Lunnon Metals charts path to success in world-class nickel domain after transformative year

Pic: John W Banagan / Stone via Getty Images

While the world is on the lookout for nickel sulphide deposits anywhere they can be found, Lunnon Metals chief Ed Ainscough maintains there’s no place like Kambalda.

The mining town 50km south of Kalgoorlie in WA has produced 1.6Mt of the stainless steel and now lithium ion battery ingredient since 1966, when WMC driller Jack Lunnon punched the discovery hole and gave birth to Australia’s first nickel boom.

Since listing in a $15 million IPO in June, Lunnon (ASX:LM8) has continued Kambalda’s rich legacy of delivering high grade nickel.

Lunnon owns the Foster and Jan nickel mines from which WMC produced more than 90,000t of nickel metal from the 1975 to 1994, operations that missed the early 2000s nickel revival that proved the making of ASX success stories Mincor, IGO and Panoramic.

Lunnon already boasts 39,000t in resources at typical Kambalda nickel grades of 3.2% and drilling since its float is already delivering high grade results.

These have confirmed historical results from kilometres of old WMC drill core logged by Lunnon at the Kambalda coreyard and backed the Lunnon team’s conviction in the quality of the Foster and Jan assets.

“One of the benefits at Kambalda is that generally above a 1% cut off if you’re going to mine, it’s going to be in the high 2s or 3s,” Ainscough said.

“And it is very pleasing to not only reproduce the nickel where WMC was hitting it, but to be hitting it at the same level of mineralisation.

“I just think that speaks to the quality of the camp and that particular contact between the Kambalda Komatiite and the Lunnon Basalt.

“It’s a world famous contact, and nearly all the nickel in Kambalda is on or close to that contact, and it’s proven to be the case so far. You’ve got to persevere and be resilient because the rewards are definitely worth the effort.”

An option to play the Kambalda narrative

Kambalda is on the cusp of a revival.

Mincor Resources will open the first new nickel mine in the district since production at the Long mine ceased in 2018, when its Cassini operation starts production in 2022.

That will see BHP’s Nickel West division restart its Kambalda concentrator, just a few clicks from Foster/Jan, for the first time in four years.

Unfortunately for investors there are not a lot of options to play the Kambalda story, with what was a diverse field of ASX companies a few years ago whittled down to just Mincor and Lunnon after Panoramic sold Lanfranchi into private hands in 2018.

That’s where the opportunity lies, Ainscough says.

“Lanfranchi’s private now, so that’s been a big message I’ve been trying to sell – if you want to invest in Kambalda through the ASX it’s Mincor, and it’s a half-a-billion dollar company plus, or little old us at $50 million,” Ainscough said.

The key for Lunnon will be resource growth, which Ainscough said is a major aim in 2022 after its success with the drill bit in recent months.

“It’s a 10 times gap and the encouragement is that’s a big gap, but it’s a gap we feel we can make a big effort to fill next year,” he said.

“That will be filled by drill results and resource growth, but we’ve just got to get the runs on the board… but what better place to be trying to do that than Kambalda?”

East Cooee resource drilling under way

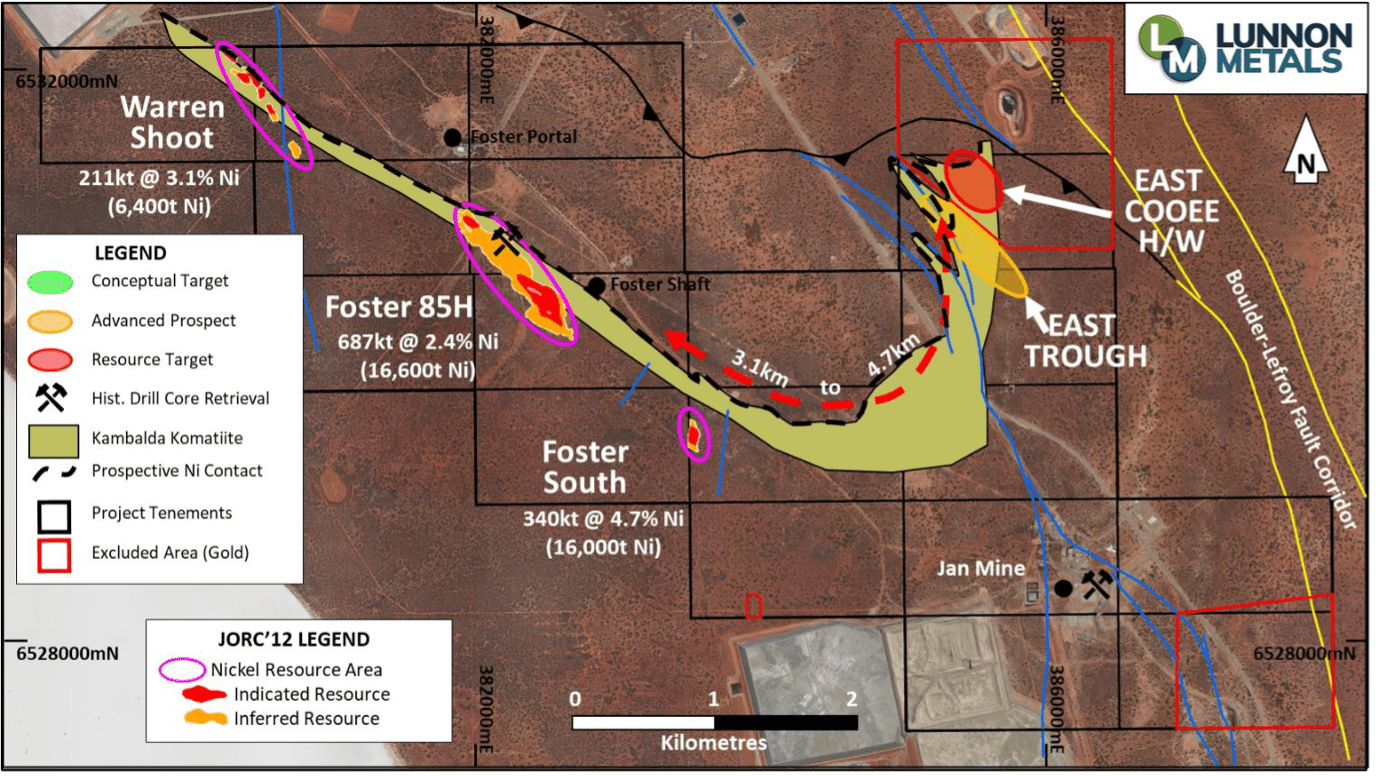

One of the company’s priority targets outside its Foster and Jan mines is East Cooee, a prospect to the north-northwest of Jan consisting of known hanging wall nickel mineralisation that was underexplored when the mines were in WMC hands.

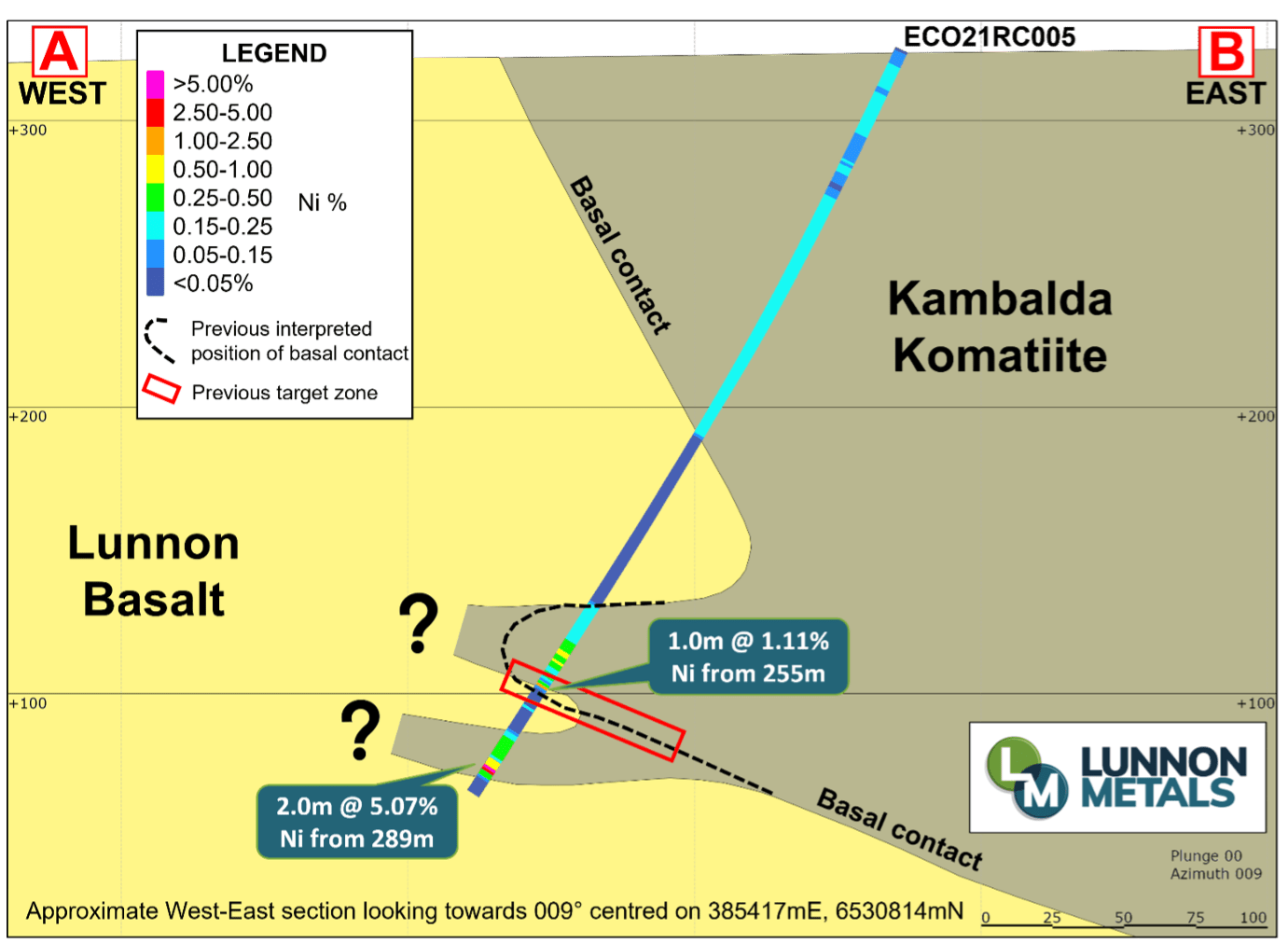

Since drilling began in July, assays from East Cooee have delivered a string of strong nickel grades, with Lunnon also recording a hit of 2m at 5.07% Ni in its first assays from the East Trough target in September.

Subsequent encouraging results at East Cooee have included 1m at 3.15% Ni, 2m at 2.44% Ni and a best hit of 9m (8.7m true width) at 1.66% Ni from 113m, including 1m at 7.44% Ni.

Contractors Blue Spec are now drilling the hanging wall prospect on infill drilling spacing of less than 40m x 40m to support the delivery of an initial Mineral Resource estimate.

East Cooee is just over 300m from a mothballed open cut gold pit mined by Lunnon’s major shareholder Gold Fields, providing a potential access point into a future underground development.

“That’s been a little bit of the surprise package because it’s so shallow and it’s so close to that existing gold open pit,” Ainscough said. “I hadn’t really considered that we would have the ability so early to have a second centre on top of the resources in the Foster Mine.

“We’ve gone back there with the RC rig and we’re drilling that out probably better than 40m by 40m.

“It’s so shallow we can drill it pretty quickly, we can get that done before Christmas and then as and when we get the results back next year we should be able to put that into a maiden resource.”

Ainscough said the location of the gold mine relative to the shallow East Cooee mineralisation meant it wasn’t out of the question that study work could begin before underground drilling starts at Foster.

Warren, historical core also delivers the goods

The other areas where Lunnon is seeing success include the Warren channel, an underexplored nickel deposit which currently hosts 211,000 tonnes at 3.1% Ni for 6400t of nickel metal.

Located 1km to the northwest of Foster itself, Lunnon believes it has the potential to mirror that mine with assays from RC drilling up and down plunge of the known resource delivering impressive results.

They included a best hit of 4m at 3.44% Ni from 163m in the channel position at Warren.

“It was seen as part of Foster underground mine (by WMC),” Ainscough said.

“Where they could they tried to drill it from Foster so the drill angles are pretty horrible.

“So I think next year for us with Warren is the ability to try and demonstrate that channel is a channel in its own right and has the ability to be as long and as prospective as Foster main.

“That’s all about resource growth.”

The analysis of historical WMC core is also paying off for Lunnon, with re-assayed samples from the unmined N75C area at Foster delivering 15.75m at 2.76% nickel at an estimated 10.7m true width.

This compared well to WMC’s result for the same hole (CD 54) of 16.52m (11.2m true width) at 3.05% Ni from 268.22m.

In 2022 a deep drilling program is also planned beneath the historical Jan mine and a government-supported hole at the new Kenilworth target is due to be drilled.

“I think we’ve set the groundwork in the last six months of the year to really have a big year in 2022, hopefully leading into a buoyant nickel market,” Ainscough said.

Nickel market on the up

Led by former Donegal Resources boss and now Lunnon non-executive director Ian Junk, Lunnon initially moved into the Foster and Jan projects in a joint venture with Gold Fields back in 2014.

Back then nickel was looking on the up, hovering around the US$20,000/t mark before slipping into a long bear market.

But with excitement around the use of nickel in batteries and electric vehicles and shifting supply-demand dynamics, it recently peaked above US$21,000/t, hitting a seven-year high.

Ainscough said being in Kambalda, Lunnon is seeking to outline high grade resources that are not dependent on booming nickel prices, but believes the broader market is looking positive.

“I think there is a natural rhythm to the nickel price and we’re entering into that next cycle, but the whole electric vehicle story, the energy transition, that’s all just a fantastic macro backdrop to the nickel price,” Ainscough said.

“I try not to pontificate too much about the nickel price.

“My firm belief is that wherever it gets to, being in Kambalda and mining at the grades that Kambalda delivers – I won’t say it doesn’t matter what the nickel price is but I’d certainly rather be mining in Kambalda regardless of the nickel price.

“I think there’s a momentum now to the whole electrification of everything that we’ll just see a new floor develop in the nickel price. Where that is, I don’t know.”

Q&A Time

Lunnon’s 2021 highlights

- Acquiring 100% of the Kambalda Nickel Project.

- Fully underwritten, oversubscribed, successful $15M IPO.

- Drill rigs turning within a month from a standing start.

- HIT NICKEL – confirming WMC historical data.

- East Cooee shaping as second centre of mineral resource growth.

“Our goal is to replicate the success of those ASX companies that bought assets from WMC before the last nickel boom. Each one of the above milestones is a key step to demonstrating we are on that trajectory and can offer investors a similar growth story leading into the next nickel cycle.”

Where is the nickel market heading?

“LM8 sees the macro setting for nickel as extremely positive; there are generational shifts under way at country, government, city and corporate levels regarding the push to achieve net zero goals that all tie in with the energy transition away from fossil fuels.

“These are all strongly in favour of nickel being an important, sought after and in demand metal.

“Covid-19 has also highlighted the issue of supply chain sovereignty and having nickel assets in one of the world’s best nickel camps in a Tier 1 country offers the sort of sustainable supply chain that governments and downstream businesses will value highly in the future.”

What is the upside for Lunnon and why will it be a good investment in 2022?

“We tell investors if you want to be exposed to nickel in Kambalda (and why wouldn’t you want to be exposed to one of the world’s most famous nickel camps against the backdrop described above?), you really only have two choices on the ASX.

“Mincor, who have done an amazing job of restarting their operations in Kambalda and Widgie with Nickel West planning to open up the Kambalda Concentrator, and Lunnon Metals.

“We are just starting out on the same growth journey as Mincor. Kambalda has three key advantages: The grade is high (often >3%), Nickel West’s concentrator offers a ‘capital light’” restart solution and the nickel assets themselves are renowned for delivering extensional growth year after year.

“We are expecting a big year in 2022 for all of these reasons.”

This article was developed in collaboration with Lunnon Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.