Lode Resources eyes antimony development with $4.5m placement

Lode is raising $4.5 million via a placement to advance its antimony and precious metals projects. Pic: Getty Images

- Lode Resources completes a $4.5 million placement to advance its antimony and precious metals projects

- A significant proportion of the funds will be used to progress Lode’s newly acquired Montezuma Antimony Project, with the aim to start production in 2025

- The latest cash boost for Lode comes at a time of soaring antimony and precious metals prices

Special Report: Lode Resources is on its way to becoming a significant player in the hot antimony space on the ASX after raising $4.5 million in an institutional placement.

Funds will be used primarily to advance its Montezuma Antimony Project which Lode (ASX:LDR) acquired just last month, as well as its other recent strategic purchase, the Magwood Antimony Mine and its precious metals assets.

Antimony goes boom

Like many other critical minerals that help power modern economies, antimony’s supply has been largely controlled by China, which made the world aware of that control by announcing in August that it would restrict exports from September 15.

That sparked a run on ASX juniors with antimony prospects around that time as the race began to find more of the metal in Australia, home to the fourth largest reserves across the globe.

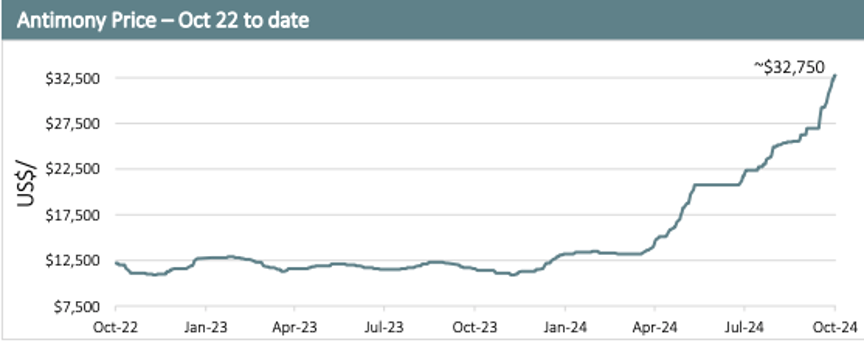

The shock move by China also sent antimony prices to an all-time high of US$24,500t in August, double the ~$US12,000t at the start of this year.

As the chatter over the past couple of months shifted to goldies, the antimony price has – under the radar of many – has been on even more of a tear and is now at ~$US32,750t.

Lode’s production plans ramp up

A significant portion of the $4.5 million placement funds from will go towards the Montezuma Antimony Project in Tasmania. The antimony-silver-lead deposit, which has yielded high grades from close to surface, already has initial development, advanced metallurgy, significant mining equipment and beneficiation infrastructure all in place.

Lode will now work towards delineating a high-grade antimony resource, finalising met testing and upgrading plant, with the aim to start production by Q3 of 2025.

Managing director Ted Leschke said: “The Montezuma Antimony Project shapes as a particularly exciting asset for Lode shareholders, with its historically recorded high-grade drill, trench and mine face sampling.

“Our enhanced cash position as a result of this funding initiative means we can now proceed to systematic mapping of the deposit, ahead of a co-ordinated drilling program with a view to progressing Montezuma to a maiden high-grade antimony resource.

“Existence of the processing infrastructure as part of the Montezuma transaction sets Lode apart from many companies, as it provides the potential to produce antimony products to further offtake and other financing discussions.”

Some of the proceeds of the raise will also be used to advance the Magwood Antimony Project, plus Lode’s the Webbs Consol Silver Project and Uralla Gold Project, with all three of those assets in the highly prospective New England Fold Belt.

Magwood was Australia’s primary producer of antimony from 1941 to 1970, with recorded grades reaching up to 62%.

Leschke added: “We’re also excited about applying part of the equity raising towards advancing our 100% owned Magwood Antimony Project. Australia’s largest antimony production source throughout the 1960s and 1970s, the Magwood mined ore was of such a strong grade that the then-owners never undertook drilling of the deposit.

“Shareholders of Lode now have that opportunity at a time when investors and government agencies are recognising the material strategic value of antimony found in western world jurisdictions.

“With the positive backdrop of strong commodity prices for our Webbs Consol Silver and Uralla Gold Projects, we are looking forward to delivering news flow across all of our asset base for the balance of 2024 and into 2025.”

About the raise

The Blue Ocean Equities and PAC Partners Securities led placement comprises two tranches of a total of 45 million new shares at 10 cents each.

The Offer Price represents a 13% discount to the last closing price of 11.5 cents per share on 29 October and a 20.7% discount to the 15-day volume-weighted average price (VWAP) of 12.6 cents per share.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.