Latin highlights confidence in Salinas by going big. Like, really big

Latin Resources is expanding its landholding around the Colina deposit within its Salinas project by almost 400%. Pic via Getty Images.

Expanding your landholding is a surefire way of declaring confidence in the mineral prospectivity of a region, which is exactly what Latin has done at its Salinas lithium project in Brazil.

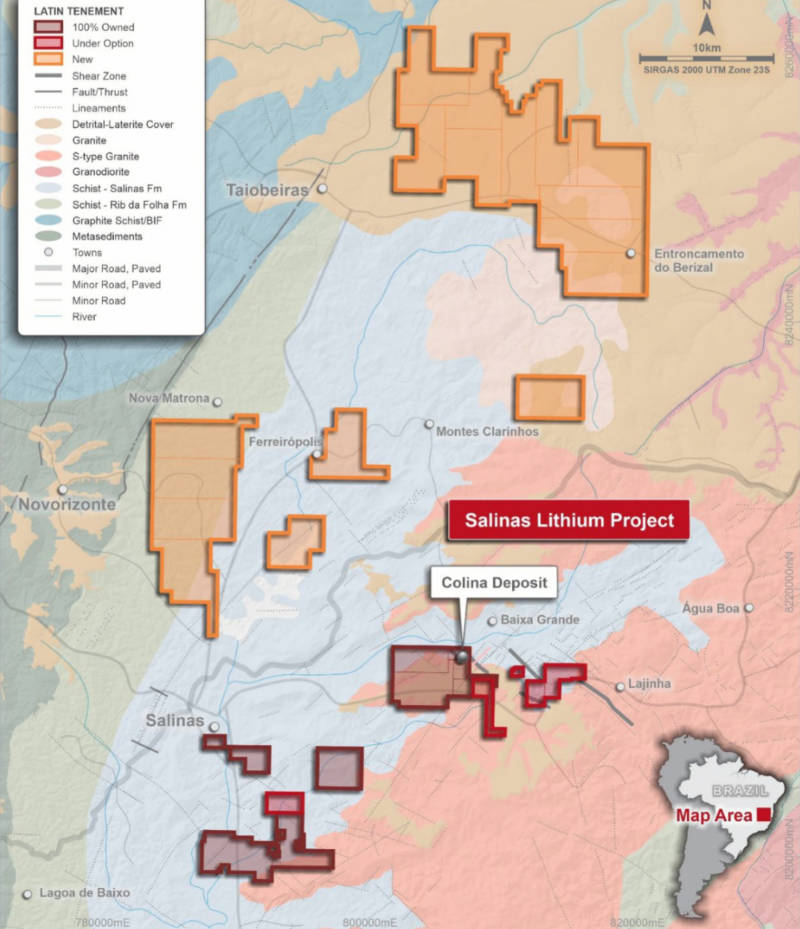

And just to make sure the message is clear, the company has applied for 17 new exploration applications covering over 29,940 hectares with the Brazilian National Mining Agency over areas that contain favourable basement lithologies to host lithium bearing pegmatites similar to those found at its Colina lithium deposit.

This will take its land holding up to 38,000 hectares, a not-insignificant increase of 367%.

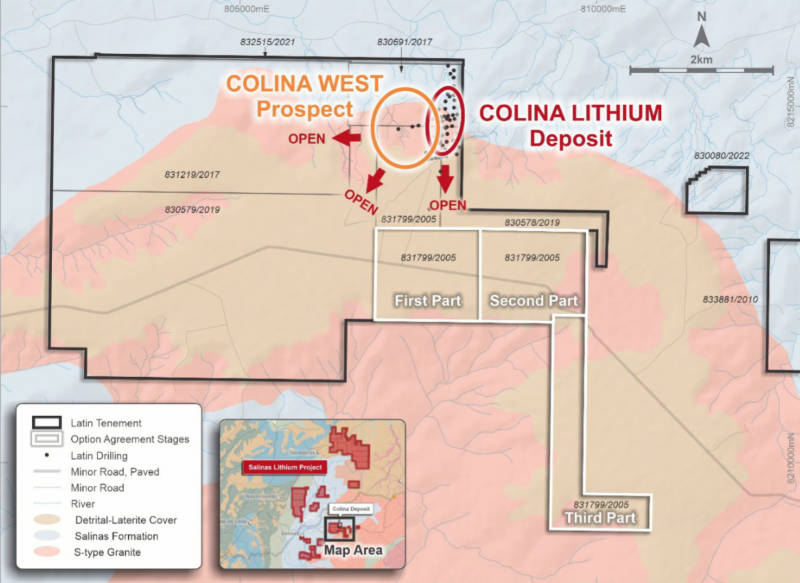

Latin Resources (ASX:LRS) has also signed an option agreement over additional mining rights directly adjacent to the south of the Colina lithium deposit, which is right at the heart of why it is so aggressively consolidating its position in the Bananal Valley region.

Previous drilling

Previous drilling has already confirmed the extension of Colina host ithologies and pegmatitic intrusive bodies such at the intersection of over 67m of cumulative lithium pegmatites at the Colina West prospect.

More such discoveries are likely to be on the way with the company currently in the midst of progressing a 65,000m diamond drilling program that kicked off in January with the aim of expanding the existing Colina Indicated and Inferred resource estimate of 13.3Mt at 1.2% Li20 (2.08Mt indicated and 11.17Mt inferred) to the West and South.

Geology manager Tony Greenaway said the discovery and delineation of Colina proved the prospectivity of the Bananal Valley region while its greater understanding of the wider regional controls to mineralisation had enabled the company to identify the new opportunities it is seeking to secure.

“The Salinas Lithium Project is continuing to grow to potentially become one of the world’s leading lithium projects with this expanded exploration tenement package,” managing director Chris Gale added.

“With the recent publication of our maiden JORC Lithium Resource, the aggressive 65,000 metres drill program planned for 2023 and feasibility studies well underway, we are extremely excited about this year for Latin Resources.”

Bigger footprint

The 17 new exploration applications are located north of its existing land holdings that host the current Colina resource and the Exploration Target of between 13.5Mt and 22Mt at a grade range of 1.2% Li2O and 1.5% Li2O.

The applications follow the completion of a regional prospectivity review of the broader Bananal Valley District surrounding the Colina deposit which allowed the company to select areas that it interpreted to be favourable for the presence of lithium-bearing pegmatites.

Most of these areas are considered to be ‘greenfields’ exploration areas that have seen little or no previous work.

Latin Resources plans to carry out preliminary reconnaissance work including the ground truthing and geological mapping and regional scale geochemical sampling before carrying out airborne geophysical and remote sensing survey over selected areas highlighted by the initial work.

Separately, the company has secured the right to acquire the tenement exploration rights

831799/2005 which is directly adjacent to the south and contiguous with the Colina deposit.

It has already secured a 100% interest in the first part with a payment of US$200,000 late last month and may secure a 100% interest in two additional areas by paying US$200,000 by 31 May 2023 and 31 July 2023 for each of the second and third parts respectively.

Prior to making these milestone payments, it intends to carry out additional reconnaissance and assessment exploration works over the Second Part and Third Part areas to determine their prospectivity for lithium pegmatite mineralisation.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.