Free from takeover pressure, Alto gets clear run at unlocking Sandstone treasures

Pic:Getty

Special Report: After a lengthy period spent dealing with mostly underwhelming takeover offers, emerging explorer Alto Metals is finally free to devote its full attention to rapidly building the gold inventory at its Sandstone project in Western Australia.

Alto (ASX: AME) advised the ASX on Thursday morning that the unsolicited off-market takeover offer lobbed by privately owned Habrok Mining in May had lapsed with less than 1% of shareholders accepting the 7c per share on the table.

Habrok’s capitulation came after Chinese-connected Goldsea Australia Mining allowed a competing cash offer to lapse in July as Foreign Investment Review Board changes complicated its plans.

Going back to last year, an all-scrip offer from fellow ASX gold junior Middle Island Resources expired in December after securing less than 1% of acceptances over the nine months it was open for.

“Three separate companies in the past 18 months have clearly recognised the latent value within our landholding at Sandstone to the point of making takeover offers,” Alto managing director Matthew Bowles said on Thursday.

“It is great to finally be unencumbered in that sense, to have some clear air to get on with our exploration plans, which include the single largest drilling campaign ever undertaken by Alto on the project, and to start to realise some of that value.”

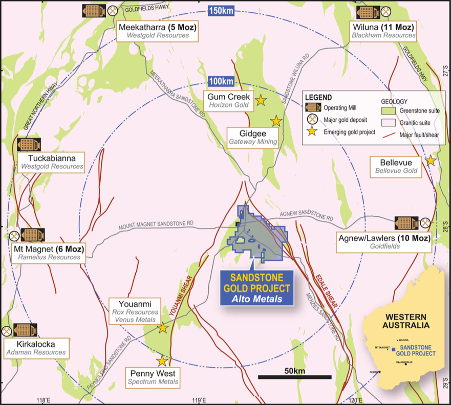

Commanding position in greenstone belt

Alto’s ground position at Sandstone – which is in WA’s East Murchison region, host to numerous multi-million ounce deposits and producing mines – covers 800km2 of the Sandstone greenstone belt.

More than 1.3 million ounces of gold has been produced from the project itself since the 1890s, including from the shallow Lord Nelson and Lord Henry pits that lie 3km from each other in the south-east corner of the tenements.

However, past owners were only focused on the near surface oxide material and very little drilling has been undertaken below 100m depth.

“Given the previous focus on near-surface oxide material, exploration on the project to date has really just scratched the surface.”

Well funded for big drilling push

Alto recently completed a $5.5 million capital raising at 7.5c a share that will fund a planned 30,000m RC drilling program at Sandstone testing along the Lords’ corridor as well as a number of regional targets.

“It is unusual for a company of our size to have such a dominant position on an entire greenstone belt and I have no doubt that is one of the reasons we’ve attracted the takeover interest,” Bowles said.

“The Lords’ corridor is where our focus will be in the short-term, but there are so many other prospective areas yet to be tested within the broader project.”

Following an update in May that incorporated shallow mineralisation identified along 200m of strike to the south of the pit, Lord Nelson now contains an inferred resource of 109,000 ounces at a grade of 1.9 g/t Au.

Lord Henry contains an indicated resource of 65,000 ounces at 1.6 g/t Au as well as a small inferred resource, while the global indicated and inferred resource for Sandstone stands at 331,000 ounces at 1.7 g/t Au.

A glimpse of the possible upside has come in recent months, with Alto returning further strong results from drilling around and beneath the Lord Nelson pit, including 16m @ 5.1g/t gold and discovering the new Orion Lode to the south, which has returned results including 29m @ 3.5g/t gold.

These results helped to lift the Alto share price above the Habrok offer price, where it has remained since June.

Alto is hoping for more of the same from an initial 5,000m wide-spaced drilling program scheduled to start next week that will test for multiple potential Lord Nelson-style repeat lodes along the Lords’ corridor and extensions to high-grade gold mineralisation beneath the Lord Nelson pit and the Orion lode.

Depending on progress and results, the balance of the 30,000m of drilling will likely be completed early next year.

This story was developed in collaboration with Alto Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.