Klaus Eckhof is looking for a ‘big blue sky project’ for Lachlan Star – possibly rhodium

Pic: John W Banagan / Stone via Getty Images

Well-known mining entrepreneur Klaus Eckhof says he has his eye on a little known metal called rhodium for his new venture, Lachlan Star.

The former AVZ Minerals chairman was yesterday brought in to the recapitalised Lachlan Star to deliver a flagship project. The stock promptly jumped 64 per cent.

Lachlan Star (ASX:LSA) — which resumed trade in May after three years in administration — has a copper and a magnesite project but is now working with Mr Eckhof to find something new.

As well as his usual faves — “everything that the EV [electric vehicle] sector likes, from lithium to cobalt” and gold — he told Stockhead he’s also pretty keen on rhodium, which is in the platinum group of metals.

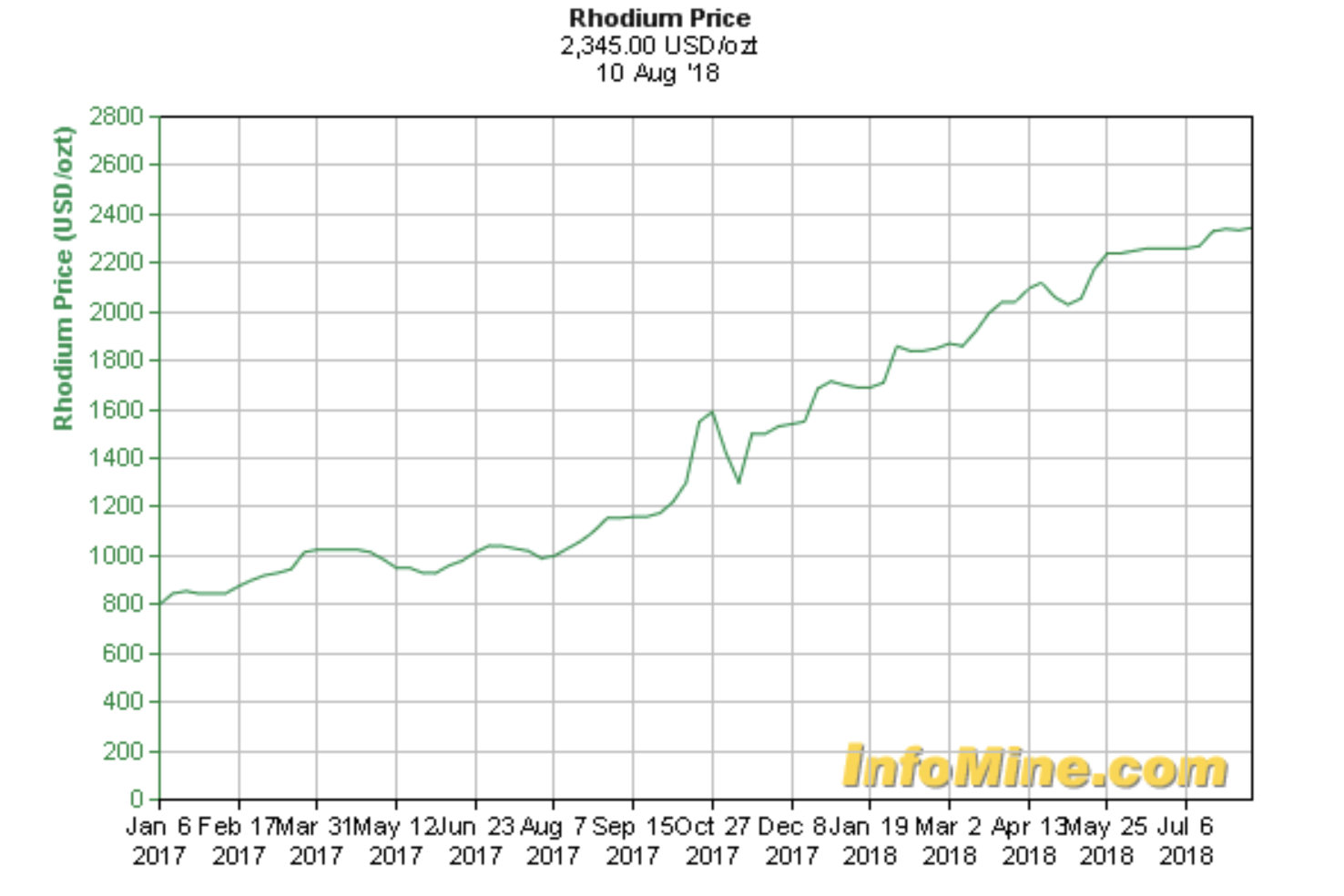

Its price went $US800 an ounce in January last year to rest at $US2345 on Monday, on the back of strong industrial demand.

Rhodium is a by-product of platinum and nickel mining. It’s used to make electrical contacts, jewellery and catalytic converters in petrol vehicles.

But it’s mostly used as an alloy to make such things as furnace coils, electrodes for aircraft spark plugs and lab crucibles.

Mr Eckhof says gold is always interesting provided you can find a resource of at least 3.5 million ounces.

But he won’t touch other “sexy” metals like vanadium.

“The markets are narrow,” he says. “Vanadium, everyone went bankrupt in the last decade already. As soon as you have something there the price crashes.

“Graphite is also not easy. It’s bespoke, you need a special product, you need a marketing guy.”

The new Star of the show

Mr Eckhoff stepped down as chairman of his last baby AVZ Minerals (ASX:AVZ) in June after selling more than half of his remaining stake.

Since then he’s been looking at several shell companies to work with.

He bought 2.65 per cent of Lachan Star in its recapitalisation and has been promised 80 million performance rights with share-based milestones now that he’s on the board.

His name was enough to push the shares up 64 per cent after the directorship was announced on Monday morning.

Mr Eckhof says he liked the fact that Lachan Star was interested in working with him and that they had plenty of money: some $2 million to spend after the recapitalisation.

Mr Eckhof is looking for a “big, blue sky project” for Lachan Star in his old stomping ground of Democratic Republic of Congo (DRC). But he also mentioned Zimbabwe — a country that is trying to position itself as open for mining business.

There are several potential options on the table already and a decision will be made within the next six months.

“I’ve worked everywhere in South America, Russia — you name it. But it’s a lot easier to work in Africa because your [geological] risk ratio is very low for what I do, and most of the people in Africa are educated in Europe,” he said.

Mr Eckhoff explained ‘geological risk’ as the difference between the opportunity to find a 5 million ounce resource for $5 million in the DRC — low risk in his world — versus spending $20 million to find a 200,000 ounce resource in Australia — a high risk venture.

Wherefore art thou, lithium?

Mr Eckhof’s last DRC venture AVZ has just confirmed it has the largest lithium resource in the world.

He believes lithium stock prices will start rising again later this year after running hard in early 2018 on the back of hype and hope.

“You’ve seen that most of the lithium stocks have come down 50 to 80 per cent. It’s a lot more negativity out there but I think that will change later in the year,” he said.

“Over-supply isn’t a concern… In Europe and the US the EV sector is expanding faster than expected.”

What about AVZ?

Mr Eckhof says he will deliver a project to Lachlan Star, prove up the resource, then hand it over to management as he has done at AVZ and past companies Moto and Aphamin.

He is still a consultant for AVZ so still has a hand in the business.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.