Kaiser Reef to dive into production in lucrative Victorian goldfields

Pic: John W Banagan / Stone via Getty Images

When Kaiser Reef relists on the ASX following its now-open IPO, it will do so as an entity transformed from that which first listed in March 2020 – and as a producing Australian gold miner.

Kaiser Reef (ASX:KAU) announced in October the planned acquisition of a series of assets in gold-hot Victoria from the administrators of Centennial Mining.

It was an acquisition which led KAU to completely rewrite its prospectus – hence the current IPO and planned re-listing in the new year. It also looms as a buy which will make Kaiser Reef a high-grade Australian gold producer from the get-go.

What did KAU pick up? The remarkable suite of assets are as follows:

- The fully permitted and currently operational A1 gold mine, which has produced 620,000 ounces of gold since 1861 and achieved output at around 11 grams per tonne over the last 18 months;

- The Maldon Goldfield, which has turned out more than 1.7 million ounces over its life at an average grade of 28g/t gold. Maldon is home to a number of historic mines, including Nuggety Reef – a project which historically produced ~300,000oz of gold at 187g/t;

- The wholly-owned Porcupine Flat gold processing plant at Maldon – fully permitted and currently operating at reduced capacity under administration;

- Four granted mining leases, including three in the Bendigo Block and one at Woods Point, with proven gold endowment.

Anything above 5g/t gold is considered high grade by modern standards.

Despite their significant historical production, the projects, like many in the region, are poorly tested by modern exploration.

“The strange thing is that a lot of Victorian gold mines are in that state,” Kaiser Reef executive director Jonathan Downes told Stockhead this week.

“A lot of the Victorian gold reefs have really only just come into the conversation. Kirkland Lake, which happens to be Canadian, have come into Fosterville and made it Australia’s most profitable gold mine at an extraordinarily high grade.

“I don’t think the region really captured peoples’ imaginations until someone showed it really could be done.”

Now Kaiser Reef has an opportunity to come in a give it a shake themselves. The company already has a significant leg up in A1, which is producing and trucking ore to the established processing infrastructure at Maldon.

Downes said while having a current production profile was one thing, a number of opportunities existed for potential discovery in the historic region.

“One of the mines at Maldon already has an existing decline on care and maintenance,” he said.

“It has air vents, electricity, its been dewatered and maintained – that’s at the Union Hill Reef, which we want to drill out and bring into production.

“They also established an access portal to the Nuggety Reef, but the orebody wasn’t extracted – we’re planning on drilling that once we’re back and listed.”

Kaiser Reef also intends to ramp the processing plant up to capacity once listed.

Kirkland is currently seeking to raise $7.5 million through the issue of 25 million shares under the prospectus.

On listing, it will have a market capitalisation of $25 million, with around $10 million in cash and no debt – the acquisition of the Victorian gold assets was carried out as all scrip.

The biggest gold name in the region, Kirkland Lake’s (ASX:KLA) market cap is currently above $11.5 billion.

Under ASX listing requirements, the company is seeking to add at least 300 new shareholders to its books as part of the IPO, which closes next Wednesday.

Lachlan Fold looming

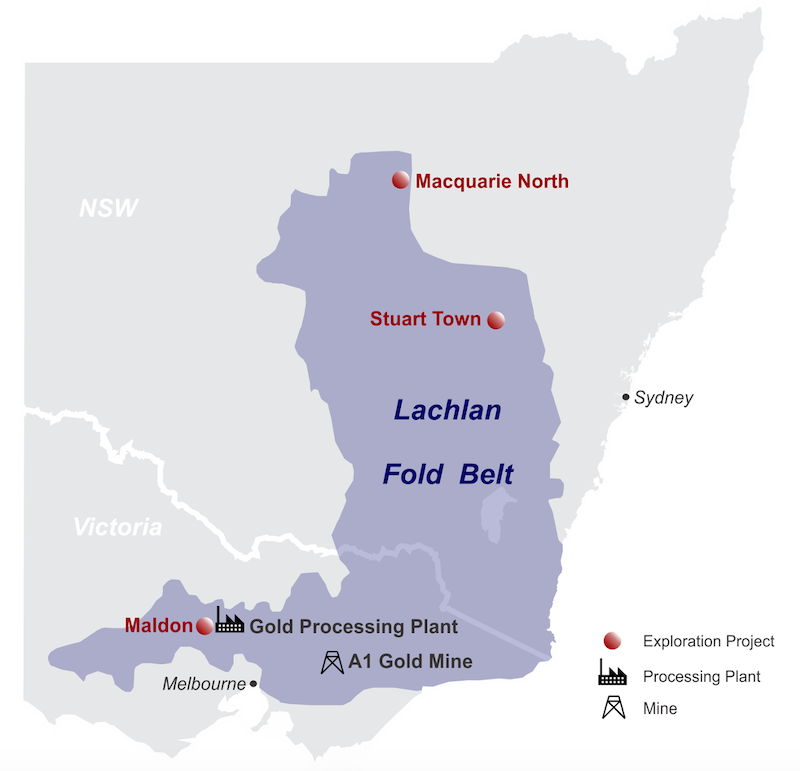

When it first listed in March, Kaiser Reef did so with a suite of highly prospective land in the also-hot Lachlan Fold Belt of New South Wales.

While the Victorian gold assets are likely to attract the immediate attention of the explorer/soon-to-be listed producer, Downes said Lachlan Fold remained firmly in its sights.

“During the prospectus you can’t do anything material to the company, so we’ve had to suspend the drilling and suspend some of the work,” he said.

“It’s very exciting ground, and it will be even more exciting once we have cashflow behind us from the acquisition.”

Kaiser was drilling at its Stuart Town gold project in the area in September.

At Stockhead, we tell it like it is. While Kaiser Reef is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.