Lunnon Metals wants to recreate the success of its peers in the Kambalda nickel district

The company holds 23kms and two historical nickel mines in Kambalda. Pic: Robert Recker (The Image Bank) via Getty Images.

Lunnon Metals listed in June, raised a tidy $15 million and in the process solidified a 51% interest in the Kambalda nickel project (KNP) via an existing joint venture with St Ives – a wholly owned subsidiary of global gold major Gold Fields Ltd.

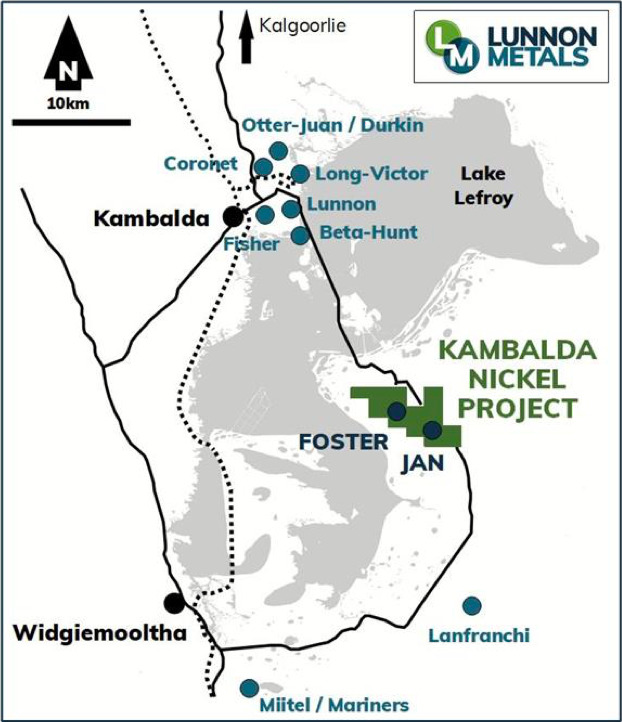

The company then acquired the residual 49% interest in the KNP from St Ives by issuing shares in consideration at the IPO and now holds 100% of the project in the Kambalda nickel district which has produced more than 1.4 million tonnes since its discovery in 1966 by WMC Resources (WMC).

Plus, the company’s compact but well-appointed 23km2 of ground also hosts two historical nickel mines – Foster and Jan – which closed in 1986 and 1994.

Lunnon Metals (ASX:LM8) has access to all of the historical drill core and the historical resources that are currently not JORC compliant.

“We’re looking to bring some of those historical estimates up to modern day JORC 2012 compliance standards, so our resource base should grow regularly regardless of whether we find anything from drilling”, managing director Ed Ainscough said.

“The historical assets at the Kambalda nickel project missed the last nickel boom, they lay fallow and didn’t have the same attention as previous WMC assets”.

“We’re pretty confident; we’ve got 39,000 nickel tonnes in resource currently, but I would fully expect that to grow without doubt, from both the exploration and the historical core programmes”.

“Obviously we’d all love to find something new, it’s every geologist’s dream to find something that somebody else has missed.”

Team has extensive experience in the region

Ainscough is confident that if there’s nickel and gold to be found, he has the team that can find it.

“I’ve had a long association with St Ives and Kambalda from 1987 onwards, and most of our team worked for WMC. A couple of us went on to work for Gold Fields,” he said.

“Aaron and I have spent so long on this ground, we have the continuity of knowledge and the technical depth which means there’s almost no one on the planet who would know as much about the gold and nickel geology, corporate and transaction history, as we do”.

“The advantage we have over our peers is that we’re right in the middle of Kambalda, so a lot of companies will say they’ve got “Kambalda-style” – but that’s a little bit like saying you’ve got champagne [that’s not from the Champagne district]”.

“We can’t put the metal in the ground, but if it’s there we think we’ve got a really good chance of finding it and hopefully investors see that as a real opportunity to shorten the time between their investment and seeing discovery or resource growth”.

Drilling underway with visible gold intersected

RC and diamond drilling is already underway at the project, with best results from East Cooee to date including 1m at 7.44% nickel, 2m at 3.46% nickel and 2m at 5.07% nickel

“We started releasing our first set of results and I’m very pleased to say that the first target we put rigs on, an area called East Cooee – which has previously been drilled by WMC but never been put into resource – has returned some good high grade Kambalda-style nickel sulphide,” Ainscough said.

“We’re drilling both the extensions of the known positions but we’re trying to explore and find new locations, where nickel has been missed previously.”

The company has also reported 7.84m at 1.50g/t Au with visible gold at the project.

“We’ve always got half an eye on the gold potential, because St Ives remains one of WA’s best performing and longest-lived gold operations, with up to 15 million ounces of gold mined to date,” Ainscough said.

“When you’re exploring for nickel at Kambalda it’s always important to understand what those gold structures are doing and we’ve assayed for it and we’ve got a good-looking structure. The grade is a bit modest, but there was visible gold and we managed to intersect that same structure a few times.

“Those assays are still pending and while nickel is definitely the main game, we’ve got the gold rights to most of the ground in the heart of what is an exceptionally endowed gold belt.”

Aiming to recreate success of peers

“In essence, the opportunity with Lunnon Metals on the ground at Foster and Jan is simply this: these assets were shut early in the piece when WMC made the strategic decision to divest itself of its nickel mines in Kambalda,” Ainscough said.

“It sold most of the remaining nickel mines to Mincor Resources (ASX:MCR), Panoramic Resources (ASX:PAN), and IGO Ltd (ASX:IGO).

“Through hard work, being more nimble and well capitalised, and with aggressive exploration, they were able to work into that next nickel boom in the mid 2000s and were extremely successful, generated a lot of cash and found a lot of nickel that WMC had essentially left on the table.

“The assets that we own were already shut and so were sold with the gold assets to Gold Fields – they missed the mid 2000s boom.

“So, it’s a very simple story. We’re just looking to replicate what those other three successful ASX listed companies did and be nimble, well capitalised, and explore aggressively.”

This article was developed in collaboration with Lunnon Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.