Lithium Universe PFS outlines value of closing lithium conversion gap

Mining

Mining

Special Report: Underlining the value of its planned Bécancour lithium refinery in Quebec, Lithium Universe has outlined robust economics in its pre-feasibility study despite the challenging lithium price environment.

Illustrating the company’s counter cyclical strategy of developing the project now in preparation for the nearly inevitable price recovery, Bécancour is expected to deliver pre-tax net present value and internal rate of return – both measures of profitability – of US$779m and 23.5% respectively.

This is based on a price forecast of US$1,170/t for 6% Li2O spodumene and US$20,970/t for battery grade lithium carbonate.

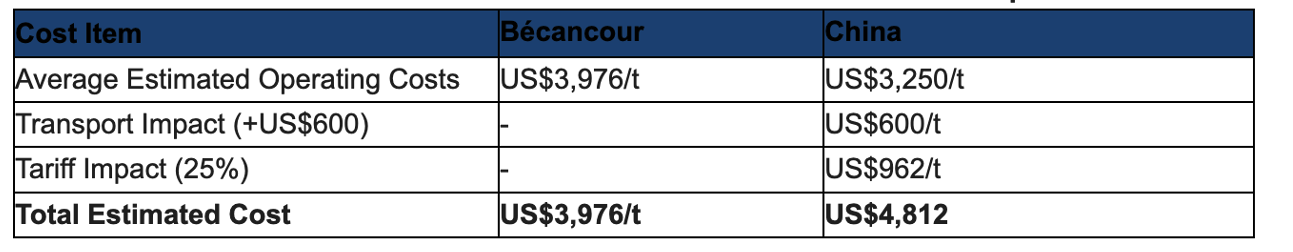

Operating costs are estimated at US$3,976/t while payback on the Capex of US$494m is expected to be ~3.5 years.

Annual revenue and EBITDA are expected to be US$383m and US$147m from the refinery, which is designed to produce 18,270t of green, battery-grade lithium carbonate per annum.

The figures outline the potential in Lithium Universe’s (ASX:LU7) plan to close the lithium conversion gap in North America.

While there are no shortage of projects aimed at finding and producing lithium in North America, as well as manufacturing lithium-ion batteries, there is a distinct lack of initiatives when it comes to domestically converting lithium into battery grade chemicals. That’s a major challenge as the West seeks to decouple its supply chains from China.

“The successful completion of our preliminary feasibility study is a significant milestone for the company, especially given that we only launched in August of last year,” LU7 chairman Iggy Tan said.

“Early on, we recognised that bridging the lithium conversion gap in North America, leveraging our accumulated lithium expertise and the proven technology from Jiangsu (a Chinese plant set up by LU7’s founders), was a clear and strategic path forward.

“Our counter-cyclical strategy is centred on advancing projects during market downturns, allowing us to strategically position ourselves for growth as the market rebounds.

“We are dedicated to funding and constructing a proven, low-risk lithium conversion refinery in Québec, marking the first step toward establishing Québec as the lithium conversion hub for the Transatlantic region.

“There is significant interest from OEMs with spodumene offtake supply seeking conversion outside of China, and discussions are already underway. We are confident that the Bécancour lithium refinery, with an annual capacity of 18,270 tonnes, will emerge as a leader in producing green, battery-grade lithium carbonate.”

LU7’s proposed Bécancour lithium refinery uses proven operating technology from the Jiangsu refinery in China that was itself designed and constructed following strict Australian and international standards to mitigate technology risks.

And while a US$3976 price tag for a tonne of Bécancour carbonate is at an on-paper premium compared to the US$3250 offered by Chinese production, the hidden costs turn LU7 product into a discount for western production.

Factoring in transport and tariff costs, a tonne of Chinese carbonate adds up closer to US$5000 a pop, a cost advantage LU7 believes underscores its belief in Québec’s potential to emerge as a key trans-Atlantic conversion hub.

The company is also intimately familiar with Jiangsu as much of its management team – including Tan – were involved in its initial engineering and construction for Galaxy Resources.

Originally intended to produce 16,000tpa of lithium carbonate, updated recovery rates and design optimisation have increased the target production rate at Bécancour to 18,270tpa.

Designed on a smaller-scale in order to use off-the-shelf parts, the facility will feature a purification unit to ensure high-quality, battery-grade lithium carbonate, optimised for use in lithium-ion batteries that use safer and longer-lived lithium-iron-phosphate chemistry.

It will be capable of processing spodumene concentrate from a wide range of global sources and benefit from access to cheap green power, transportation savings and favourable US/Canadian tariffs.

LU7 is continuing offtake discussions with interested OEMs and is progressing the full definitive feasibility study.

This article was developed in collaboration with Lithium Universe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.