New England Fold Belt hunter Lode gets ready to drill

Mining

Lode Resources joined the ranks of ASX-listed explorers on Friday and will very soon start drilling in the highly prospective, but underexplored New England Fold Belt of NSW after successfully completing a $5m IPO.

Lode Resources received strong support for its IPO from new and existing shareholders, which ensures it has enough cash to fund ongoing exploration across its wholly owned brownfield precious and base metals projects.

“Having pegged our tenements prior to the recent land rush in the region, Lode has picked the most prospective ground with historical mining activity on all our key permits,” managing director Ted Leschke said.

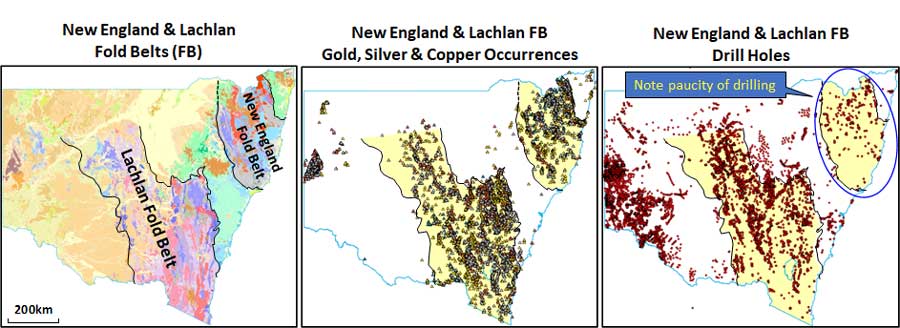

The New England Fold Belt is highly prospective but underexplored, with current in situ resource value estimated to be just 2 per cent of the entire state due to a lack of exploration.

Despite historical production of gold, silver and base metals, it has seen very modest drilling compared to the well picked-over Lachlan Fold Belt to the south. The New England Fold Belt has just one exploration hole for every 13 holes drilled in the Lachlan Fold Belt.

But more recently, this “forgotten mineral province” has landed on the radar of the majors.

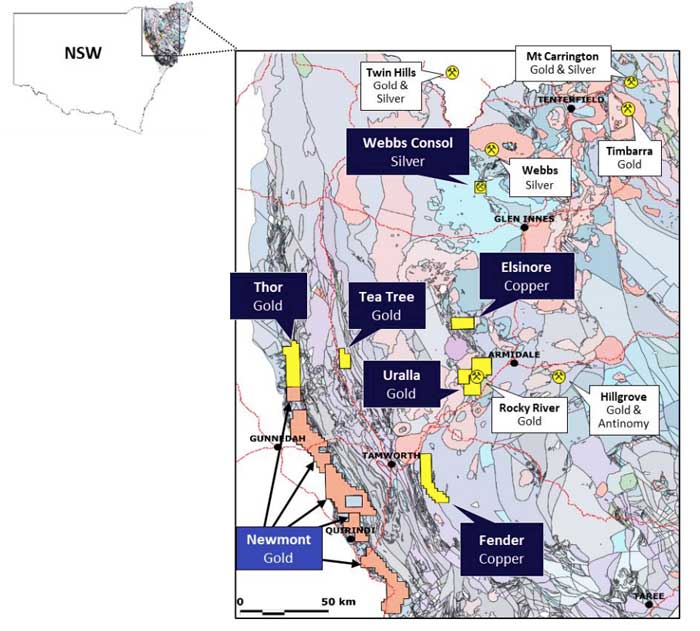

Just in the last year, the area under exploration title has grown from 7,296sqkm to 17,322sqkm, an increase of 137%. Companies acquiring ground include several North American players, with the largest being Newmont.

Gold companies like Newmont only chase multi-million-ounce gold deposits.

One of Lode’s gold projects sits adjacent to gold tenements newly acquired by Newmont, in the same geology. This is significant given Newmont currently has the largest gold reserve base in the industry.

Meanwhile, the Uralla gold project, which spans 300sqkm and will be the first to be drilled, sits within a significant goldfield, which Lode believes hosts Intrusive Related Gold System (IRGS)-style mineralisation.

IRGS deposits can host millions of ounces of gold.

Uralla was one of the earlier goldfields discovered in NSW and a significant gold producer in the 1850s.

Lode’s immediate priority is drilling the Uralla project, which comprises two tenements that almost entirely cover the historic Uralla goldfield. The company has already identified several key targets with high-grade historical gold intercepts including at the Hudson’s prospect, which is the priority for drilling.

“Preparations for drilling at the Uralla gold project are well advanced and we anticipate kicking off a 3,000m, 15-hole program shortly,” Leschke said. “Drilling will initially be focused on the Hudson’s prospect, the first of several key targets we have identified and where high-grade gold at surface has been encountered.

“Drilling at Webbs Consol silver project and then the Trough Gully copper project, both of which host historic mines, will then begin during the current quarter.”

A steady stream of exploration results is expected as Lode moves quickly to begin drilling on multiple projects.

Results from the initial drilling at Uralla are expected around mid-September.

The company plans to undertake 6,000m of reverse circulation drilling across its three drill-ready projects this year, with a further 9,500m planned for 2022.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.