Koba Resources feeds its appetite for uranium with acquisition of high-grade Harrier project in eastern Canada

Koba is expanding its uranium portfolio with the acquisition of the Harrier project. Pic: Getty Images

- Koba Resources acquiring high-grade Harrier uranium project in Newfoundland and Labrador, Canada

- Harrier is on the same belt that hosts Paladin Energy’s 128Mlb Michelin project

- Historical rock chip sampling has returned +1% U3O8 assays from nine different prospects

- Upcoming prospecting and sampling program will ensure that drilling has the best chance of making a discovery

Special Report: Uranium-focused Koba Resources is heading north to acquire a high-grade uranium project within an underexplored, world-class uranium district in Labrador, Canada.

While no stranger to Canada – the company holds the Whitlock lithium project in Manitoba, Canada, the acquisition of the 131km2 Harrier uranium project follows on the heels of its January 2024 acquisition of an 80% interest in the advanced Yarramba project in South Australia in January, highlighting its focus on the energy metal.

Yarramba covers 5,100km2 and is 120km southeast of the longstanding Beverley mine and immediately north of the high-grade Jason’s deposit that Boss Energy (ASX:BOE) is developing as part of the imminent restart of its Honeymoon operations.

While Yarramba has not been tested since 2012, a historical JORC 2004 resource of 8.2Mt at 260ppm U3O8 at the key Oban deposit and drill results such as 7.5m at 831ppm U3O8, along with hits such as 1.3m at 827ppm U3O8 outside the existing resource, has Koba Resources (ASX:KOB) chomping at its bit to get boots on the ground.

Work at Yarramba is likely to focus on bringing the Oban resource to compliance with the more modern JORC 2012 standards while simultaneously increasing both its size and grade.

The company could also resume early stage exploration at Whitlock over the coming months.

Canadian uranium

However, any work on Whitlock might have to wait until KOB completes initial field work at the Harrier Project – expected to commence in June this work will generate targets for its inaugural drill program.

The company has good reasons to be keen.

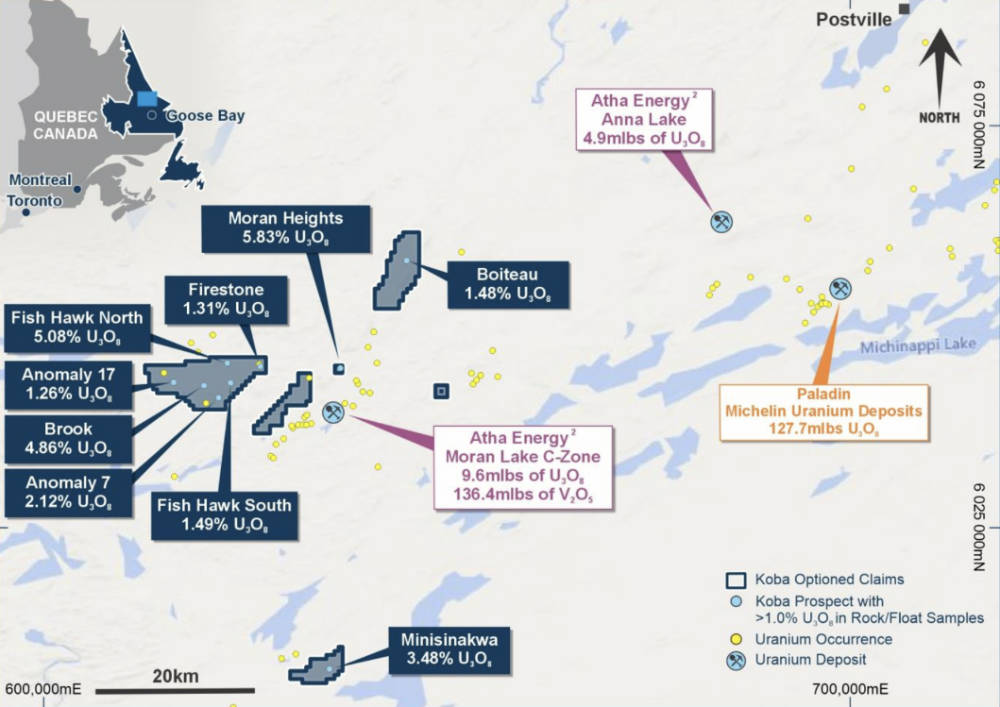

Harrier sits within an under-explored belt of Proterozoic and Archean aged rocks that also hosts Paladin Energy’s (ASX:PDN) Michelin project. Michelin comprises six deposits with a collective resource of 127.7Mlb of U3O8 and the Moran Lake and Anna Lake deposits that have historical resources totalling 14.5Mlb U3O8 and 136.4Mlb of vanadium pentoxide.

However, it is not just nearology that the project can lay its claim to fame to.

Historical exploration has proven that high-grade uranium mineralisation is abundant across the project with rock chip sampling returning +1% U3O8 from nine different prospects, three of which have never been drilled.

Top samples are 5.83% U3O8 at the Moran Heights prospect, 5.08% U3O8 at Fish Hawk North and 4.86% at Brook. While isolated, those are super grades. The average uranium deposit mined globally have grades in the order of 0.2% U3O8.

Despite this prospectivity, the project is heavily underexplored with just 89 holes totalling 9834m drilled across its grounds.

All this for an upfront consideration of C$150,000 ($168,283) for a 12-month option that allows KOB to acquire 100% of the project with further staged payments of C$575,000 in cash and shares over four years.

The company is also required to spend a minimum of C$3 million on exploration and development within four years of exercising the option while the vendor retains a 2% net smelter royalty.

“Koba’s focus remains firmly on our Yarramba uranium project in South Australia, where drilling is set to commence next month. But the opportunity to acquire the extremely prospective Harrier uranium project, for minimal cost, was too good to pass up,” managing director Ben Vallerine said.

“This additional project allows us to continue to leverage on our North American uranium experience and will increase our chance of making a significant uranium discovery in the near-term

“The Harrier project includes nine very exciting prospects. At each of these nine prospects rock chip assay results in excess of 1% U3O8 have been returned, including assays up to 5.83% U3O8. Incredibly, very little exploration or drilling has been undertaken previously.

“This is some of the highest-grade uranium mineralisation in the world. We know there are big deposits in this district, with the 128Mlb Michelin project located only 50km east of our project. So not only is there potential to discover very high-grade deposits, they could also be very large.”

Forward plan

While KOB has identified nine priority targets at Harrier, it expects that the ongoing data review will define additional targets due to its widespread mineralisation.

Further data review will lead to the prioritisation of targets with the top prospects to be tested in the upcoming field exploration program.

Preparations are underway for a prospecting and sampling program that will start in June 2024 to ensure that the company’s first drill program is focused on targets that are most likely to yield a discovery.

This article was developed in collaboration with Koba Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.