Lanthanein has high hopes for Lyons as neighbour nears REE production

A 10,000m RC drilling program is planned for April. Pic: via Getty Images.

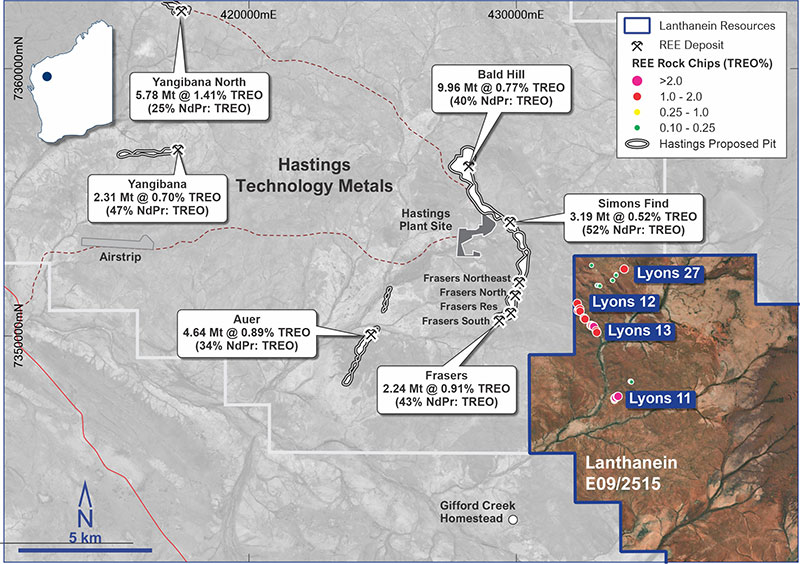

Lanthanein Resources has high hopes for its Lyons rare earths project which is right next door to Hastings’ advanced Yangibana Rare Earths project that is due to come into production this year.

Not to mention, Lyon’s ironstone hosted mineralisation is virtually identical to Yangibana and the carbonatite source for the rare earths in the area are also at Lyons.

Like Yangibana and Lynas Rare Earths’ world class Mt Weld deposits, WA’s carbonatites have become an increasingly important source of rare earths mineralisation on a global scale, with potential to also host economic quantities of thorium, uranium, niobium, yttrium and phosphorous.

“We’re right next door to a mine that’s being developed, we’ve got virtually identical rocks and we’re exploring for rare earths mineralisation that is economically viable – this has been proved by the fact that Hastings Technology Metals (ASX:HAS) have generated reserves and they’re building a mine on it,” Lanthanein (ASX:LNR) Technical director Brian Thomas said.

“It’s one thing to have assays proving you have rare earths but it’s another to actually have economically viable mineralisation that you can process and sell.

“We are in an area that we know will produce saleable rare earths.”

Another REE discovery could be on the cards

Thomas says the big advantage for rare earths players in the region like Hastings, Dreadnought Resources (ASX:DRE) and Lanthanein with the Gascoyne rare earth discoveries is the very high neodymium and praseodymium ratios as a percentage of the total rare earths – which in the Gascoyne are in the range of >35-40% compared to a global average of ~15%.

“These are the high value products that end up in the permanent magnets which are in the wind turbine generators and are part of the electric motors in the EV’s,” he said.

Niobium in particular, which is mainly used in improving the strength of steel, but also has growing uses in lithium-ion batteries, intelligent glass, solar panels, 5G tech, and nuclear energy.

The company believes its geological setting could lead to another rare earths discovery in the region, and is also looking to drill the carbonatites – the source of the ironstone dykes that host the rare earths that they and Hastings are chasing.

Comparable results to high-grade neighbours

“Back when Lanthanein was still called Frontier Resources (May, 2022) we announced positive results on metallurgical test work on the high grade rock chips which were comparable to what both Hastings and Dreadnought have announced,” Thomas said.

“The hosting mineral of monazite is also the same as what Iluka will be processing at their soon to be built Eneabba plant so there is little or no technology risk on building a processing solution.

“And while Hastings have probably got sufficient resources to get it funded and get it started, a few extra resources and reserves next door wouldn’t go astray for a long-term operation.”

10,000m of drilling planned

New ironstones have recently been defined at Lyons in sampling, with an additional 25 outcropping ironstones identified through satellite data.

That’s all within 1.5km of Hastings’ Yangibana project, where it is proposing to mine new open cuts to supply rare earths to produce permanent magnets.

And neighbour Lanthanein is now planning to drill two carbonatite targets – LI01-01 and LI03-01 – down to 450m, tracking their magnetic margins.

Then comes a more than 10km RC program due to start in April testing ironstone trends and carbonatite targets under thin cover for rare earths.

This article was developed in collaboration with Lanthanein Limited (ASX:LNR), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.