Lords’ riches closer to reality for Alto

Pic:Getty

Special Report: Alto Metals believes it is closer to unlocking a major gold system between the historic Lord Henry and Lord Nelson gold mines in WA’s Sandstone district after receiving results from a geophysical survey and early drilling.

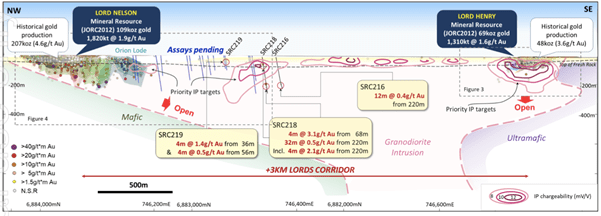

Alto (ASX: AME) controls 800km2 of ground at Sandstone but has been focusing its recent exploration efforts on the Lords Corridor, a 3km-plus stretch between the Lord Henry and Lord Nelson mines, both of which currently contain relatively modest, JORC-compliant gold resources.

On Tuesday, the company announced that an induced polarisation (IP) survey conducted along the corridor in December had defined a significant number of anomalies extending to depths of more than 400m, potentially indicating “the larger source of mineralisation that we are targeting”.

Demonstrating the effectiveness of IP, the survey showed a large, strong response over the Lord Henry deposit, which hosts a higher amount of sulphide mineralisation than Lord Nelson.

Sulphide mineralisation at Sandstone is typically higher grade than oxide mineralisation and previously reported drilling results from Lord Henry include 2m at 51.3 g/t gold from 70m and 6m at 10.2 g/t gold from 50m.

Alto also reported on Tuesday new results from reverse circulation drilling about 1km south of known mineralisation at Lord Nelson, noting that a 32 metre-thick “halo” of gold mineralisation had been intersected close to one of the strongest anomalies identified in the IP survey.

“What is notable is that high anomalous values of chargeability correlate to our geological model and the margins of the known high-grade shoots at Lord Nelson and Lord Henry,” managing director Matthew Bowles said.

“This makes the anomalies particularly compelling targets for the upcoming drill program.

“Importantly, the first assay results from drilling 800m south of the Orion Lode have confirmed a 32m thick halo of gold mineralisation at the eastern edge of one of the IP anomalies.”

The Lord Henry and Lord Nelson deposits were only mined to respective depths of 40m and 90m because the mill at Sandstone was configured to process softer oxide ore, not harder fresh rock.

As a result, previous exploration drilling in the area has been shallow and limited.

Alto is the first company to test for mineralisation at depth and has already seen success, with results from Lord Nelson including 6m at 16.4 g/t from 167m and 16m at 5.2 g/t gold from 240m.

The company is now awaiting the final batch of assays from the drilling completed in December.

Those, combined with results received to date from drilling and the IP survey, will help inform future targeting activities along the Lords Corridor.

RC drilling is expected to resume on site early this month, with a second rig due to arrive in the following weeks to accelerate the program.

“As well as drill testing these new targets identified from the IP as a priority, we will also be testing the extensions to known high-grade shoots at Lord Henry, Lord Nelson and the Orion Lode,” Bowles said.

Alto completed approximately 6,000m of RC drilling in the lead-up to Christmas and has planned a further 24,000m as part of the program committed to when it raised $5.5 million through a share placement in September last year.

None of these gained traction, but the level of interest confirmed that the latent value at Sandstone had not gone unnoticed by others.

Global indicated and inferred resources for Alto’s Sandstone project stand at 331,000 ounces at a grade of 1.7 g/t gold, with the bulk of those located at Lord Nelson and Lord Henry.

This story was developed in collaboration with Alto Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.