‘Low cost, high margin, long life’: QMines delivers study to put Mt Chalmers copper project well into the profit zone

The pre-feasibility study shows great metrics for profitability out of Mt Chalmers at a time of bullish sentiment for the copper market. Pic via Getty Images.

- PFS at Mt Chalmers project envisages $636m free cashflow over initial 10-year life

- Mine to produce 65,000t copper, 160,000oz gold, 30,600t zinc and 1.8Moz silver

- NPV of $373m, 54% IRR

- “Mt Chalmers represents a low cost, high margin and long-life project with immediate upside,” says QML’s Andrew Sparke

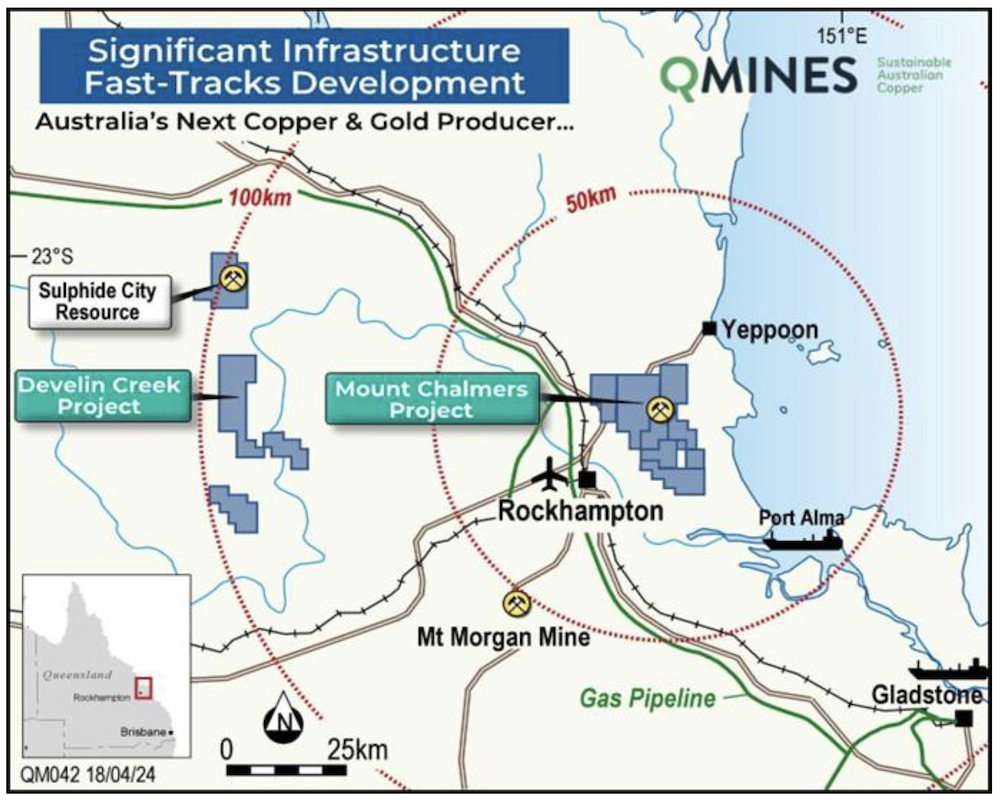

Special Report: A pre-feasibility study (PFS) on QMines’ flagship Mt Chalmers copper project 17km north-east of Rockhampton in QLD is showing great metrics for a profitable +10 year mine development.

It’s a great time to be a copper developer, as forecast price rises associated with the global energy transition and significant supply issues look to drive the red metal’s bull run.

QMines’ (ASX:QML) Mt Chalmers asset is centred on a high-grade historical mine which produced 1.2Mt at 2% copper, 3.6g/t gold and 19g/t silver between 1898-1982.

Including the recently acquired Develin Creek project, QML’s global resource now sits at a combined 15.1Mt at 1.3% Cu containing 195,800t.

Mt Chalmers Pre Feasibility Study

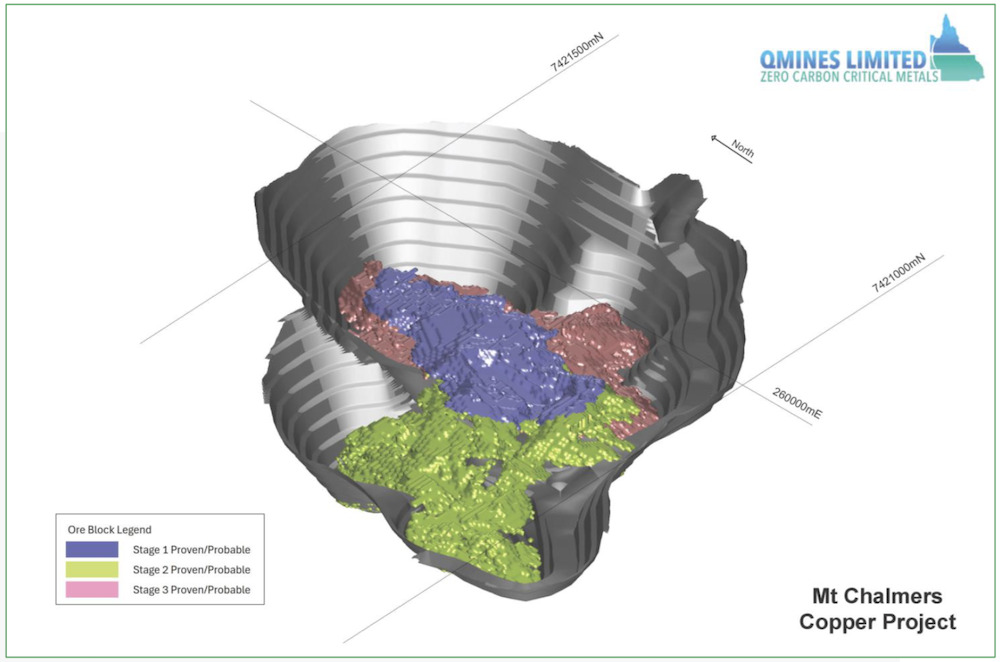

A new PFS – a detailed look at the economics of building a project – envisages Mt Chalmers as a shallow, high-grade, three-stage open pit project with high recoveries, low capex and an initial 10.4 year mine life with immediate opportunities to grow the scale of the operation.

Able to be profitably extracted to a depth of 220m, the PFS shows the proposed mine will use a 1Mtpa plant to process 65,000t copper, 160,000oz gold, 30,600t zinc, 1.8Moz silver and 583,000t pyrite.

Development boasts an excellent internal rate of return (IRR) and net present value (NPV) of 54% and $373.4m, with life of mine free cashflow of $636m.

It would take just 1.84 years to pay back the $191.9m construction cost.

A high confidence Mt Chalmers Maiden Ore Reserve of 9.6Mt (Proved & Probable) was also declared.

QML says there is more growth to come, as resources just 800m away from Mt Chalmers at Develin Creek (Sulphide City & Scorpion) and Woods Shaft are not currently in the mine plan.

‘Low cost, high margin, long life project’

“The completion of the Pre-Feasibility Study represents a significant milestone for the business and our shareholders as we continue to demonstrate Mt Chalmers is a project with scale and potential for development,” QML executive chair Andrew Sparke says.

“The company has demonstrated that Mt Chalmers can be commercialised using industry standard treatment processes and techniques.

“With improving base metals prices associated with supply constraints, Mt Chalmers represents a low cost, high margin and long-life project with immediate upside from three satellite deposits and a large exploration package.”

This article was developed in collaboration with QMines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.