Kula is all set to advance lithium exploration as activity heats up in the Greenbushes region

Kula is getting ready to start further lithium exploration at its Kirup Project near the giant Greenbushes mine. Pic: via Getty Images.

Greenbushes is the world’s largest hard rock lithium mine, so it is unsurprising that the surrounding region – where Kula holds two large lithium projects – is a hotbed of activity.

After all, it is hard to deny the attraction of exploring around a mine which is singularly responsible for meeting about 22% of world’s lithium demand – for the 2023 financial year – and has delivered earnings before interest, taxes and amortisation of $9.5bn for its owners Tianqi Lithium, IGO Limited (ASX:IGO) and Albemarle.

During the June 2023 quarter, IGO carried out reconnaissance field mapping across the Bridgetown-Greenbushes – where it is earning up to 70% from Venus Metals – with the goal of identifying lithium-bearing pegmatites.

A detailed structural interpretation covering the main project area was completed and will be used to plan further work programs and targeting for pegmatites. It also plans to carry out additional mapping and rock chip sampling. Target generation work is planned for the next quarter.

Corporate activity in the region is also heating up with Lithium Power International (ASX:LPI) selling its subsidiary Western Lithium to Albemarle for $30m in June 2023.

Meanwhile, Galan Lithium (ASX:GLN) purchased 20% of the Greenbushes South project from Lithium Australia (ASX:LIT) for $3m back in December last year, which implies a $15m enterprise value for the whole project.

Music to Kula’s ears

Both these transactions are of interest to $6.3m market cap Kula Gold (ASX:KGD) as they are all adjacent to its Brunswick and Kirup tenements, which collectively cover about 417km2 of prime lithium exploration ground within 20km of the Greenbushes mine.

The tenements that make up the two projects are located within prospective magnetic structures, and unexplored pegmatite outcrops.

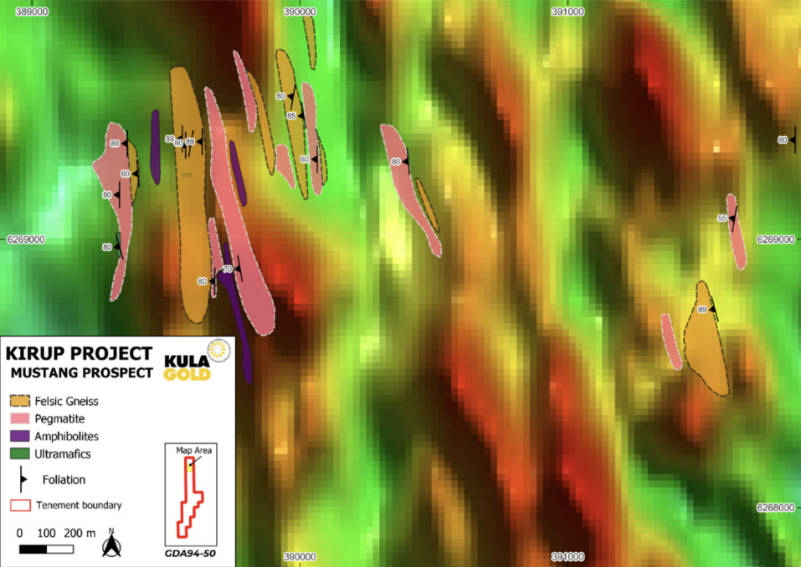

Kula’s exploration to date has defined three large targets and drilling to test the first – Mustang – is now in the final stages of preparation.

Mustang is located in the northern part of E70-5452 and hosts a number of north-northwest striking pegmatitic bodies within an area with a strike length of 1km and width of about 100m.

Reconnaissance mapping and rock chip sampling had detected bladed spodumene and pegmatite, providing the company with a walk-up drill target to test for lithium-caesium-tantalum mineralisation below the weathered zone, which is estimated to be 15-50m as is evident at the nearby Greenbushes Mine.

The company has secured a suitable reverse circulation rig and is finalising the contract ahead of the maiden drill program at the 1km by 100m pegmatite target.

It is also continuing exploration work aimed at advancing two other large lithium pegmatite targets as well as defining new lithium targets in the region.

At the Cobra prospect in the central part of E70-5452, recent mapping and rock chip sampling near anomalous lithium rock chip results of up to 240.8 parts per million have increased the strike length to about 2km and the width to more than 300m.

The company had acquired Kirup for its proximity to Greenbushes, existing mapped pegmatites and to complement its existing Brunswick lithium project further to the north.

Any success from the upcoming RC drilling program will likely draw attention from the market to Kula’s relatively low market capitalisation compared to its peers despite having operations so close to well established operations.

This article was developed in collaboration with Kula Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.