years at a fixed price with Tesla having the option to increase offtake to 35,000tpa.

Tesla’s interest in the company’s AAMs is easy to explain as the anodes produced at the company’s pilot plant have already demonstrated First Cycle Efficiency (FCE) results that meet and outperform the industry standard requirements for both EVs and stationary energy storage.

In layman’s terms, its anodes – which use proprietary technology – offer advantages such as compact size, the ability to hold more energy and increased safety.

This interest in the company’s AAMs also segues neatly into yet another key arm of the company’s operations.

Graphite makes up about 95% of the anode, which is essentially the negative electrode and one of the main components of a lithium-ion battery.

A slightly different type of vertical integration

So it is fortunate indeed that Magnis happens to own the Nachu graphite project in Tanzania’s southeast.

Nachu graphite contains a very large proportion (41%) of valuable Jumbo and Super Jumbo size flakes, and its use in the production of the AAMs from the pilot plant plays a role in why they perform so well.

It shouldn’t come as a surprise then that the company is in discussions to secure funding to advance the project quickly towards production.

Nachu covers a 29.77km2 area and has an existing flake graphite resource of 174Mt grading 5.4% total graphitic carbon, more than enough to keep production of 220,000tpa of flake graphite concentrate going on for decades.

A Bankable Feasibility Study has already outlined some very attractive economics including net present value and internal rate of return (both measures of a project’s profitability) of US$1.2bn and 51% respectively.

With this level of vertical integration in the works, it is little wonder that Professor M. Stanley Whittingham – one of three key figures credited with the development of lithium-ion batteries and a former non-executive director of the company – continues to back the company.

Partnership drive

Hoursala says that the company is always on the lookout for more JV partners, noting that a lot of capital is required to progress its projects and also because the market is so massive that no company can meet demand on their own.

“Sony, LG, Ford are all in JVs across the US. Everyone is teaming up and Magnis is also primed for a next level JV,” he noted.

“No other ASX company has gone as far as we have. It is a shame that Australian companies are kicking goals overseas instead of locally though we hope that will change soon.”

This article was developed in collaboration with Magnis Energy Technologies, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.