Kingwest scoping study unlocks options for Goongarrie Lady

Unlocking options Pic: Getty Images

Special Report: Kingwest has completed a scoping study for its non-core Goongarrie Lady gold deposit that highlights its potential to be brought back into production quickly.

Goongarrie Lady was mined in the 1990s by Julia Mines, producing 29,000 tonnes of ore grading 4.5 grams per tonne (g/t) gold until heavy rain flood the pit and caused wall instability at a time of low gold prices.

While Kingwest Resources (ASX:KWR) is focused on its Menzies gold project (MGP) in Western Australia’s Eastern Goldfields, it is also keen to rapidly commercialise, sell or find a joint venture partner for Goongarrie Lady.

In its scoping study, the company estimated that the project could generate net cash flow of between $6m and $12m before tax and financing costs from a production target of 150,000 tonnes of ore grading 3.12g/t gold.

Goongarrie Lady is likely to be a quick project for redevelopment given its favourable historic metallurgy, proximity to a gold processing plant and advanced permitting status.

The company noted that previous production had demonstrated good metallurgical recovery, with studies modelling recovery at 92 per cent while several third-party toll treatment mills in the region are accessible by road.

There is also high confidence in the resource basis for the scoping study as 95 per cent of the proposed mined material and 97 per cent of the gold is contained in the higher confidence measured or indicated categories inside the pit shell.

READ: There could be several ‘Penny West’ style deposits hiding at Menzies, Kingwest says

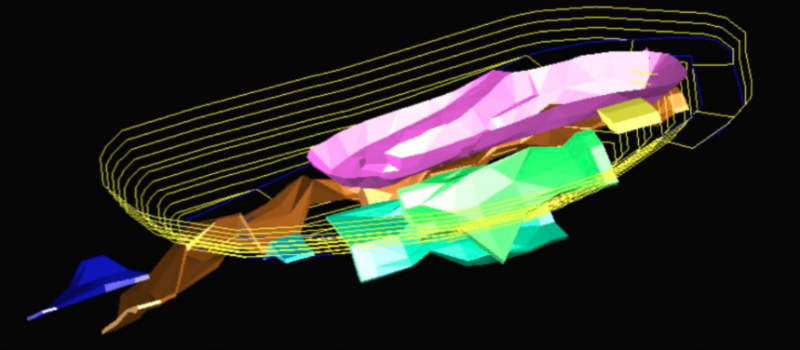

Goongarrie Lady currently has a measured resource of 255,000 tonnes grading 1.96g/t gold and an indicated resource of 172,000 tonnes grading 1.56g/t gold.

The optimum pit shell sees the mining of 190,000 tonnes of ore at 2.57g/t gold to return cash flow of $8m at an Australian dollar gold price of $1,650 per ounce and $16m at a $2,300 per ounce price.

This is certainly conservative given that gold is currently trading just below $2,730 per ounce.

Potential exists to enlarge the pit by carrying out further resource definition drilling.

>> Now watch: 90 Seconds With…Ed Turner, Kingwest Resources

This story was developed in collaboration with Kingwest Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.