Laterite or sulphide? There’s plenty of space for both sources of nickel to thrive

Demand for nickel is so strong we can all agree that there's room for both nickel from sulphides and laterite. Pic via Getty Images.

During the same time period that the Ukrainian Soviet Socialist Republic (UkrSSR) was handed control of Crimea in 1954, to the subsequent annexation of that same region again by Russia in 2014, nickel has had a steady place in the world, mainly for its use in stainless steel products you’d find in household kitchens.

1954 was also the year the Denver mint in the US first produced over 100 million nickels for circulation – yet is materially a dime percentage of the product itself.

60 years went by, and the commodities’ use was unvaried… for the most part.

Then – and as a cursor effect of the 2008 global financial crisis – the price of nickel had tanked, so much so, that over a dozen mines went into care and maintenance in WA alone; including BHP’s Leinster mine, Xtrata’s Cosmos and Prospero operations, Russian-backed Norilsk’s Lake Johnston, and a bunch of others over the following decade.

Yet the trickle-down consequences from that period is just one factor that’s helped buoy nickel prices today.

The market space is so large that a bunch of ASX-listed juniors are jumping in to prove up both long-term laterite and low-capex sulphide production to help meet demand, and there’s an across-the-board agreement that both types of projects have their value in the market.

All about the batteries

Fast-forward more than a decade and Penny’s brother Nick is forecasted to be an increasingly valuable commodity.

By the end of 2021, about 70% of the world’s nickel production was still consumed by the stainless steel sector, while batteries took up a modest 5%, according to S&P Global.

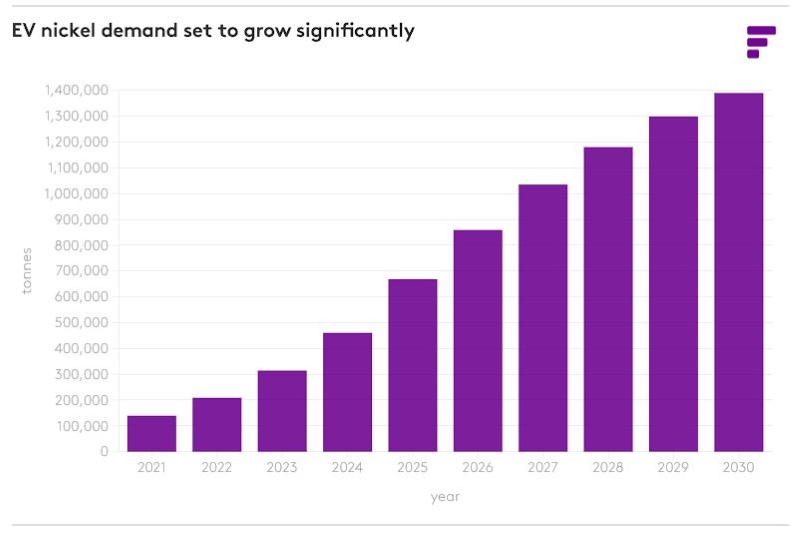

Burgeoned by the aforementioned period of uneconomic viability and coupled with today’s energy storage and EV boom, nickel demand is expected to accelerate substantially due to its use in battery manufacturing, with many predicting the battery sector to near 35% of total nickel demand by the end of the decade, S&P Global says.

Big hitters in the nickel space – such as Brazilian mining heavyweight Vale – foresee a whopping 44% increase in demand by 2030.

“Demand for nickel is forecast to increase rapidly this decade with the energy transition,” the miner said near the end of last year.

“Growth in nickel supplies should be driven mainly by Indonesia and Canada (where it also operates in) – as well as Australia,” it added.

Vale expects to produce up to 245,000t of nickel per year for the next seven years, compared to last year’s projection of ~190,000t.

On the juniors level, NickelSearch (ASX:NIS) MD Nicole Duncan says the electrification of the world is a massive driver behind exploration companies pivoting back to nickel.

“Nickel is and will remain a key ingredient in battery technology for quite some time, especially when you take into account an increase in EV production,” Duncan says.

“There are some that are of the view that nickel prices are currently being impacted by nickel supply coming online from Indonesia and the recent dip in price has reflected that, however EV nickel demand is going to be a huge growth factor and the overall economics for the commodities’ use in stainless steel and other applications will be able to absorb that supply as demand is forecast to rise significantly over the next decade.”

M&A

There have been signs that M&A interest in nickel and battery metals is growing. Last year IGO (ASX:IGO) paid $1.3b to acquire Western Areas in a soon-to-be-impaired deal initially announced in late 2021, while BHP (ASX:BHP) picked up the $1.7b West Musgrave project in its $9.6b purchase of copper miner OZ Minerals.

And Andrew Forrest’s Wyloo Metals recently reached majority control of Kambalda nickel miner Mincor Resources (ASX:MCR) in a cash deal valuing the company at $760m.

Indonesia

Indonesia has ambitious plans to capture a greater share of value in the battery supply chain and benefit from the wave of nickel demand from batteries, largely from laterite projects.

According to BMI, in 2015 Indonesia only produced 2% of the global supply of refined nickel, however by 2023, Benchmark’s forecasts show Indonesia to account for half of global nickel output.

Fast-forward to 2030, and Indonesia’s share of supply has the potential to rise to more than 60%.

Yet just how Indonesian nickel projects dispose of their waste products (ESG again) will be key to how large the industry can grow since the country’s production is mainly pig iron from laterite.

Sulphide, so good

Nickel production from sulphide boasts fast processing times, a higher concentration in orebodies and hits ESG markers through its less intense energy requirements.

Speaking to Stockhead, Metal Hawk (ASX:MHK) MD Will Felbin says the metrics around nickel sulphide projects are solid – if you can get your hands on one.

“Nickel from sulphides are generally higher grade, come with lower capex to get in production, yet are also hard to find,” Felbin says.

“During past cycles in the nickel price, sulphide operations would get the ‘low-hanging fruit’ so to speak – usually nearer to the surface.

“The more recent nickel sulphide discoveries are those that are further under cover, yet nowadays, modern exploration techniques such as electromagnetic (EM) surveys are extremely important in our endeavours to economically prove up resources that have been previously underexplored.

“Laterite projects are large and long-lasting, but once you close them, it’s a lot of capital expenditure to get going again, and companies have found that out the hard way in the past.”

“Luckily for us, we’ve found one, and where we’re at in the Goldfields mining district it’s easy to sell the product. We have access to infrastructure, concentrators and smelters that have been around for decades that we can harness.”

Metal Hawk recently secured an option to acquire the large-scale Yarmany project in WA’s Eastern Goldfields, where limited historical drilling has confirmed a favourable geological setting with potential for komatiite-hosted nickel sulphides and pegmatite-hosted lithium mineralisation.

The tenements, while highly prospective for both nickel and lithium mineralisation, have also received only limited, mostly superficial exploration for pegmatite-hosted lithium-caesium-tantalum (LCT) mineralisation.

Belbin says Metal Hawk is in the process of ramping up exploration to provide investors with a clear vision towards production.

“We look forward to an exciting period for the company with lithium and nickel exploration ramping up at Yarmany and the next phase of drilling at Fraser South due to commence shortly.”

Meanwhile, NickelSearch (ASX:NIS) has been flying lately on the back of news that the company has once again intersected massive sulphide mineralisation at the Sexton prospect within the wider Carlingup project.

During the campaign, diamond drilling hit visual sulphides in the Upper Mineralised Horizon (UMH) and Lower Mineralised Horizon (LMH), with both horizons intersected at shallower depths than expected.

The samples from the drill holes have been sent for laboratory analysis and are expected in about a month.

And in Africa, Adavale Resources (ASX:ADD) has two rigs spinning at its flagship Kabanga Jirani nickel project in Tanzania, where final assays are pending for a handful of holes.

It recently raised $2.47m via two quickly-backed placements for further exploration efforts.

ADD’s project is adjacent to the world-class Kabanga deposit, one of the largest undeveloped nickel sulphide projects in the world.

Kabanga contains 58Mt of resources at an average nickel grade of 2.62%, up to an even higher equivalent of 3.14% when copper and cobalt credits are included.

Then there’s Warriedar Resources (ASX:WA8) which is currently undergoing a 2,300m RC program designed to test a number of underexplored geophysical targets at its Fields Find project in WA’s Murchison province – affectionately called a ‘polymetallic enigma’ given it contains elevated levels of sulphide-hosted nickel, copper and gold deposits.

Golden Mile Resources (ASX:G88) is all set to commence RC drilling at its Quicksilver nickel-cobalt project in WA, with the field crew mobilised and drill rig scheduled to arrive later this week.

The primary program consists of nine RC holes for 2,350m to test the potential of disseminated nickel sulphides within the primary zone beneath the nickel-cobalt oxide resource.

G88 reckons the drilling may also provide further insight into the source of the rare earths element (REE) mineralisation encountered in the oxide – which remains unexplained.

Conico’s (ASX:CNJ) Mt Thirsty cobalt-nickel-manganese-scandium JV with Greenstone Resources (ASX:GSR) in northwest WA has a current JORC Resource of 66.2Mt at 0.06% cobalt, 0.43% nickel, 0.45% manganese, with a scoping study expected to be released soon to provide the foundation of the project’s development.

NickelX (ASX:NKL) is acquiring an advanced nickel and advanced hard rock lithium exploration project in Central Europe, in close proximity to where 27 lithium battery Gigafactories are planned for 2030.

The Ransko nickel-copper-cobalt project covers 6.93km2 and hosts significant Ni-Cu-Co mineralisation defined by historic mapping, sampling, geophysics, limited vertically oriented drilling and exploration shafts and adits.

Explorer DevEx Resources (ASX:DEV) has launched a foray into exploring for Kambalda-style nickel sulphide mineralisation after reaching an agreement to earn into the Highway project in Western Australia.

Highway comprises the non-gold mineral rights contained within tenements E29/0966 and E29/0996, where previous broad-spaced aircore drilling has confirmed that the nickel-bearing Highway ultramafic extends for a strike length of 11km.

The Highway ultramafic also hosts Future Battery Minerals’ (ASX:FBM) Saints nickel deposits immediately to the south and the historical Scotia nickel sulphide mine further to the south.

Laterite now

While nickel from laterite has initially large capex costs compared to sulphide, projects are often mining the ground they set up for decades.

And this has not deterred interest from big hitters downstream whatsoever.

Take Alliance Nickel (ASX:AXN) for example, next door to Glencore’s Murrin Murrin mine. It struck a strategic partnership with leading automaker Stellantis (Jeep, RAM, Chrysler, Maserati, Alfa Romeo, Fiat and Peugeot) for the offtake of 40% of production at the junior’s undeveloped 85.2Mt NiWest nickel-cobalt project over an initial five-year-term – a relationship cemented by Stellantis taking up a $15m placement in Alliance.

Another nickel laterite player to watch is NICO Resources (ASX:NC1), which owns the large-scale Wingellina project, and a PFS study indicated it could have an initial 42-year mine life as a 40,000tpa nickel and a 3,000tpa cobalt producer.

At Stockhead, we tell it like it is. While NickelSearch, Metal Hawk, Warriedar Resources, Adavale Resources, Conico, Golden Mile Resources, Greenstone Resources, Nickel X, DevEx and Alliance Nickel are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.