Alto fully funded for Sandstone drilling as investors flock to $5.5m cap raise

Mining

Mining

Special Report: Following multiple takeover offers, the investor interest in Alto Metals is still extremely high with the junior explorer raising $5.5m in a strongly bid capital raising.

Alto Metals (ASX:AME) is now fully funded to pursue an aggressive and much larger drilling program at its Sandstone gold project in Western Australia.

The placement, which raised $5.5m at 7.5c per share, was strongly backed by existing major shareholders and a number of new resource-focused institutional and sophisticated investors.

Alto says the firm commitments received were well in excess of the offer size, indicating strong demand.

The company has been a hot target for potential suitors because of the highly prospective patch of ground Alto has in the Sandstone region, which has become somewhat of an exploration hotspot.

Alto’s ground position covers 800sqkm of the Sandstone Greenstone Belt and is surrounded by multi-million-ounce gold deposits and producing mines in the East Murchison of WA.

The company’s Sandstone project has produced over 1.3 million ounces of gold since the 1890s.

However, past explorers were only focused on the near-surface oxide material and there was very little drilling below 100m depth.

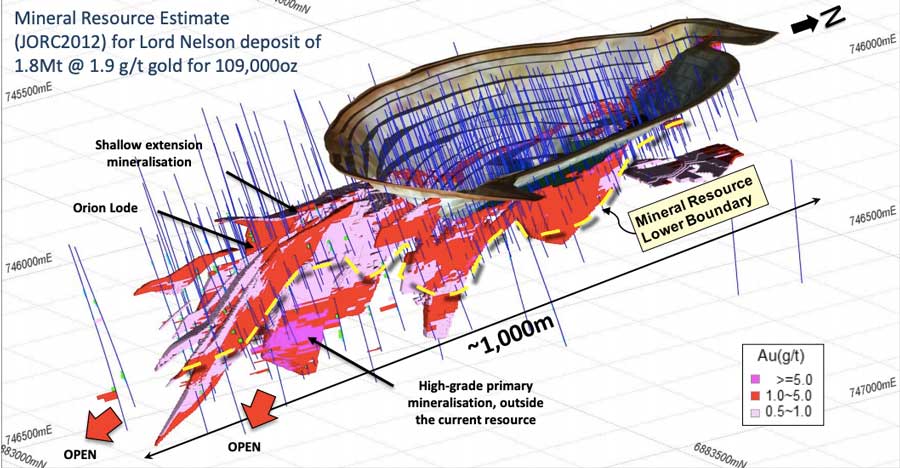

Alto has so far defined a JORC-compliant resource of 6.2 million tonnes at 1.7 grams per tonne (g/t) for 331,000oz of contained gold.

The company is currently the subject of an unsolicited off-market cash takeover offer of 7c per share from Habrok (Alto) Ltd.

Indicating the strong interest in Alto’s portfolio, the company has had three unsolicited takeover offers in less than 12 months.

And it is currently trading well above all of the bids.

The three suitors obviously clearly see the value in Alto’s project, but for managing director Matthew Bowles and Alto it’s all about getting out there and doing the drilling, and there have been some big shareholders come in and support that strategy.

“The proceeds from this raising will allow Alto to undertake an extensive 30,000m RC (reverse circulation) drilling program, focused on testing extensions of known gold mineralisation at Lord Nelson and the new Orion lode discovery, in addition to a number of potential repeat lodes and along the 3km Lords’ corridor,” Bowles said.

A 5,000m wide-spaced RC drilling program will kick off in the next week to test multiple potential Lord Nelson repeats along the Lords’ Corridor, and high-grade gold mineralisation beneath the Lord Nelson pit and the Orion Lode.

Drilling at Lord Nelson has intersected multiple high-grade (>10g/t gold) zones of gold mineralisation.

And results indicate the potential for a much bigger gold system.

“The 5,000m is a precursor to a much larger program. We’ve got plenty of funds and it’s all about drilling that corridor,” Bowles said.

A further 25,000m of RC drilling will test additional near-term targets along the 3km Lords’ corridor as well as regional targets including Vanguard, Indomitable and Chance.

Alto says all known deposits remain ‘open’ along strike and at depth.

‘Open’ just means the company hasn’t found the edges of this potentially massive system yet.

Alto’s directors, along with major shareholder Windsong Valley, plan to chip in an extra $900,000 at the same price as the previous placement.

The company plans to seek shareholder approval for the new issue of shares to its directors.

This article was developed in collaboration with Alto Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.