Kula Gold keen to hit the ground running with exploration across multiple pegmatites at Kirup

Kula Gold is hoping to begin exploration activities on the multiple pegmatites already mapped upon settlement of the acquisition. Pic via Getty Images

The Kula Gold team undertook a recent field reconnaissance trip as part of due diligence to acquire and add the Kirup Project to its existing portfolio.

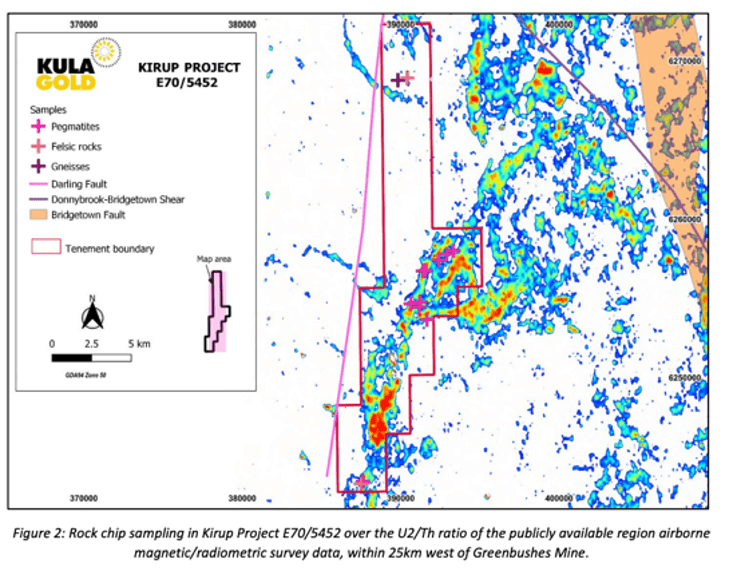

With an area of 117km2, the Kirup Project (E70/5452) is within 25km of the world-class Greenbushes Lithium Mine and increases Kula Gold’s (ASX:KGD) existing lithium exploration ground.

It also complements its existing Brunswick Lithium Project further to the north, where the company recently mapped a large 2km by up to 300m wide pegmatite on the same Donnybrook-Bridgeton shear zone, which hosts Greenbushes.

“This is the best place to explore for lithium,” Kula chief executive officer Ric Dawson says.

“Right near the biggest hard rock lithium mine in the world – sampling has been completed and we look forward to the results.”

Kula recently acquired a 70% interest in Kirup, which is subject to the completion of financial, legal, and technical due diligence to the satisfaction of Kula, the purchase of 100% of Merchant Ventures (owned by Stowell) by Sentinel via an option agreement, and regulatory approvals.

What’s next?

KGD’s due diligence team visited Kirup to check out the 11 previously identified pegmatites localities.

Ground truthing of some of these previously identified occurrences show outcrops to be generally offset where encouraging lithium bearing rock types have been spotted and sampled.

Kula believes the very strong anomalous signature (red outline) provides a good target for the technical team to explore in the acquisition tenement.

This article was developed in collaboration with Kula Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.