Lunnon Metals outlines high grade trend at East Cooee in hunt for Kambalda nickel sulphides

Pic: Mordolff/E+ via Getty Images.

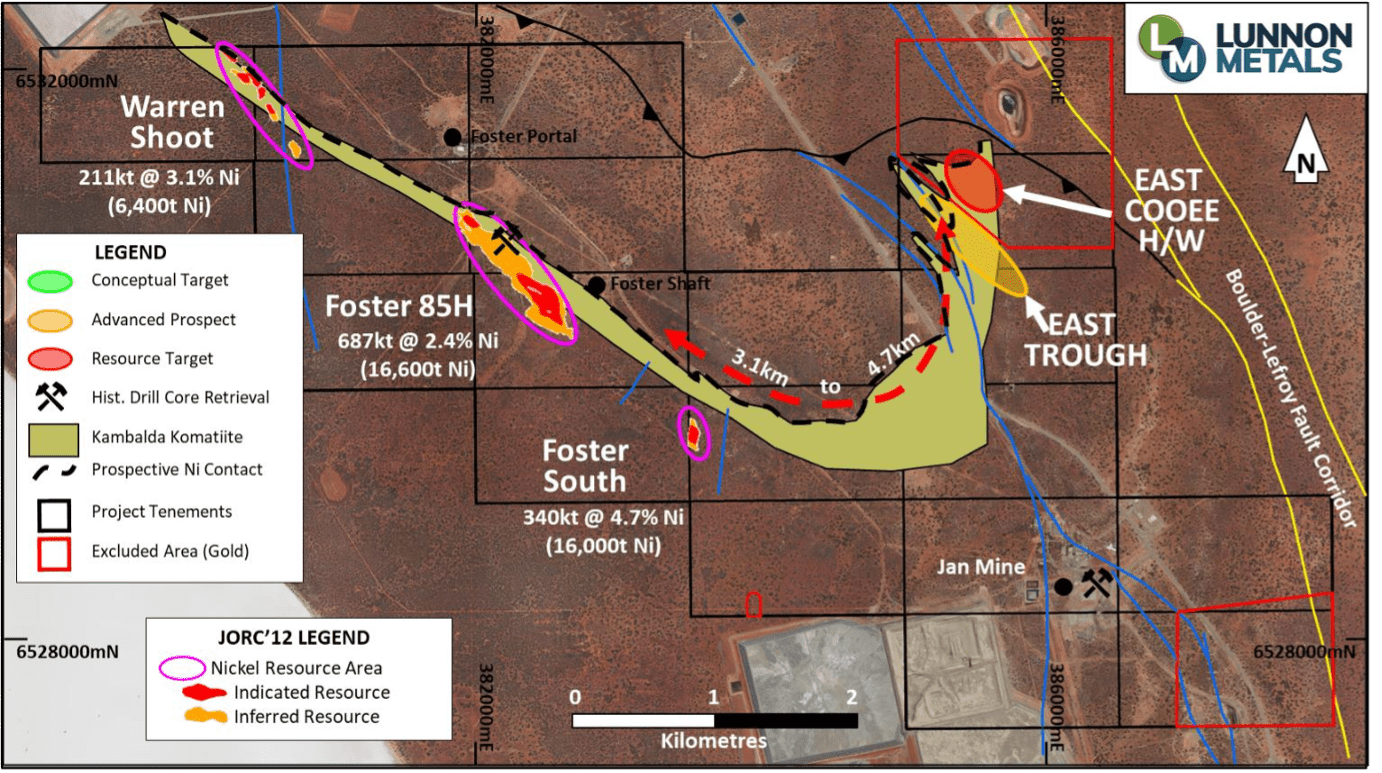

Nickel explorer Lunnon Metals is outlining a key high grade trend at its Kambalda nickel project, with recent drilling at the East Cooee hanging wall returning grades of more than 3% nickel.

Recently listed Lunnon Metals (ASX:LM8) owns the Foster and Jan nickel mines, which have been left largely untouched since Western Mining Corporation produced more than 90,000t at high grades between the 1970s and 1990s.

The latest results from the Hanging Wall surface returned a 1m intersection at 3.15% from 138m downhole and 2m at 2.44% nickel from 174m downhole in separate RC holes.

The hits continue the streak for Lunnon at East Cooee, where grades of up to 7.44% were struck in recent drilling in the Hanging Wall prospect and a strike of 2m at 5.07% was made at the East Trough prospect.

Downhole transient electro-magnetic surveys were also completed in the holes drilled in the latest program, indicating the orientation of a high grade trend aligned with nickel intercepts of more than 5%m, recorded over an area of 400 by 80m, once historical WMC drilling is taken into account.

East Cooee is a significant target for Lunnon because it is located some 2.7km north-northwest of the Jan shaft and more than 2.5km from Foster so sits entirely outside its existing 39,000t nickel resource.

That makes it an entirely new mineralised zone on Lunnon’s tenements, demonstrating the fertility of the package for typical Kambalda style high grade nickel sulphides and a major growth opportunity for the explorer.

“The East Cooee H/W prospect is shaping up as a potential significant contributor to our growth plans. These results confirm a higher grade trend is present and supported by the DHTEM survey results,” Lunnon managing director Ed Ainscough said.

East Cooee is a great prospect not just because of the emergence of high grade nickel sulphides and its third production centre potential, but it would also be easily accessible with the West Idough open pit, mined by major shareholder Gold Fields at its nearby St Ives operations, providing a perfect launching pad to head underground.

“Planning of both infill RC drilling on the higher grade trend followed by diamond holes for metallurgical purposes is underway,” Ainscough said.

“Importantly, this area is right next door to the East Cooee Trough and close to an existing open pit for a possible future access point, both strong reasons to advance this prospect as quickly as possible.”

Next steps

Nickel recently moved above US$20,000/t, levels not seen in more than five years.

The commodity has been energised both by supply crunches overseas and its emergence as one of the key metals for the lithium ion batteries that power electric vehicles.

Nickel sulphides like those found in Kambalda – a locale that has produced 1.6Mt of the metal since its discovery by Western Mining Corporation’s Roy Woodall, with driller Jack Lunnon on the diamond rig on that fateful day in 1966 – are the best and cleanest form of nickel for batteries.

Lunnon (the company) now wants to define the orientation of its high grade trend as a priority, and is eyeing the opportunity to extend the zones down plunge.

Infill RC drilling targeting the conductive plates modelled from the DHTEM surveys will be planned which, if successful, will be spaced to support a maiden mineral resource estimate for the East Cooee Hanging Wall prospect.

Once that’s done diamond drilling is also planned to target the high grade trend, provide representative samples for metallurgical testing and gather structural information to assist in modelling the high grade zones.

This article was developed in collaboration with Lunnon Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.