M&A, exploration running hot in NSW’s Lachlan Fold Belt

The Lachlan Fold Belt is a hive of exploration and M&A activity. Pic: Getty Images.

- The Lachlan Fold Belt in NSW is again catching the eye of the mining world

- Vertex is planning to bring one of Australia’s highest grade gold mines to life at Reward

- A high grade polymetallic discovery called Achilles is also capturing attention, along with rare earths, gold and base metals finds

Seemingly forgotten after the big Boda discovery trained the world’s eyes on NSW’s Lachlan Fold Belt a few years back, signs suggest the mining world is again fixating on the bountiful mining and exploration district.

It’s home to some of the country’s top gold mines including Northparkes, Cadia and Cowal, with >110Moz of gold discoveries to-date in and around the Central Lachlan and Cobar mineralised districts.

Known for hosting the large porphyry gold and copper mineralisation favoured by majors, 2024 has so far seen a plethora of exploration, project developments, new producers and M&A activity.

Exploration is now harnessing new technologies and a new way of looking at the intricate geology of the historical Lachlan Fold Belt, with finds popping up on the regular across gold, copper, base metals, antimony, rare earths and other critical minerals.

Mid to large-cap miners are muscling in too, swooping in to buy or farm-in to projects, shake on M&A deals or just pick up swathes of tenure to go it alone.

Going for gold

Near-term producer Vertex Minerals (ASX:VTX) is rebooting the Reward gold mine, using ore from surrounding deposits and exploration into deep targets beneath the historic mine to grow its potential.

In a fast start-up scenario, VTX is aiming initially to produce close to 50,000oz from within a larger indicated resource of 225,200oz at 16.72g/t , aiming to start mining by the end of this year.

Over two years the mine delivers $41m in free cash before tax, paying itself off in just six months.

It’s now got a clear pathway after raising $3.77m early last month, ensuring it’s fully funded to pump out gold bars through a refurbished processing plant.

Once in production, VTX will acquire its own diamond drill rig to expand on the high-grade Reward resource.

Stockhead spoke to VTX exec chair Roger Jackson, who said the south-west corner of New South Wales was ripe to enjoy the mining revival already seen in WA, South Australia and QLD.

“There’s very interesting, unique deposits that metamorphic events have transposed high-grades of polymetallics into (in the) Lachlan Fold,” Jackson said.

The region has got hotter at the more speculative end of the market too, largely due to the Achilles discovery from Australian Gold and Copper (ASX:AGC). Drilling there yielded crazy high grades of gold, silver and base metals in April, with a highlight 5m at 16.9g/t gold, 1667g/t silver, 0.4% copper and 15% lead-zinc from 112m.

“There’s been some nice finds recently, such as Achilles, that has attracted a lot of attention and that helps projects in the region, like ours, that are moving into production,” Jackson said.

He believes new ideas and technologies will help explorers tap potential hinted at in historical datasets.

“Those of us that have been here for a while already understand Lachlan Fold’s huge potential and it’s good to see the market is starting to get excited about it,” Jackson said.

Let’s take a look at other activity around the grounds in the Lachlan Fold Belt.

The Movers and shakers

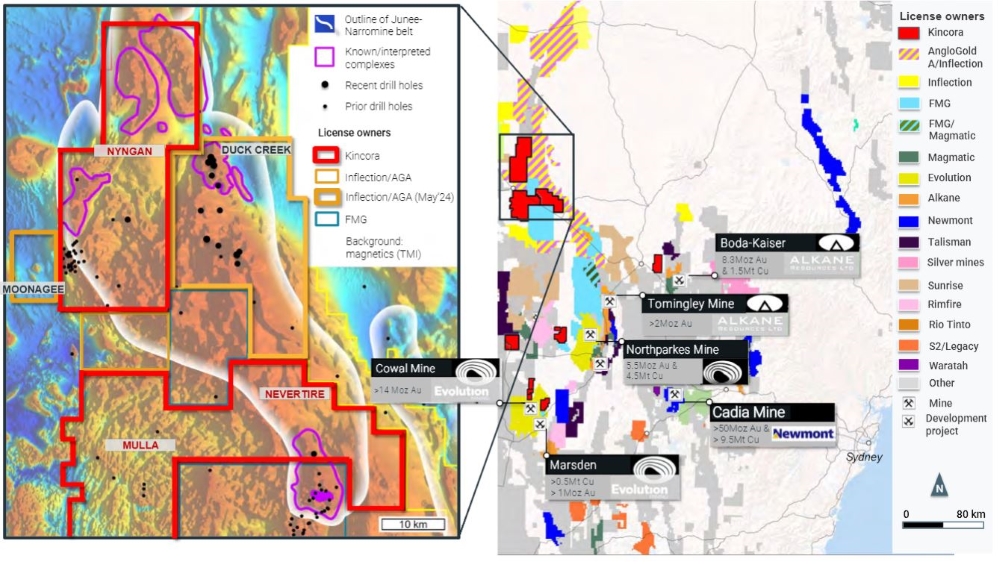

Global mining major AngloGold Ashanti has made a couple of deals – a $135m earn-in to >7000km2 across five projects owned by Inflection Resources and a potential $50m investment to earn an 80% interest in Kincora Copper (ASX:KCC) Northern Junee-Narromine Belt project.

Juniors S2 Resources (ASX:S2R) and Legacy Minerals Holdings (ASX:LGM) have been making deals to test for Cadia-style porphyry mineralisation, while LGM has agreed for Helix Resources (ASX:HLX) to farm-in for an 80% interest in the Central Cobar tenement by spending $2.8m.

LGM has other JVs in the region too. Newmont is spending up to $15m to earn into its Bauloora copper project and Earth AI is drill testing a newly discovered PGE-Ni sulphide system at Fontenoy, giving the explorer a total $28.3m worth of free carried exploration funding.

And Fortescue (ASX:FMG) will spend up to $14m over six years at Magmatic Resources (ASX:MAG) Myall to earn up to 75% in the project and unlock a potentially major copper-gold system.

As well as the Reward mine at Hill End, home to 1.8Moz of historic production, Alkane Resources (ASX:ALK) $1.7bn Boda-Kaiser project has drawn attention, a global scale addition to its 70,000-80,000ozpa Tomingley gold mine.

The Explorers

Godolphin Resources (ASX:GRL) is running exploration at its Lewis Ponds gold deposit and boasts the first standalone ionic clay-hosted REE project in the region, Narraburra.

Late last month, leach testing of the deposit identified conditions for the optimal extraction of REEs as part of Phase 3 metallurgical test work, achieving 81% extraction rates of valuable magnet rare earths with limited deleterious element extraction and low (1-3.3kg/t) acid consumption.

This is significant, as it represents a potential processing pathway for the project, which has an existing resource of 94.9Mt grading 739ppm total rare earth oxides, including a high-grade component of 20Mt at 1079ppm TREO.

Elsehwhere, overall silver ounces at Argent Minerals’ (ASX:ARD) Kempfield have increased from 42.8Moz to 65.8Moz.

The updated silver resource positions the project as Australia’s second largest pre-mining silver asset and further resource growth, via first pass RC drilling, will begin once all approvals have been received.

“This exceptional new resource cements Kempfield as the second largest undeveloped silver deposit in Australia,” ARD MD Pedro Kastellorizos says.

“The significance of the estimate, both in size and the associated value of the metal content within the resource area is substantial.

“Argent believes the discovery of further mineralisation within the project area will enhance the overall value of future operations.”

Earlier last week, Golden Deeps (ASX:GED) skyrocketed ~217% on the back of drilling into a huge 80m sulphide find at its Havilah project.

Before striking into the mineralisation the junior had scoured its tenure with handheld pXRF gizmos that indicate ballpark percentages of minerals that potentially lie underneath.

The tech showed 18.5% copper and 34.8% zinc, so GED took out the diamond drill and subsequently intersected a huge 80m zone rich in Cu-Zn sulphides. Assays will tell the full story.

MinRex Resources (ASX:MRR) has found some targets for drilling into its multi-commodity Mt Pleasant project, which has prospectivity for copper, molybdenum and gold.

Drilled down into by CSR and Pacminex up until 1982, reviewed data from exploration efforts has shown a molybdenum, scheelite and chalcopyrite (Mo-W-Cu) mineralisation >1.1km in length, 750m in width and to a vertical depth of 540m.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.