There could be several ‘Penny West’ style deposits hiding at Menzies, Kingwest says

Pic: John W Banagan / Stone via Getty Images

Kingwest chief exec Ed Turner has a track record of turning unloved assets into company makers. He aims to do it again at the historic, high-grade Menzies Gold Project (MGP) in WA.

Ed Turner was exploration manager at the now defunct Abra Mining, which sold its namesake lead-silver project in WA to a Chinese state-owned enterprise for about $100m in 2008.

Then the GFC hit, lead prices crashed, and that Chinese company sat on the project for years and did nothing.

In 2017, newly listed $6m market cap explorer Galena Mining (ASX:G1A) bought the project back for just $3.5m with Turner at the helm.

“Abra, one of the largest undeveloped lead-silver deposits in the world, was historically considered a bulk-tonnage low-grade mine,” Turner says.

“But at 250m below surface, it was going to cost a lot of money to get into production.”

Galena’s strategy was to focus on the high-grade stuff instead.

“There’s much higher profit margins to be made on mining those higher grades but the challenge was in defining them,” Turner says.

“We ended up proving up about 13 million tonnes at 10 per cent lead, within 40 million tonnes at 7.3 per cent.

“With an excellent team of geologists, we managed three resource estimates, a scoping study, and a PFS in just over a year.”

The $552m net present value Abra project is now on track for first production in 2021, COVID-19 willing.

Turner has since moved into the role of chief exec at Kingwest Resources (ASX:KWR), which acquired the Menzies Gold Project (MGP) last year.

The MGP was one of the highest-grade goldfields in WA, with historic production of at least 800,000oz gold at 19 grams per tonne (g/t) gold, which included 650,000oz gold at 22.5g/t gold from underground.

Anything above 5g/t these days is generally considered high-grade.

Like Abra, Menzies is an unloved asset with massive potential. Modern exploration over the area has been limited since mining ceased over 20 years ago.

“Unloved is the right word for it,” Turner says.

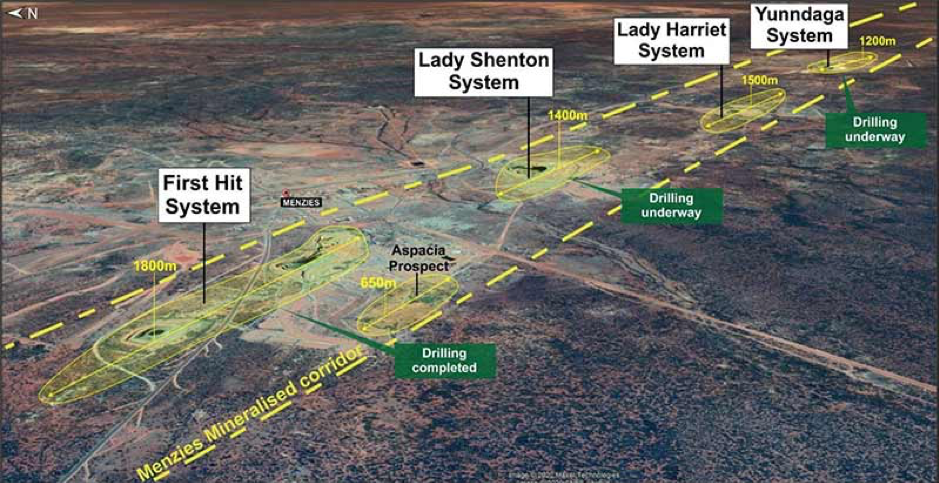

“We think we could have multiple Penny Wests within this corridor.”

That is a nice comparison to make. Drilling success at the historic Penny West gold mine saw Spectrum Metals (ASX:SPX) go from sub-$5m market cap, ‘bottom-of-the-drawer’ spec stock to +$200m takeover target in just over a year.

“I looked at Menzies and immediately thought ‘this is a big system’,” Turner says.

“There’s a lot of small high-grade deposits within the big system but these sorts of mineralisation typically have ‘roots’.

“At Menzies, within that 15km corridor, we have over 5000 historic workings between 1m and 600m vertical depth.

“People assumed that the gold had been mined out but early work we have done proves that the high-grade mineralisation – historically very impressive – is still there to be found.”

New results from the MGP, including a record-breaking 3m grading 158.4g/t gold intercept at the First Hit gold mine, confirms that there is lot of high-grade stuff left in the ground.

That was underlined by a surprise discovery within Lady Shenton, where shallow drilling hit 3m at 7.2g/t from 47m, including 1m at 13.4g/t from 47m.

These results sent the stock up 30 per cent on April 14.

A new seven to eight week, 4,700m diamond drilling program into the deeper high-grade targets in and below the existing Yunndaga, Lady Shenton and First Hit gold mines has now kicked off.

“We currently have a +250,000oz at 2g/t resource near surface, but deeper down our exploration targets are between 250,000oz and 500,000oz at more like 13 to 23g/t,” Turner says.

“That’s what we are trying to define with this round of drilling – but that target is expected to grow in time”.

“There are so many great targets our biggest challenge is choosing which ones to prioritise. That’s an excellent problem to have.”

>>NOW LISTEN TO: Explorers Podcast: Reviving WA’s old and forgotten high-grade gold fields is proving lucrative business

This story was developed in collaboration with Kingwest Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.